For more than twenty years our entrepreneurial vocation and our principal Purpose –financial inclusion– have forged a GENuine and vital project, focused on providing high-quality financial services and products to lower-income segments of the population. These allow previously excluded people and communities to benefit from the tools offered by financial inclusion and to propel their social, economic, and human development.

At Gentera we understand financial inclusion as the access to and use of a range of financial products and services, within a framework of appropriate regulation that protects people’s interests and enhances their financial skills, permanently sustained by complements such as consumer protection and financial education.

Through our companies, we have consolidated a comprehensive portfolio of products and services focused on providing access to credit, savings, payment channels, and financial education to communities at the base of the economic pyramid in the Americas. This includes, within a value generation system, men and women entrepreneurs who are working to improve their quality of life.

Source: Report on Financial Inclusion I, published by the Comisión Nacional Bancaria y de Valores (CNBV).

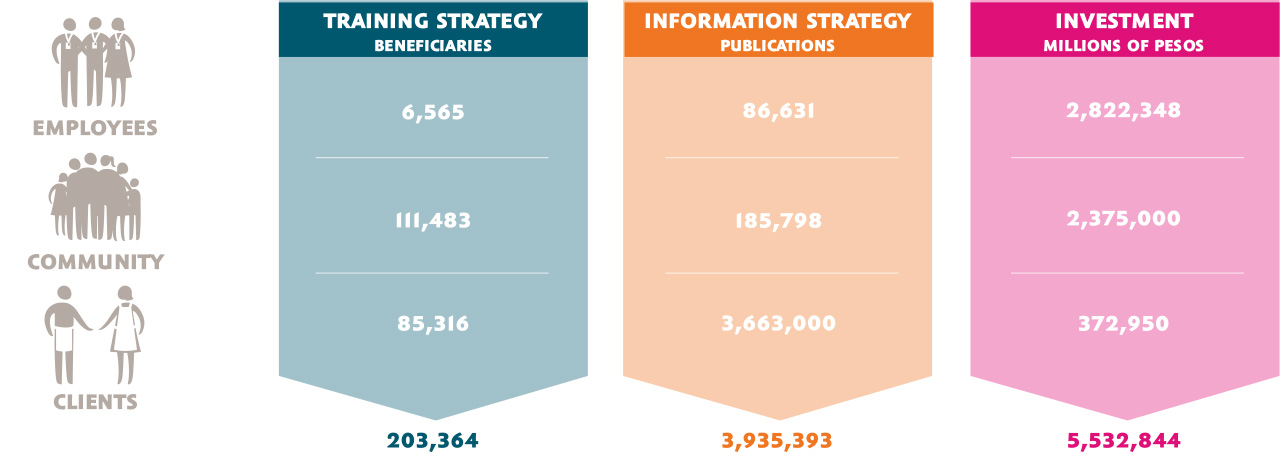

Compartamos is the identity that represents all of our companies specializing in microfinance, currently present in Mexico, Peru, and Guatemala.

Our credit products are designed to empower our customers, making it possible for them to initiate or grow their businesses, to reactivate their personal economies, and so to provide wellbeing to their families and the community.

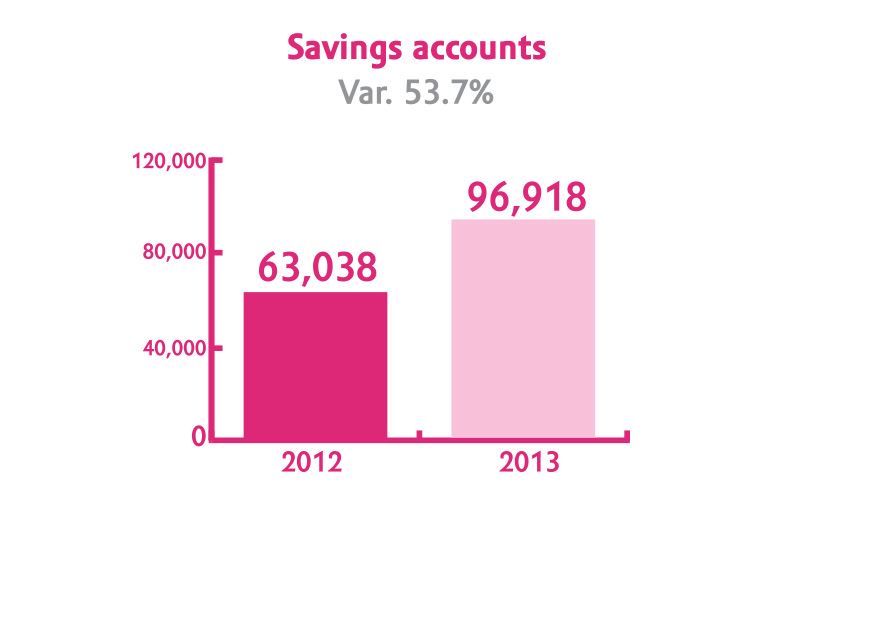

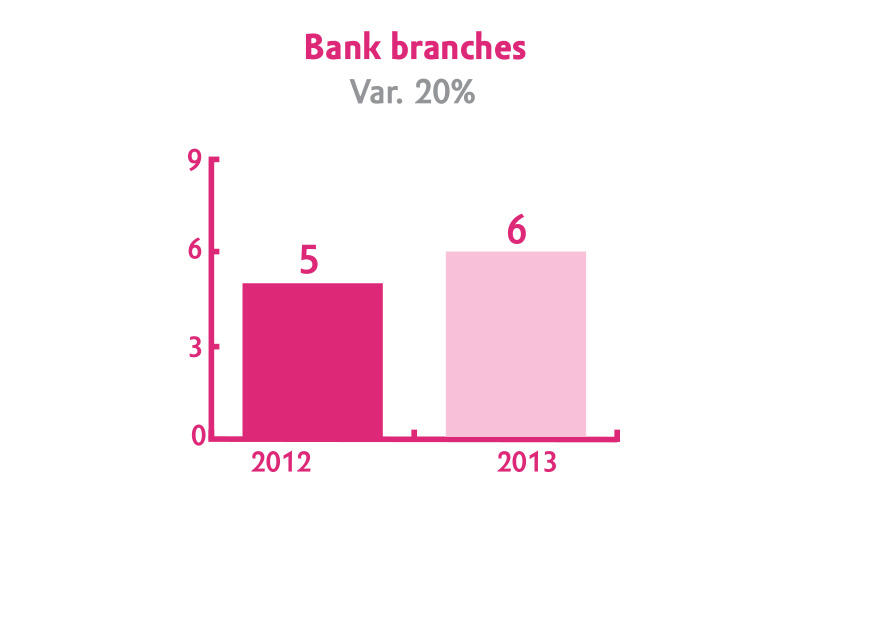

Compartamos Banco’s deposit capture project is aimed at offering a different option and added value to customers who wish to save, in addition to developing a means of extra funding for the institution. We continued in 2013 to explore the needs of our clients in this area and to monitor their response to our offer, with a view to providing a product with the convenience, ease, and availability that they require.

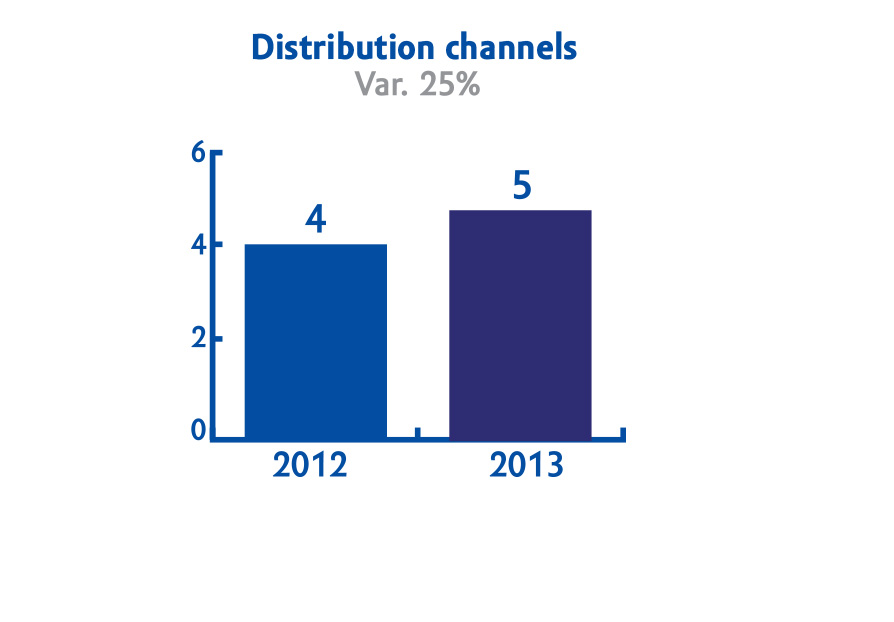

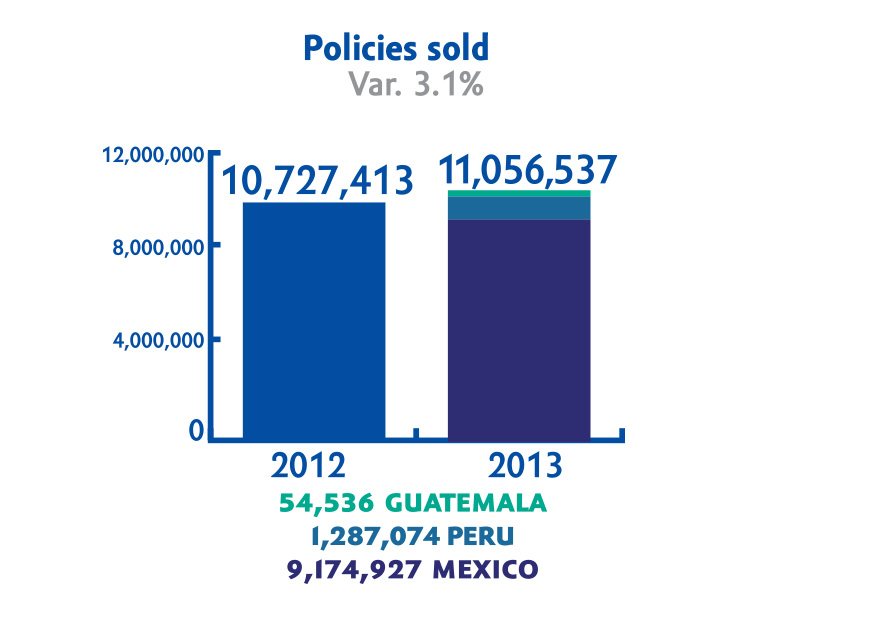

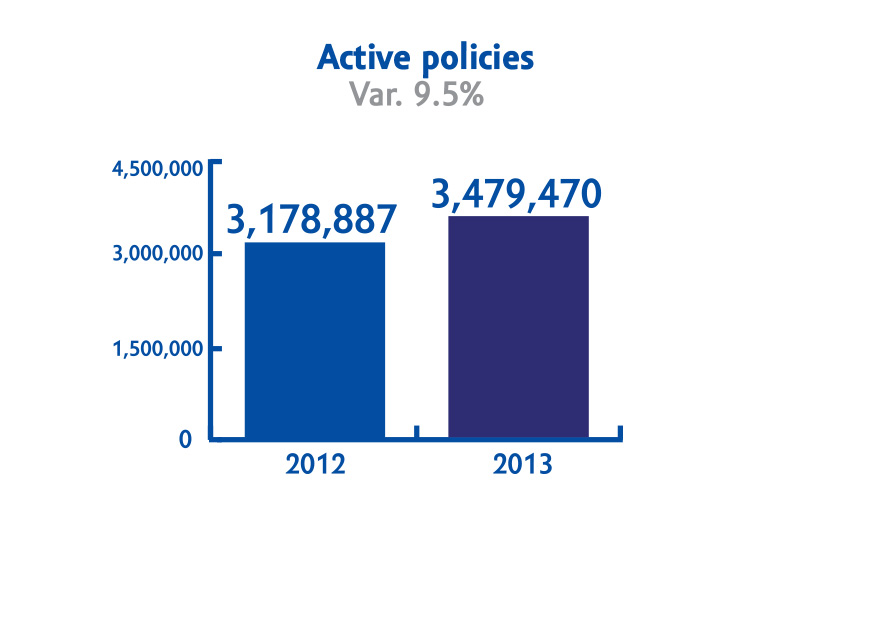

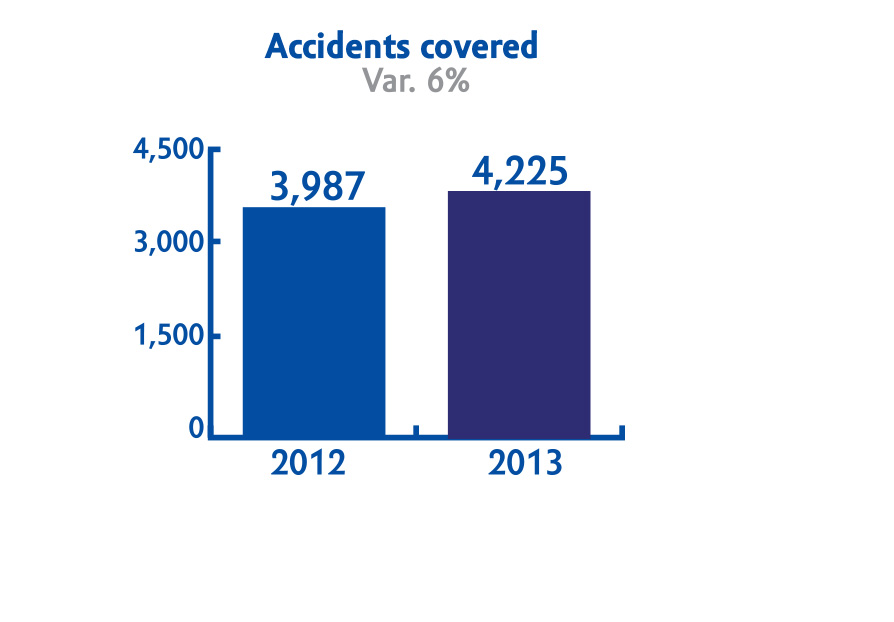

Aterna is a microinsurance broker specializing in the needs of people at the base of the economic pyramid. It has designed and operates insurance to prevent and respond to the unforeseen circumstances to which this segment of the population is especially vulnerable, acting as an intermediary between the insurance sector and the distribution channels. In 2013, Aterna expanded its business model from Mexico into Peru and Guatemala, placing 1,827,074 policies through Compartamos Financiera (Peru) and 54,536 policies through Compartamos S.A. (Guatemala).

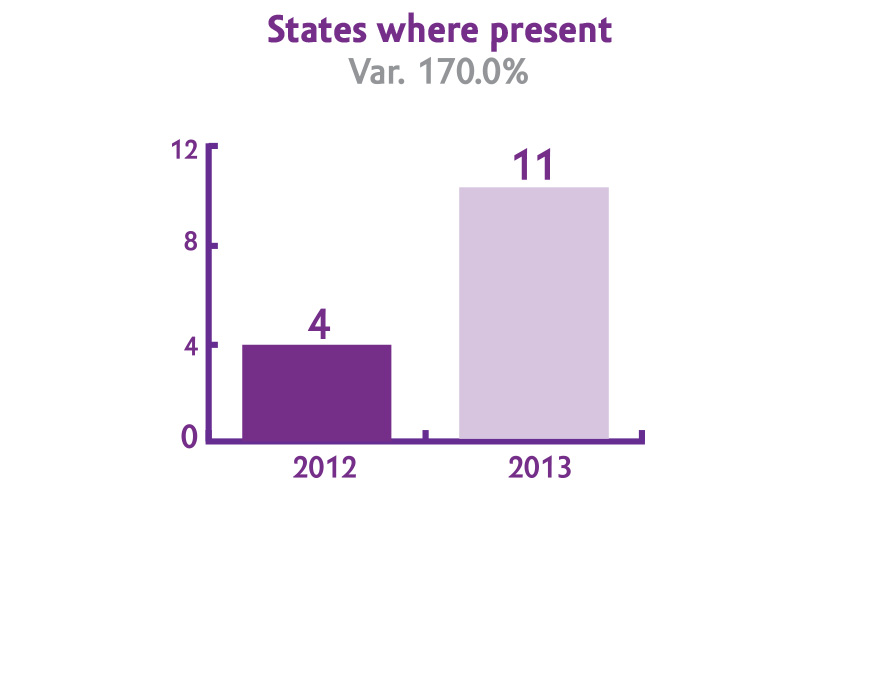

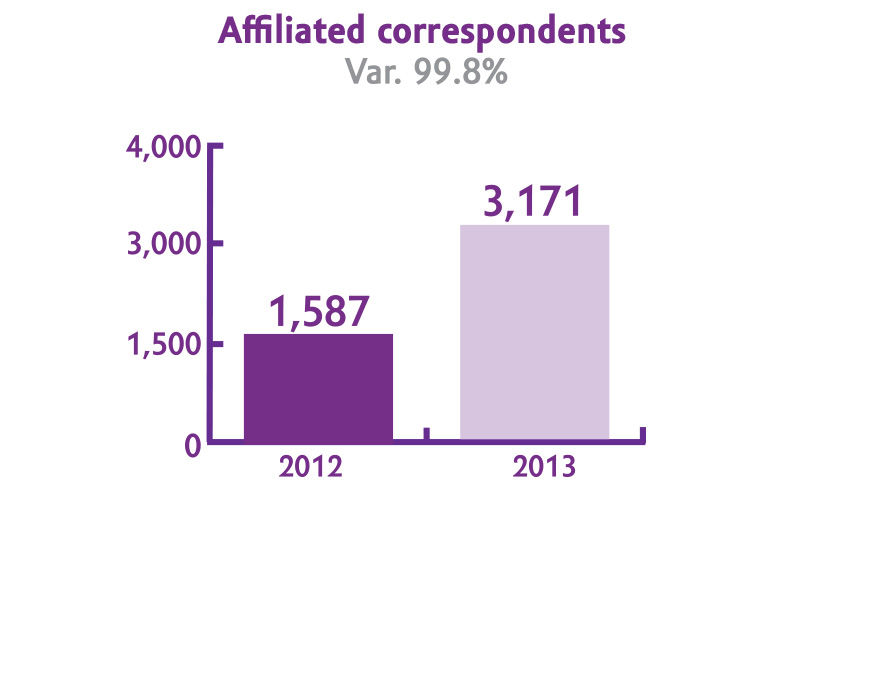

Yastás seeks to enhance the quality of life of people who live in marginalized areas, offering fast, easy, and safe ways to perform both financial and non-financial transactions. In this way, Yastás propels the social and economic development of communities, at the same time fostering their inclusion within the financial system.

The generation of social and economic value by Yastás is measured by the growth of its service points and the number of transactions it handles, which increased in 2013 by 99.8% and 281%, respectively.

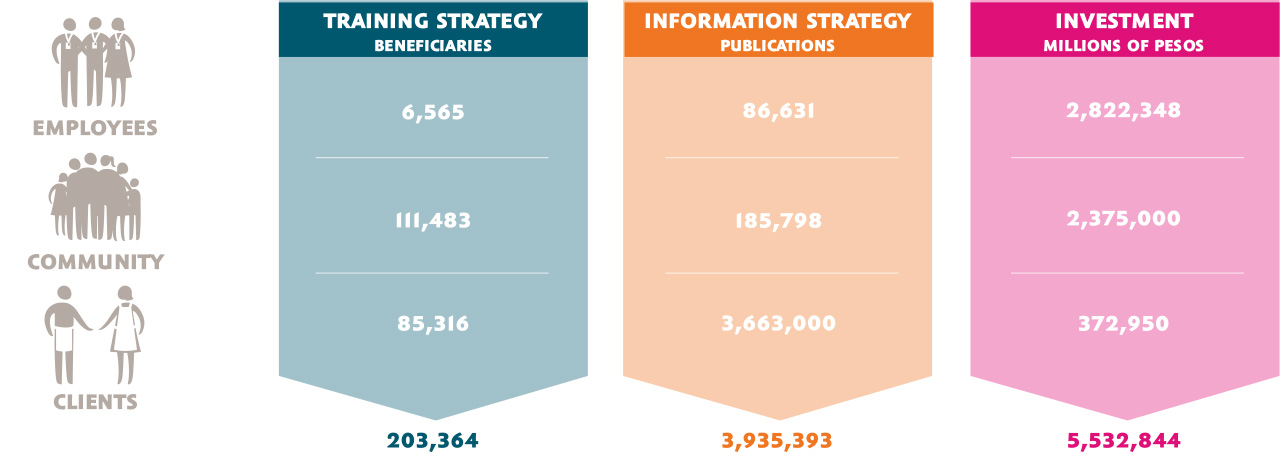

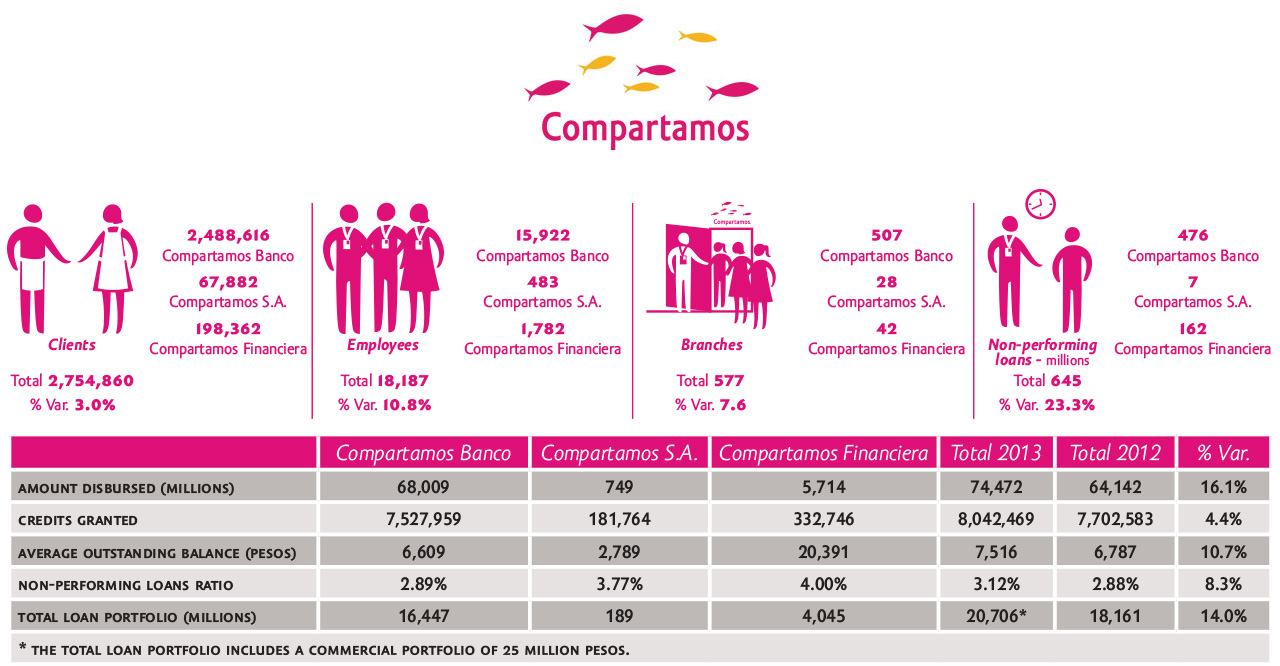

Financial education is a vital aspect of the value we offer to our customers. We seek to develop financial abilities through formative and informative strategies among our employees, clients, and the community. These strategies can contribute to informed decision making that makes for the proper handling of personal resources and the responsible use of financial services, all to the benefit of families and their wellbeing.

In the course of 2013 the workshop Improving My Personal Finances was given to all of our employees in Mexico and Guatemala, in the aim of providing tools that allow them to determine their own personal savings and payment capacities, as well as those of their clients, with a view to avoiding excessive indebtedness.

We also offered lectures on this subject at the First Compartamos Banco´s Micro-Enterprise Fair, attended by 2,366* people, including clients and members of the general public. Also, in an alliance with Promotora Social México and Fundación Proempleo, 2,000 training scholarships were granted to clients for use in the next calendar year.

At National Financial Education Week in Mexico we distributed 151,000 copies of Conduguías** and financial education notebooks, in collaboration with the Mexico’s financial consumer watchdog, the CONDUSEF. At the Women’s Encounters we provided 437 sessions in financial education, attended by 85,316 female clients.

* Made up of clients and the community, hence independent of the consolidated figures in the table. ** Financial product and service guides.