We are a business group whose purpose is to eradicate financial exclusion at the base of the pyramid in the Americas.

SOCIAL VALUE

We grow to offer opportunities for financial inclusion to the greatest number of people in the shortest possible time and to share the benefits with the communities in which we operate.

ECONOMIC VALUE

We build innovative, effective, and profitable commercial models from which all can benefit.

HUMAN VALUE

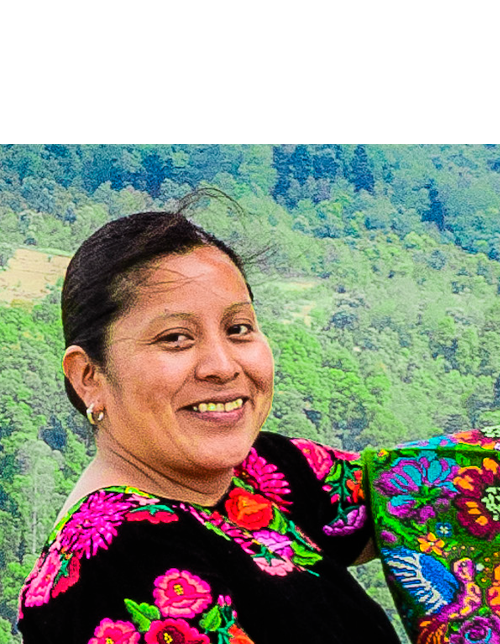

We believe in people and trust in their ability to grow, to improve, and to fulfill their goals. We also believe that financial education allows our clients to use financial services to their own benefit.

Through financial inclusion we foster the social, economic, and human development of people. In this way, we GENerate value for all.

We reach the ENTire community.

A total of 2,754,860 clients have been granted credit for working capital in the three markets where Compartamos operates, 3.0% more than in 2012.

The index of clients retained has reached record highs: 79.8% in Mexico, 73.5% in Guatemala, and 67.1% in Peru.

The Client Protection Index (IPAC* by its Spanish-language acronym) was enhanced and now permeates the 13 management areas of Compartamos Banco, following up on compliance with our seven client protection principles.

Weekly contact was established with our Crédito Mujer clients in the countries where we operate.

Yastás increased its number of transaction points from 1,587 to 3,171 in 2013 and obtained authorization from the Comisión Nacional Bancaria y de Valores (CNBV) to accumulate Compartamos Banco loan payments through its correspondents.

The number of savings account clients in our deposit capture program increased by 53.7% in 2013.

The Social Responsibility and Sustainability Fund, into which 2% of net earnings is earmarked annually, disbursed 40,192,666 pesos in 2013 in support of education and health projects in the communities in which we operate, to the benefit of 244,138 people.

14,328 employees from all of our companies participated in 70,173 hours of community volunteer work.

We held 26 Compartamos con la Comunidad Days in Mexico and two in Guatemala, with the voluntary participation of 2,844 employees. Thanks to the efforts of all, a total of 41,757 people were indirectly benefitted.

We GENerate profitability as a motor of development

We offer services to 2,754,860 clients, 3.0% more than in 2012.

Our team consists of 19,339 employees, 16.5% more than in 2012

Our total loan portfolio amounted to just over 20,706 million pesos.

Our non-performing loans ratio was 3.12%.

Our interest income was 12,590 million pesos.

We have 577 branches attending our clients in the countries where we operate.

With 3,171 correspondents in 11 different states in Mexico and 16 issuers, including Compartamos Banco, Yastás handled 10.3 million transactions in 2013.

Aterna placed 9,174,927 insurance policies in Mexico, 54,536 in Guatemala, and 1,827,074 in Peru

We have figured on the benchmark index (the IPC) and the Sustainable Index of the Mexican Stock Exchange for six and three years in a row, respectively.

We are PEOPLE-oriented.

We have a total of 19,339 employees, 16.5% more than in 2012.

All of our companies together have created 2,738 new jobs.

100% of our employees are evaluated annually in terms of skills and 99.6% have received certification in the Ethics and Conduct Code of the company for which they work.

We invested 72.2 million pesos in workplace training and earmarked 8.0 million pesos into Human Training programs, both directed at 100% of our employees in Mexico and Peru.

In 2013, a total of 476 employees received training in Mexico, Guatemala, and Peru through our Serviazgo® Leadership Program.

Con nuestro Programa de Liderazgo formamos a 476 colaboradores durante 2013 en México, Guatemala y Perú, bajo el Modelo Integral de Serviazgo®.

48% of our employees are women.

We held 73 annual encounters in the three countries in which we operate to share and disseminate our Philosophy and Purpose.

In 2013 we offered 949,688 hours of training, or an average of 56 hours per employee.

Through the Improving My Finances Workshop, 1,907 hours of financial education were given to our employees in Mexico

We GENerate continual improvement plans and implement innovative corporate governance practices.

We have six committees supporting our Board of Directors.

Two-thirds of the Committees of the Board of Directors are chaired by independent directors.

Half of our directors are independent, while women make up an eighth part of the Board.

The directors who make up the organizational structure of Gentera are not remunerated.

All of the operating companies of Gentera have an experienced board made up of both inside and independent directors

Our actions reflect our commitment to sustainable development and the care of the environment.