Cash and other investments were 2,533 million pesos at the end of 2013, down by 14.3% over the end of 2012.

Cash and other investments accounted for 10.0% of total assets, down from the 12.9% registered in 2012. Strong liquidity permits growth at lower cost and constitutes an important factor in Gentera’s business model.

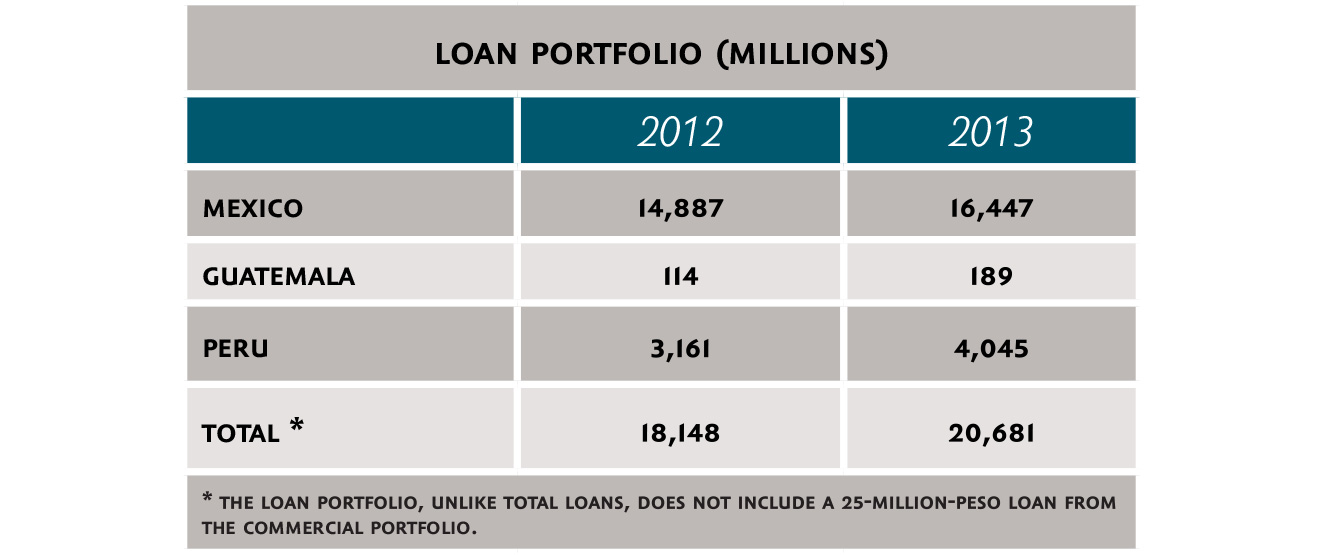

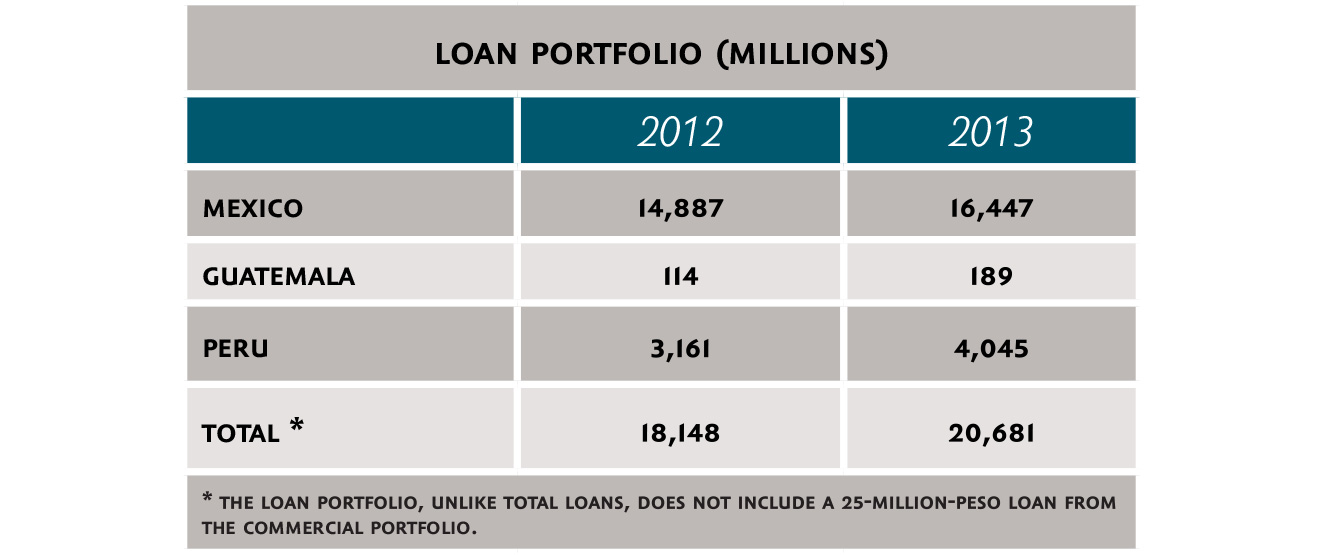

The loan portfolio amounted to 20,681 million pesos at the end of 2013, compared to 18,148 million pesos in 2012, reflecting growth of 14.0%. This was the result of an increase in clients in the markets in which we operate.

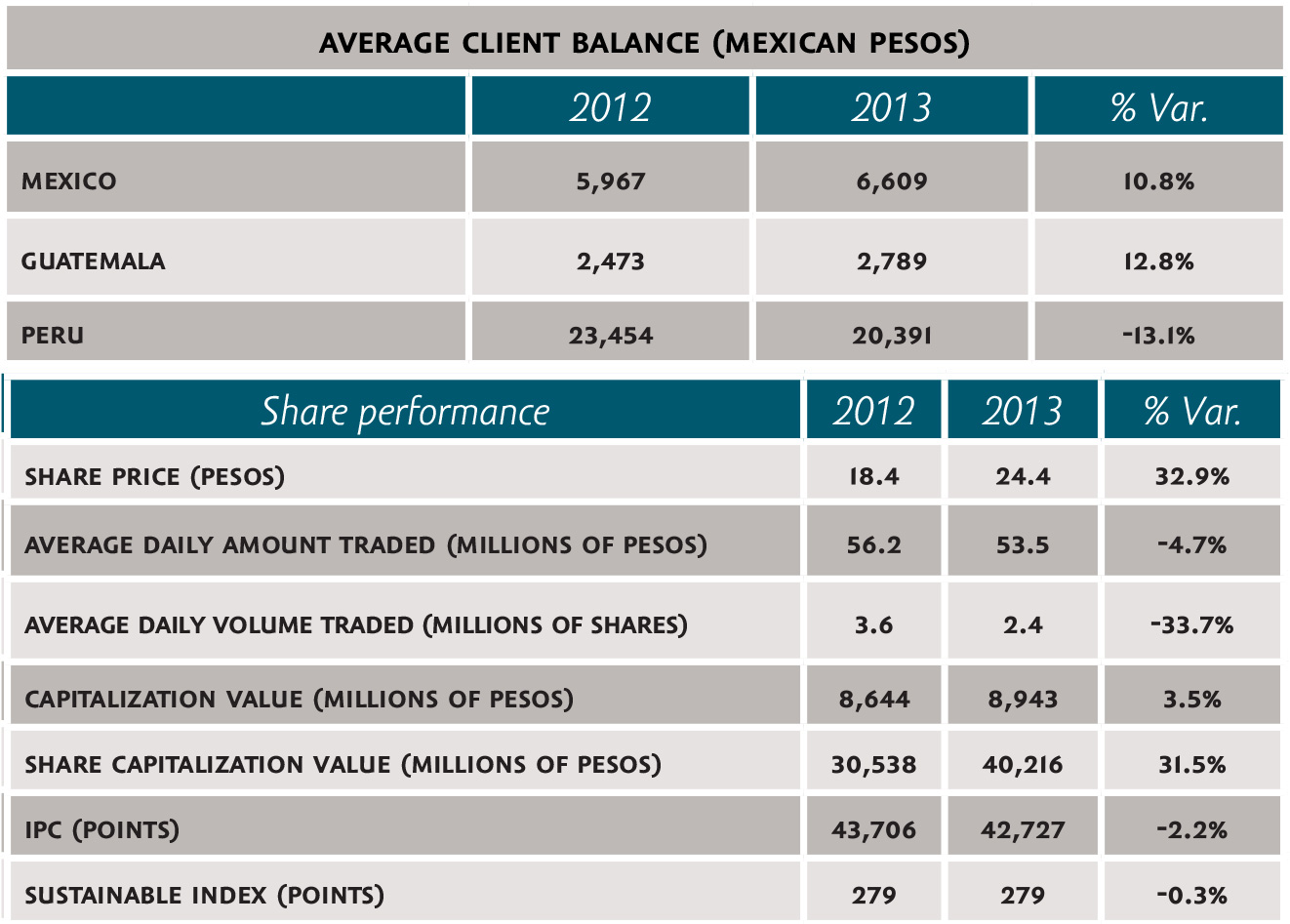

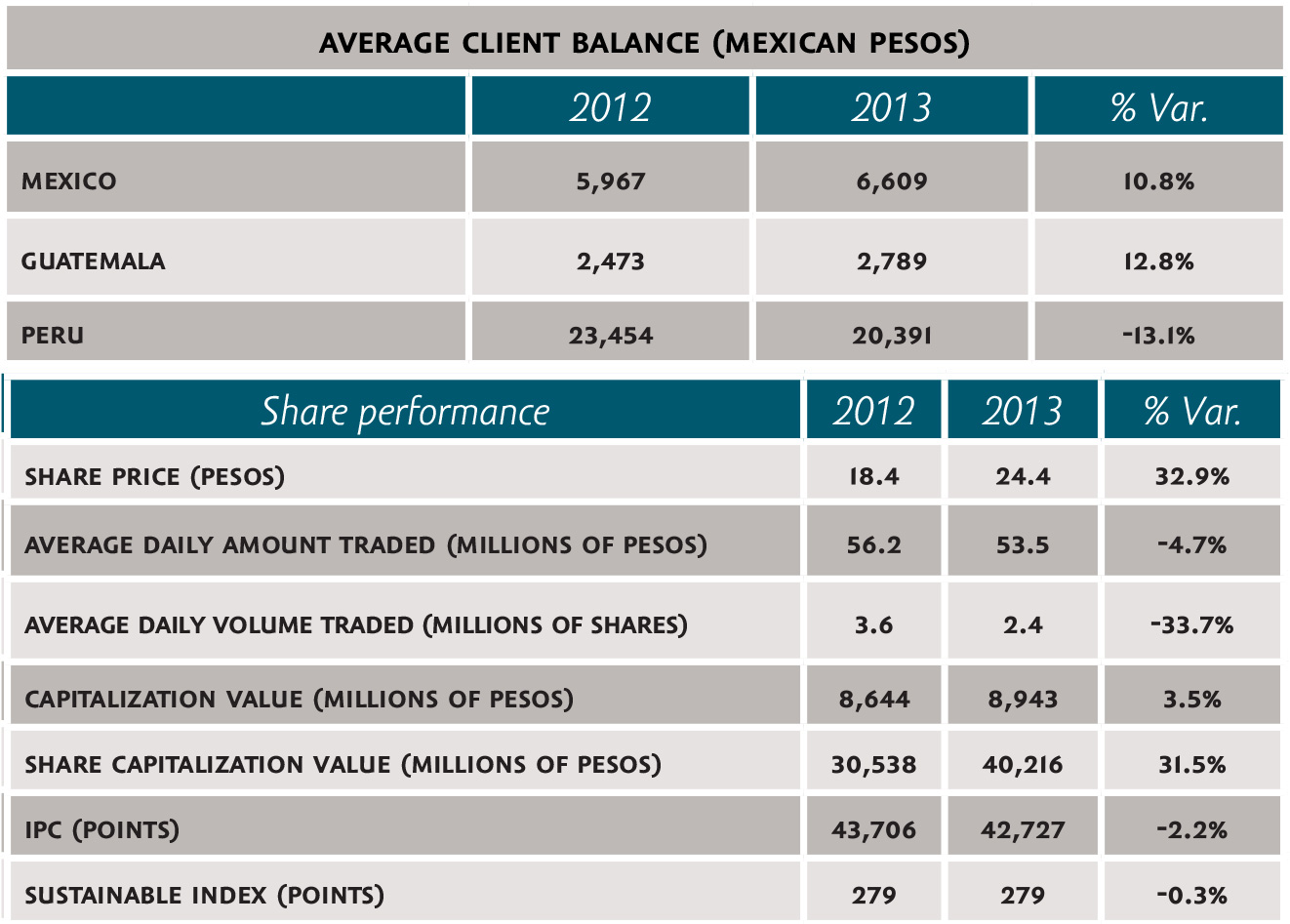

The average outstanding balance rose in Mexico and Guatemala, whereas in Peru it dropped, from 23,454 in 2012 to 20,391 in 2013.

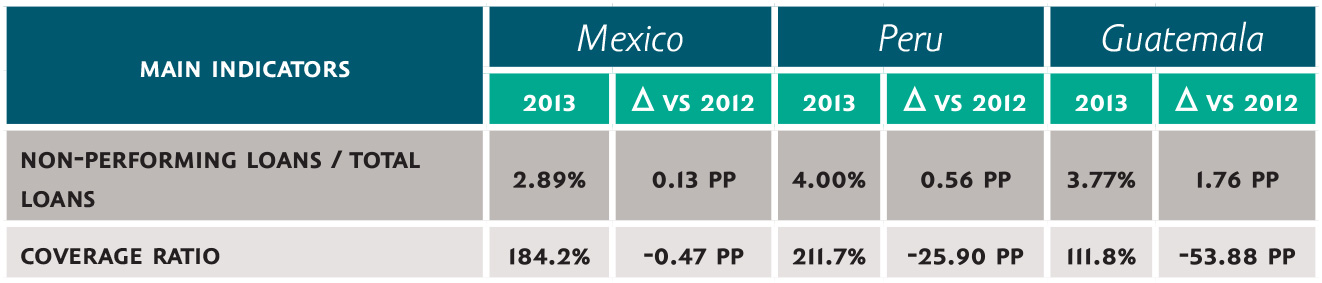

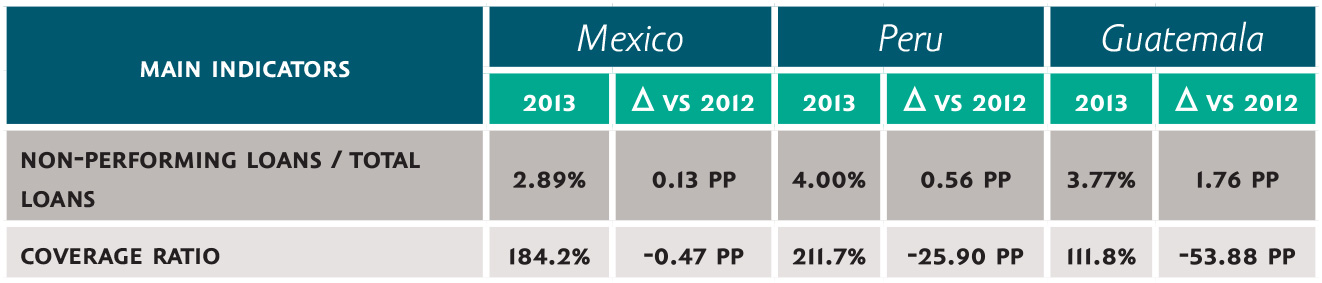

Non-performing loans at the end of 2013 amounted to 645 million pesos, 23.3% more than in 2012. This growth was mainly due to changes in the mix of the loan portfolio and to market dynamics, which trended toward growth in individual credits. In order to keep our late-payment ratio low and in line with market conditions in the places where we operate, we kept a close watch on our loan portfolio in terms of analysis and supervision.

The late-payment ratio in 2013 was 3.12%, below the sector average.

The coverage ratio in 2013 was 184.2% for Compartamos Banco, 211.7% for Compartamos S.A., and 111.8 for Compartamos Financiera.

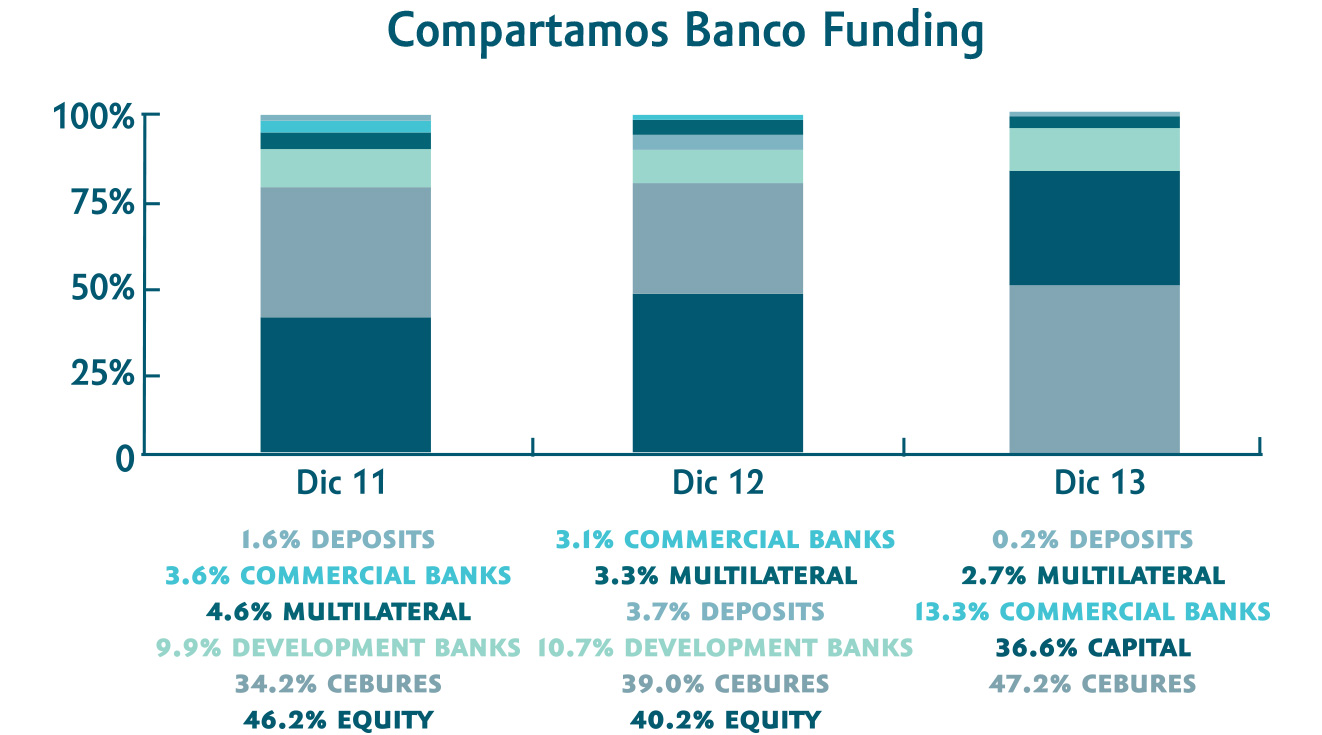

Total liabilities at the end of 2013 were 16,419 million pesos. The increase of 15.7% compared to the previous year was due to the greater demand for resources to fund the growth of the loan portfolio. The items that showed the greatest growth were long-term debt issuances and, in relative terms, traditional deposits, in combination with a decrease in bank loans.

Debt market conditions were favorable during the year and, combined with Gentera’s financial solidity, resulted in better conditions to access funding at lower costs and longer terms.

Gentera’s total stockholders’ equity stood at 8,943 million pesos at the end of 2013, up by 299 million pesos, equivalent to 3.5%, from the 8,644 million pesos registered at year-end 2012.

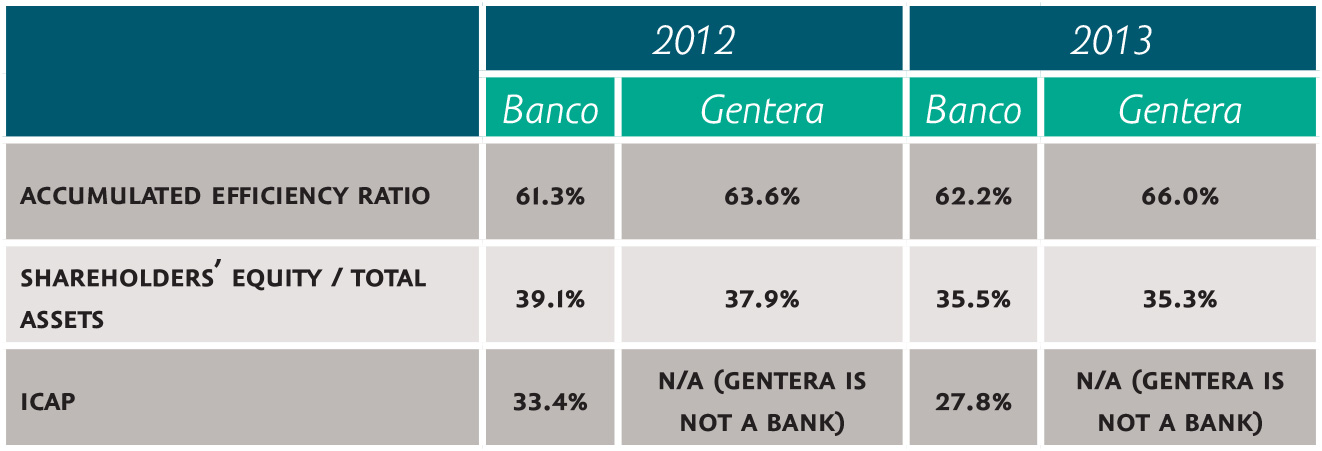

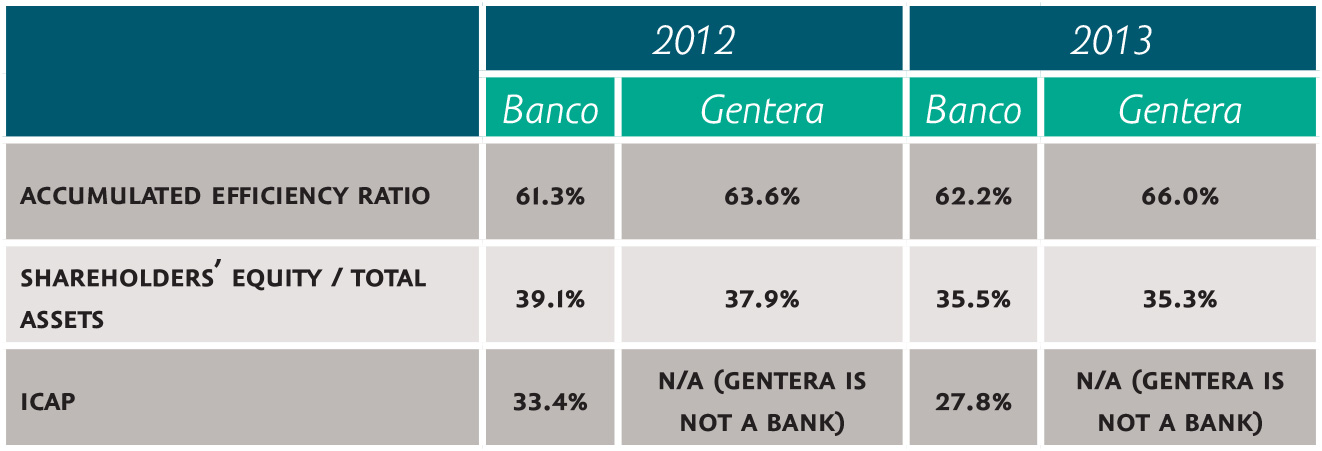

The capitalization ratio was 35.5% in 2013, compared to 37.9% in 2012.

Return on average assets (ROAA) was 9.1% in 2013, compared to 10.0% in 2012. Return on average equity (ROAE) inched up to 25.3% in 2013 from the level of 25.1% registered in 2012.

Other accounts receivable at the end of 2013 amounted to 1,732 million pesos, 32.6% more than the 1,306 registered at year-end 2012.

The accumulated efficiency ratio of Gentera in 2013 was 66.0%, up from 63.6% over the previous year. This rise was mainly due to new infrastructure for the service offices and the hiring of personnel.

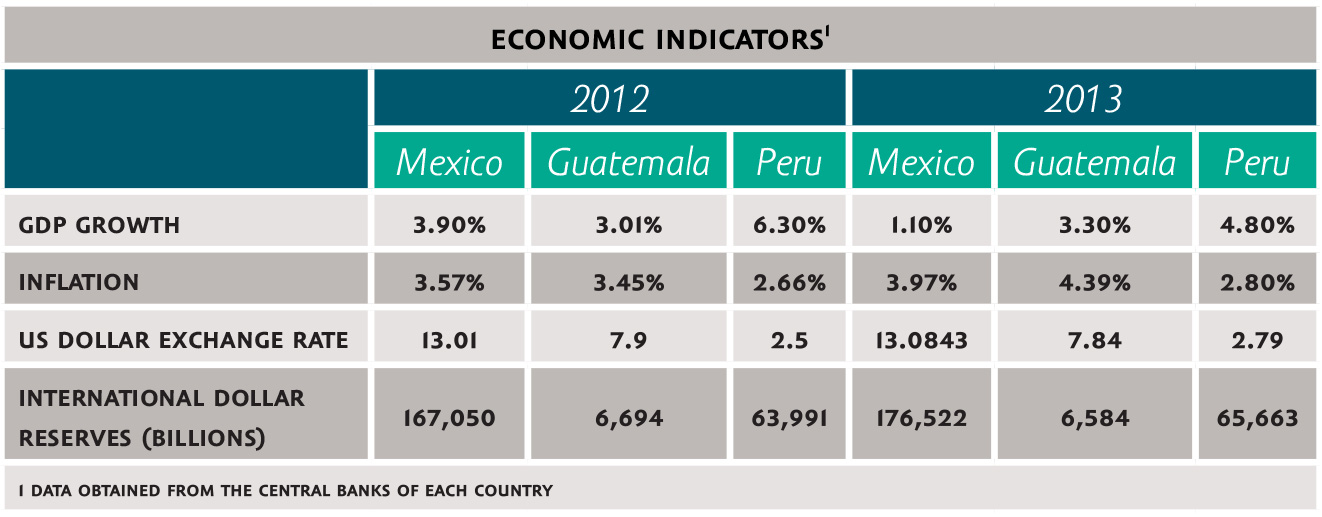

The 32.9% rise in Gentera’s share price contrasts sharply with the 2.2% fall in the benchmark index (the IPC) and the 0.3% fall in the Sustainable Index of the Mexican Exchange. (Gentera is listed on both of these indexes.)

The positive share performance in 2013 was due to Gentera’s operating and financial performance, as well as to an intensive and continual effort to communicate with the financial markets, keeping investors and analysts correctly informed about the company’s trends and prospects. This resulted in a more efficient share price appraisal.

As part of the evolution of Grupo Compartamos into Gentera, the Extraordinary Shareholders’ Meeting of Compartamos, S.A.B. de C.V. held on December 16th 2013 approved the change of the company name to Gentera, S.A.B. de C.V. As a result, the ticker symbol under which our shares are publicly traded on the Mexican Stock Exchange was also changed. The company’s new ticker symbol in 2014 will be GENTERA.