Credit has proved to be an important vehicle for the empowerment of women, giving them decision-making possibilities in their economic activities and their homes, building self-confidence, and generating development for themselves, their families, and their businesses.

In order to reach the largest number of people in the least possible time, we constantly renew and revise our knowledge of the markets in which we are present. We conduct surveys and carry out analyses of the social and economic conditions of both the communities themselves and the people at the base of the economic pyramid, in the aim of offering a portfolio of products suited to their needs.View more [+]

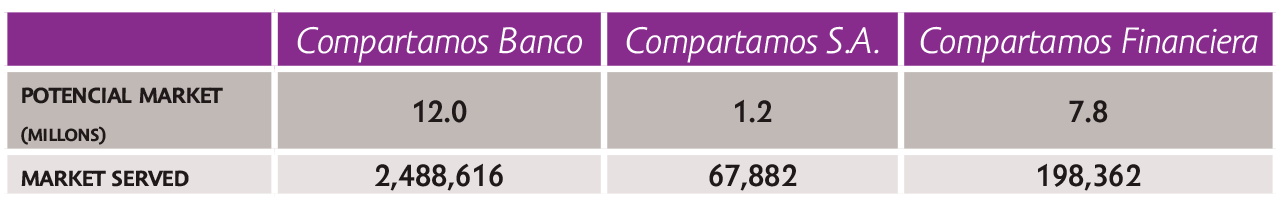

By means of publically available data from the national statistics agencies* of the countries in which we are present, we have determined the potential markets of the each business, in order to design strategies in accord with their growth and development. In the case of credit, we have a potential market of some 21 million people. We have so far reached 12.9% of this market, a fact which both encourages us and promises future growth. Our greatest challenge is the market for insurance and payment channels.

Regardless of the country in which we are operating, our clients must meet three requirements in order to be eligible for a credit: to be of legal age, to live in a low-income urban or rural community (base of the economic pyramid), and to have a business or the potential to start one up.

The diversification of our products, clients, and loan portfolio allows us to reduce liquidity risks and the perils of excessive indebtedness, lending solidity to our operations.

* Mexico, Instituto Nacional de Estadística y Geografía (INEGI)):http://www.inegi.org.mx/. Guatemala, Instituto Nacional de Estadística (INE): http://www.ine.gob.gt/np/. Perú, Instituto Nacional de Estadística e Informática (INEI): http://www.inei.gob.pe/.

Close [-].

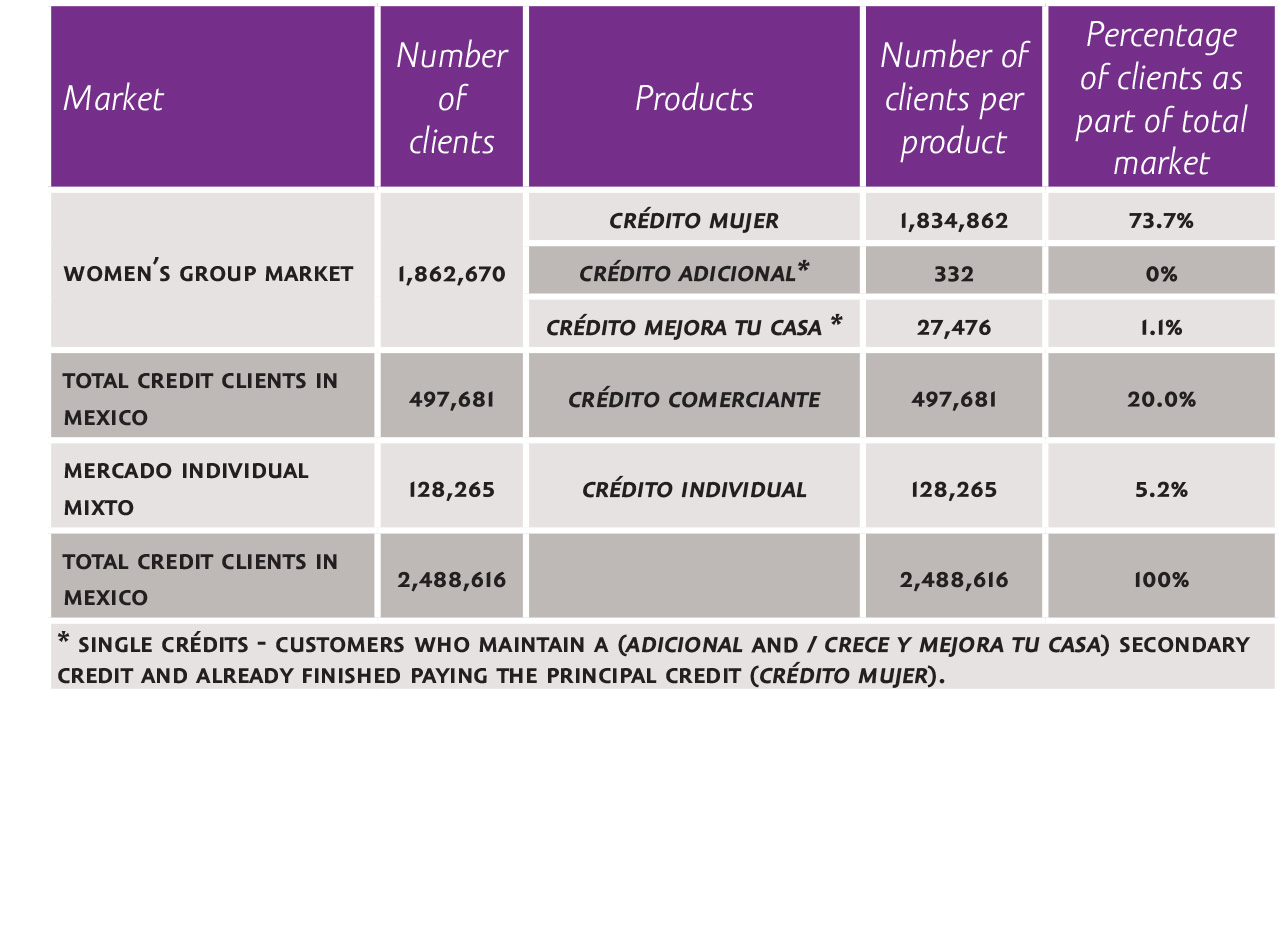

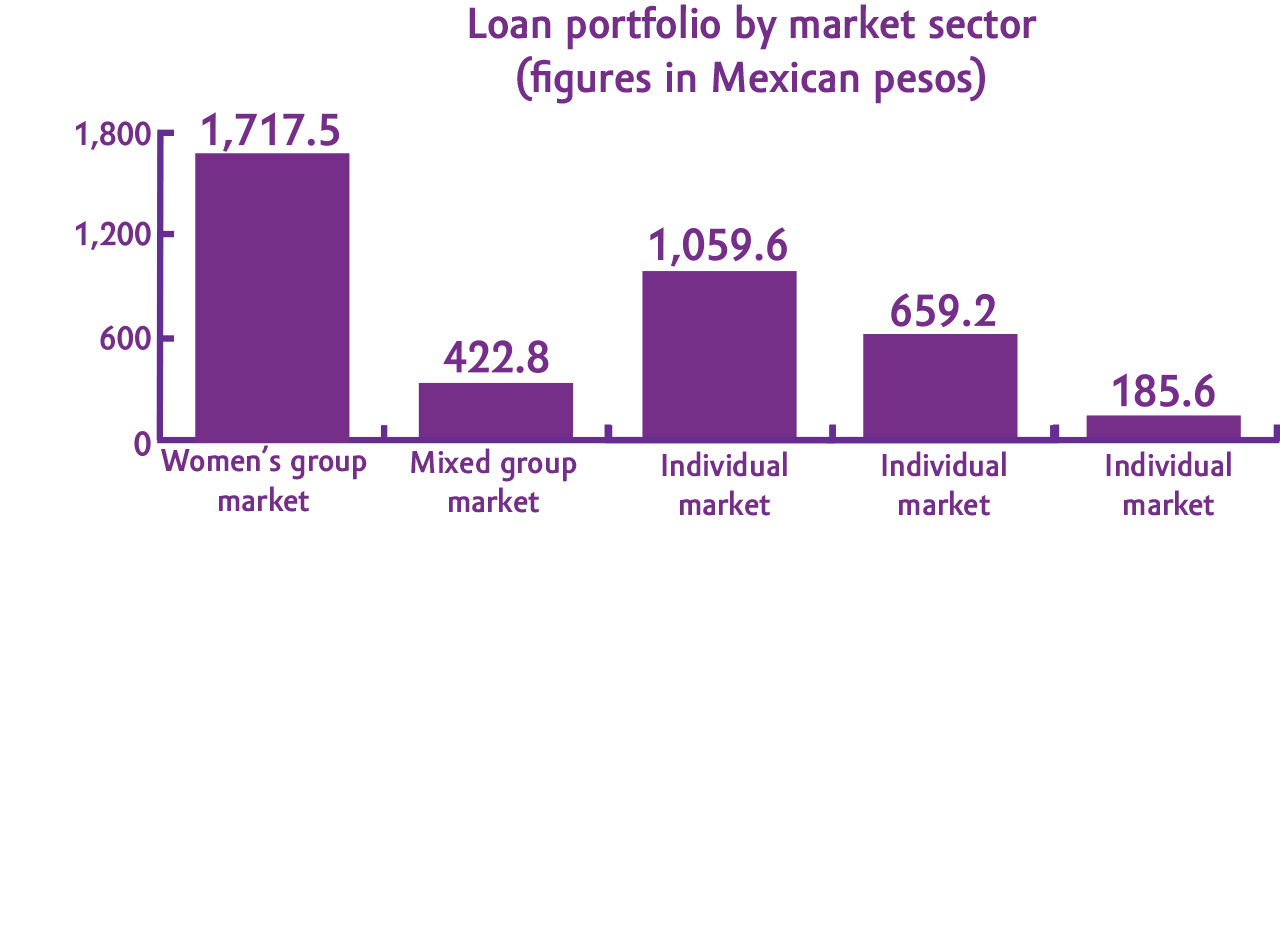

• Compartamos Banco has four types of credit products in the group market, whose number of clients decreased by 1.3% in 2013.

• In the individual market, which grew by 22.7%, it offers a single type of credit.

• Women make up 91.8% of Compartamos Banco’s total clients.

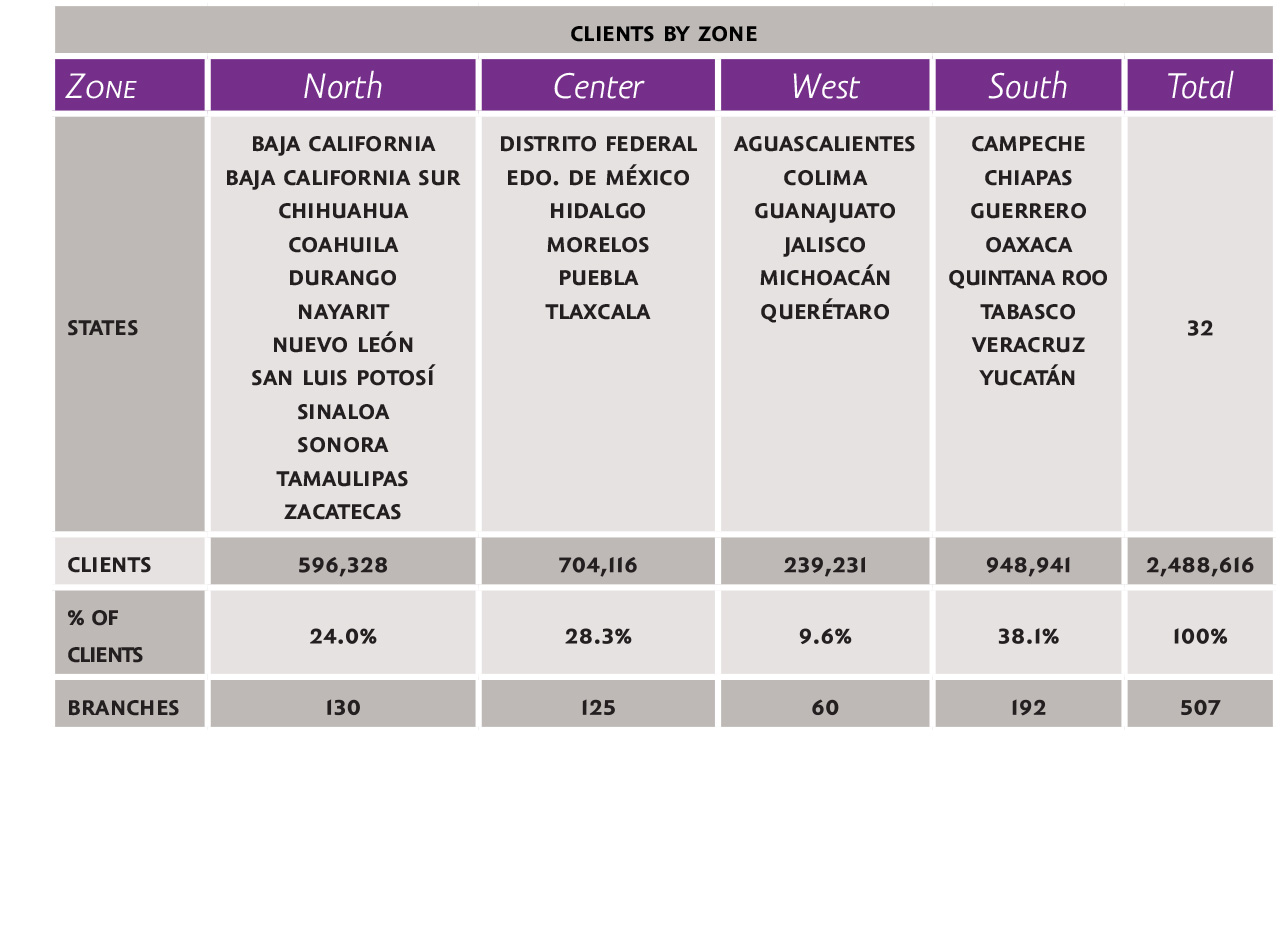

• The southern region of Mexico concentrates 38.1% of the bank’s clients, down by 1.1 percentage point from 2012.

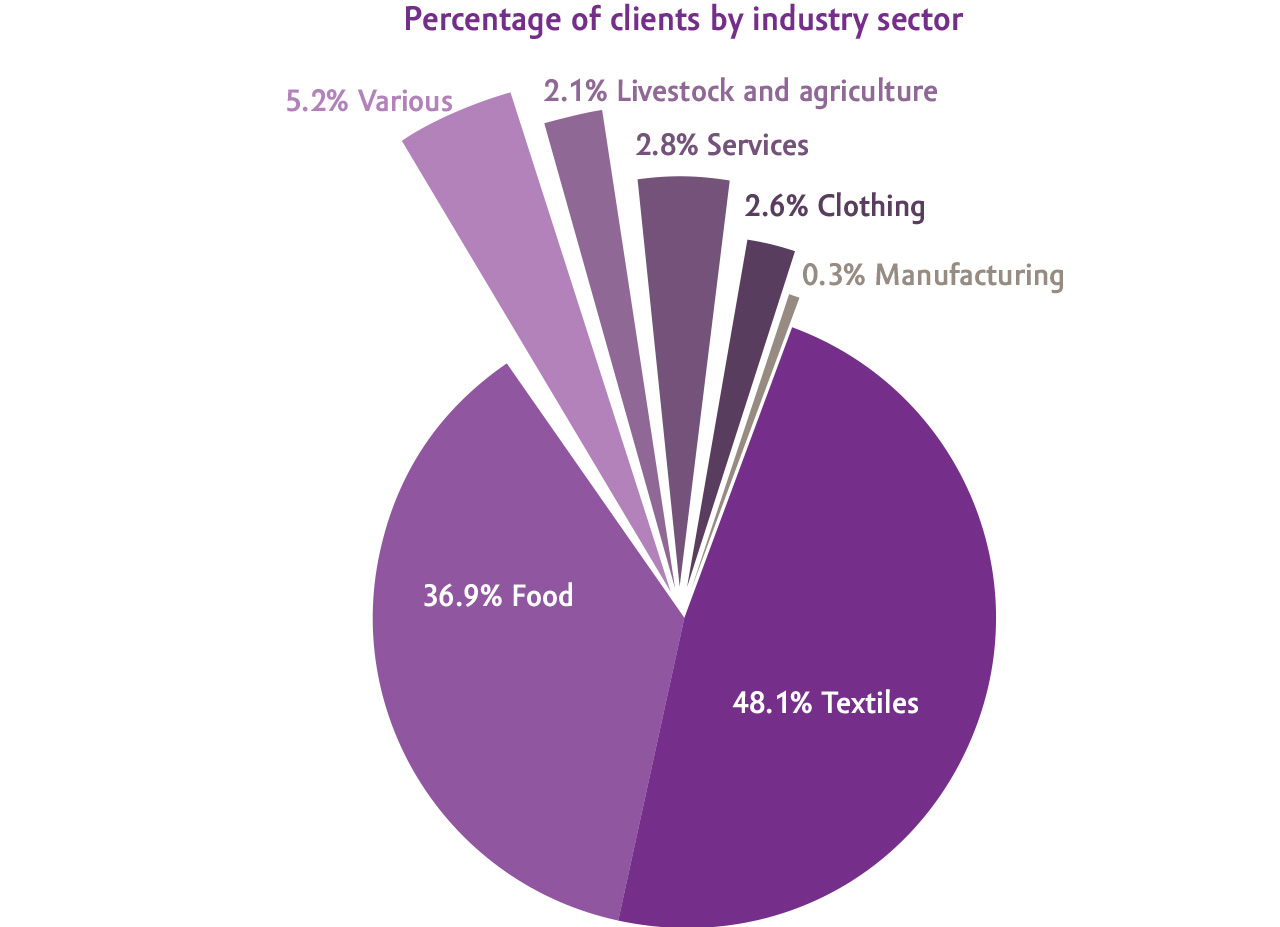

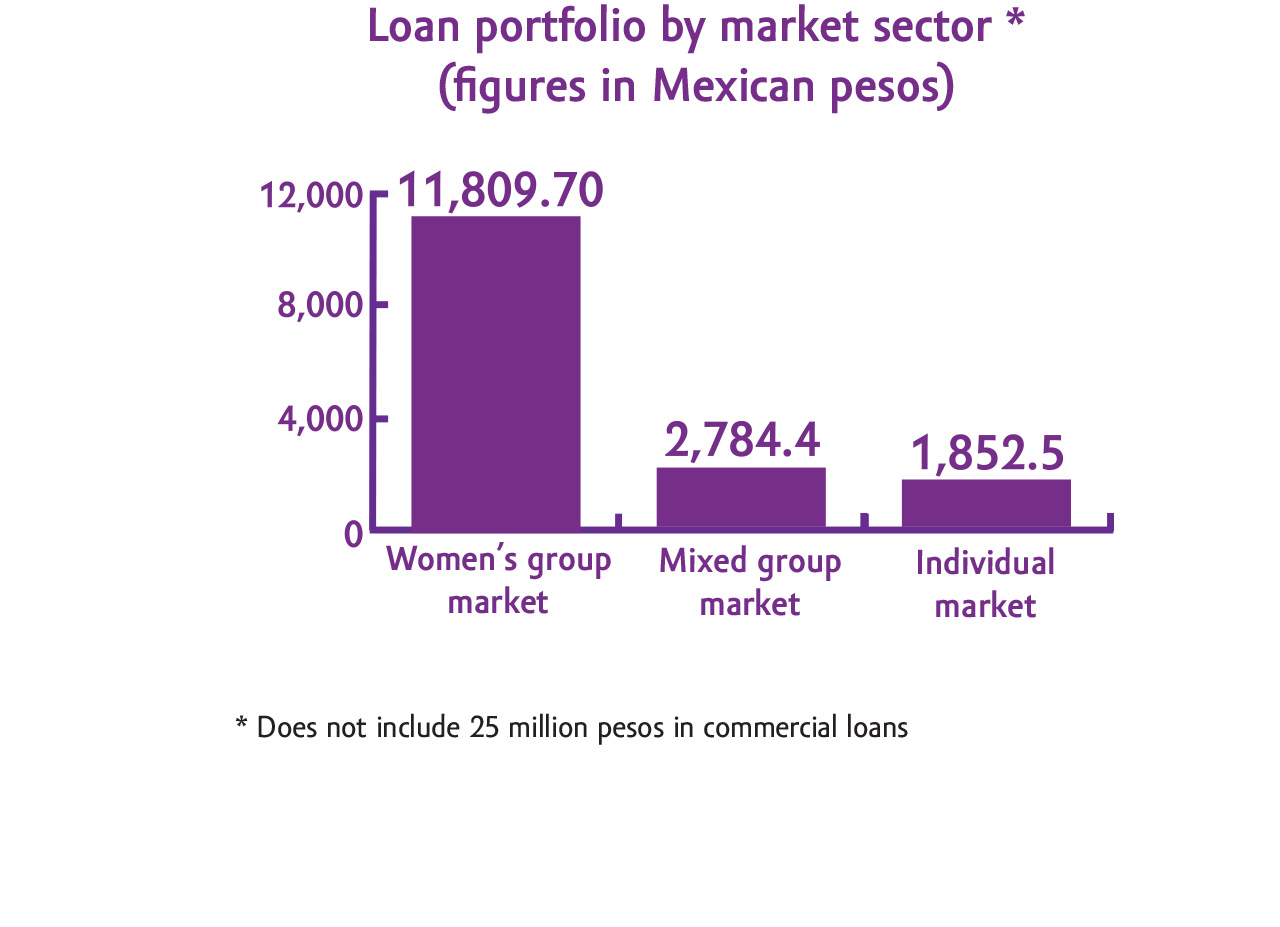

• The group market makes up 87.3% of the total loan portfolio of Compartamos Banco, and the sale of textiles is the most common commercial activities of its clients.

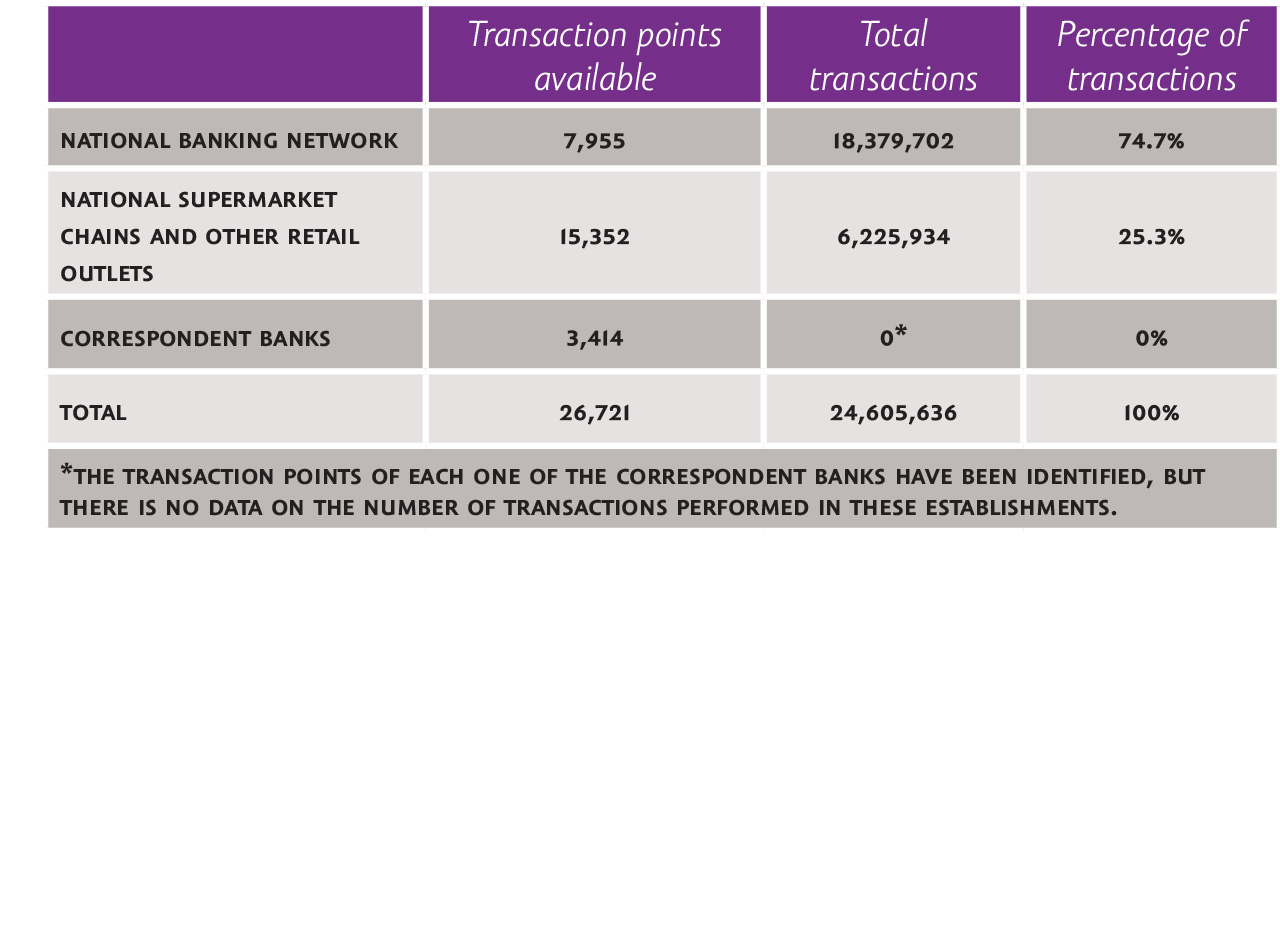

• For the purpose of distributing credits and receiving payments, we have 26,721 transaction points in Mexico, 6,542 more than in 2012. By means of alliances with the national banking network, supermarket chains, and other retail outlets, as well as correspondent banks, a total of 24,605,636 transactions were handled in 2013. Of these, 68.9% consisted of loan payments and 31.1% distribution of credits.

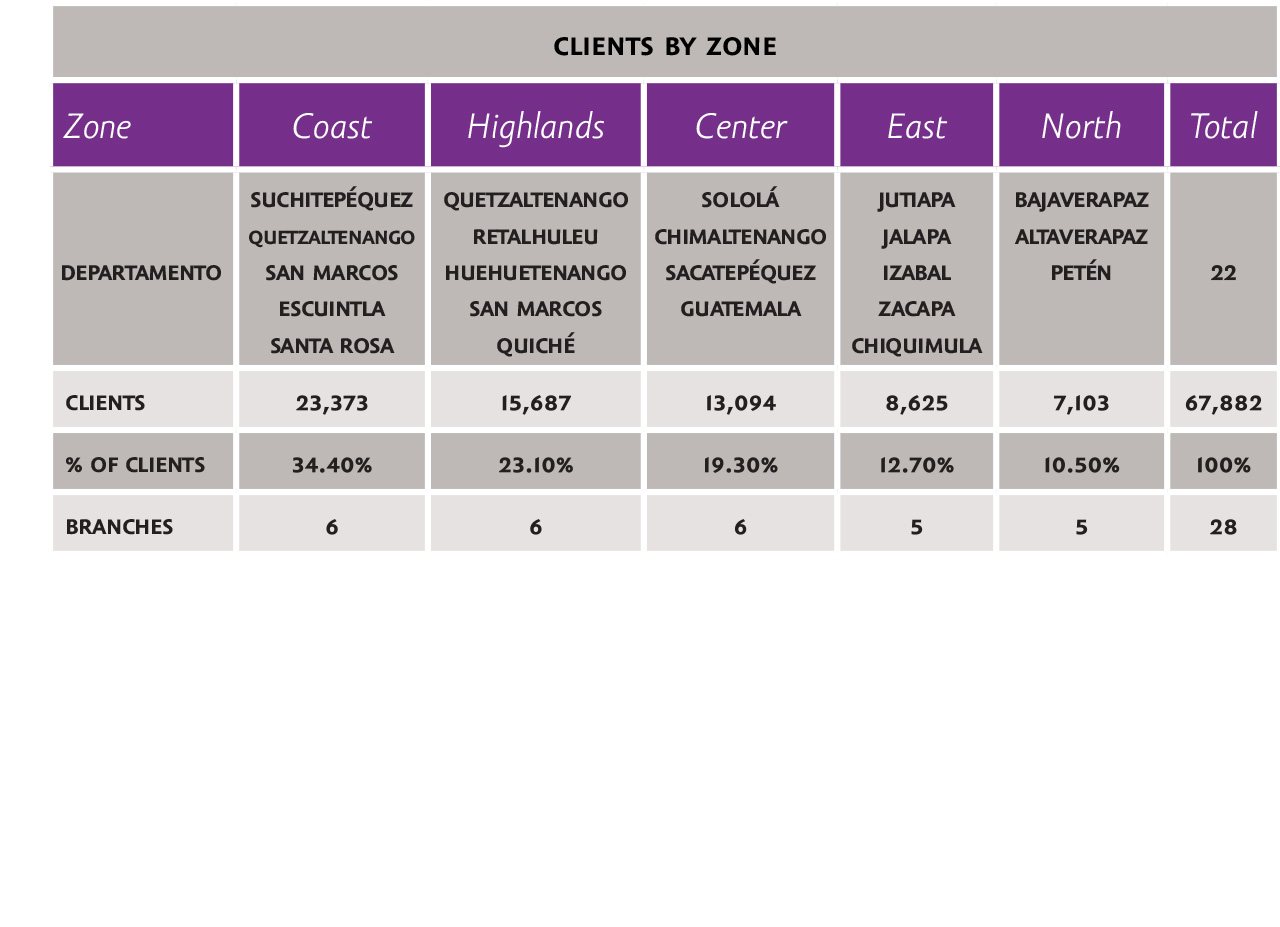

• Compartamos S.A. offers a single credit product, the Crédito Mujer, for which the number of clients grew by 47.7% over 2012.

• The number of branches went from 18 in 2012 to 28 in 2013, while the number of employees grew by 55.8%, reflecting the strength of this type of credit offer.

• All the clients of Compartamos S.A. are women.

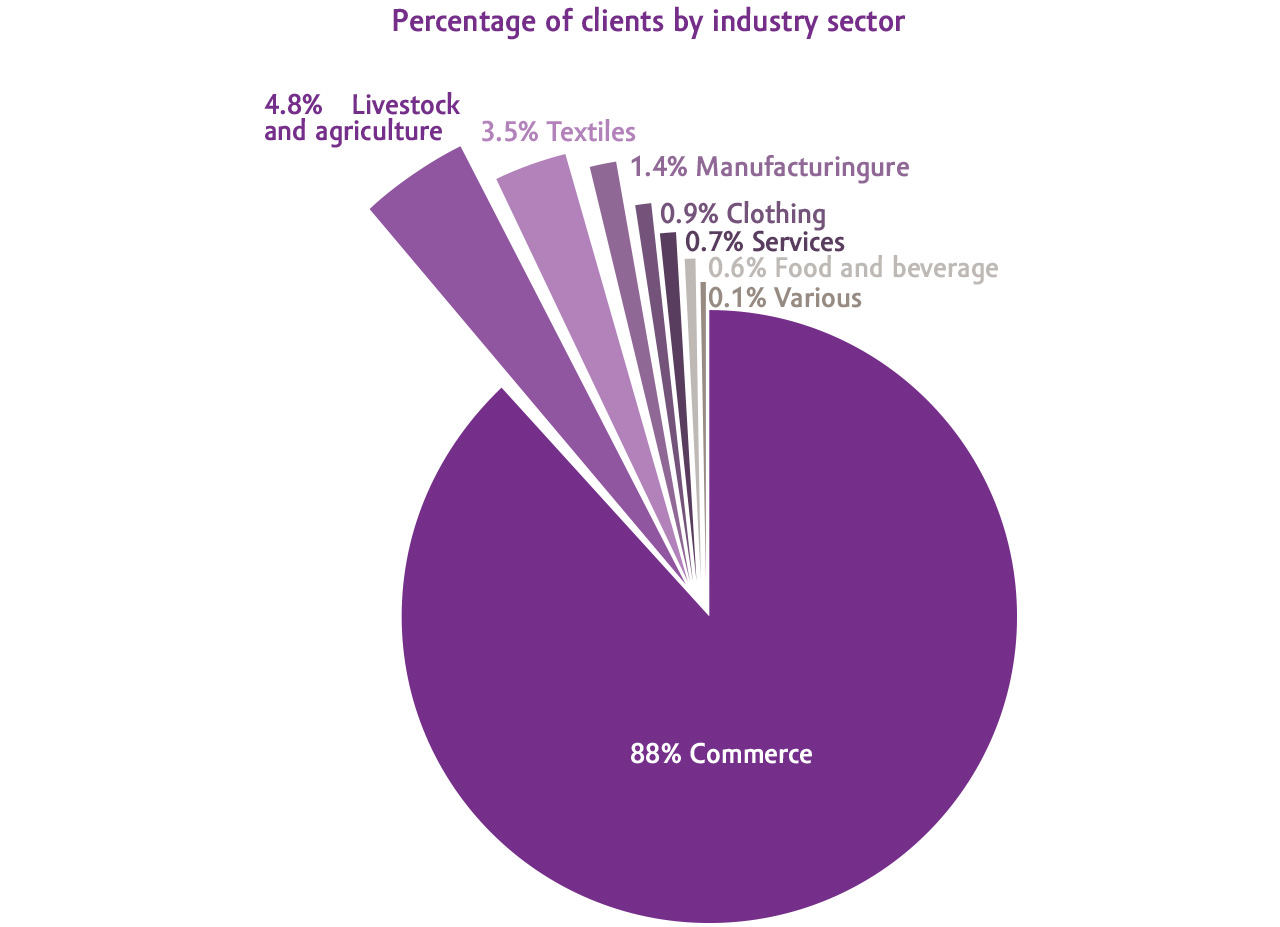

• The greatest concentration of clients is in the coastal region, which comprises five departamentos states. The most common activity of clients is commerce, which accounts for 88.0% of total activities.

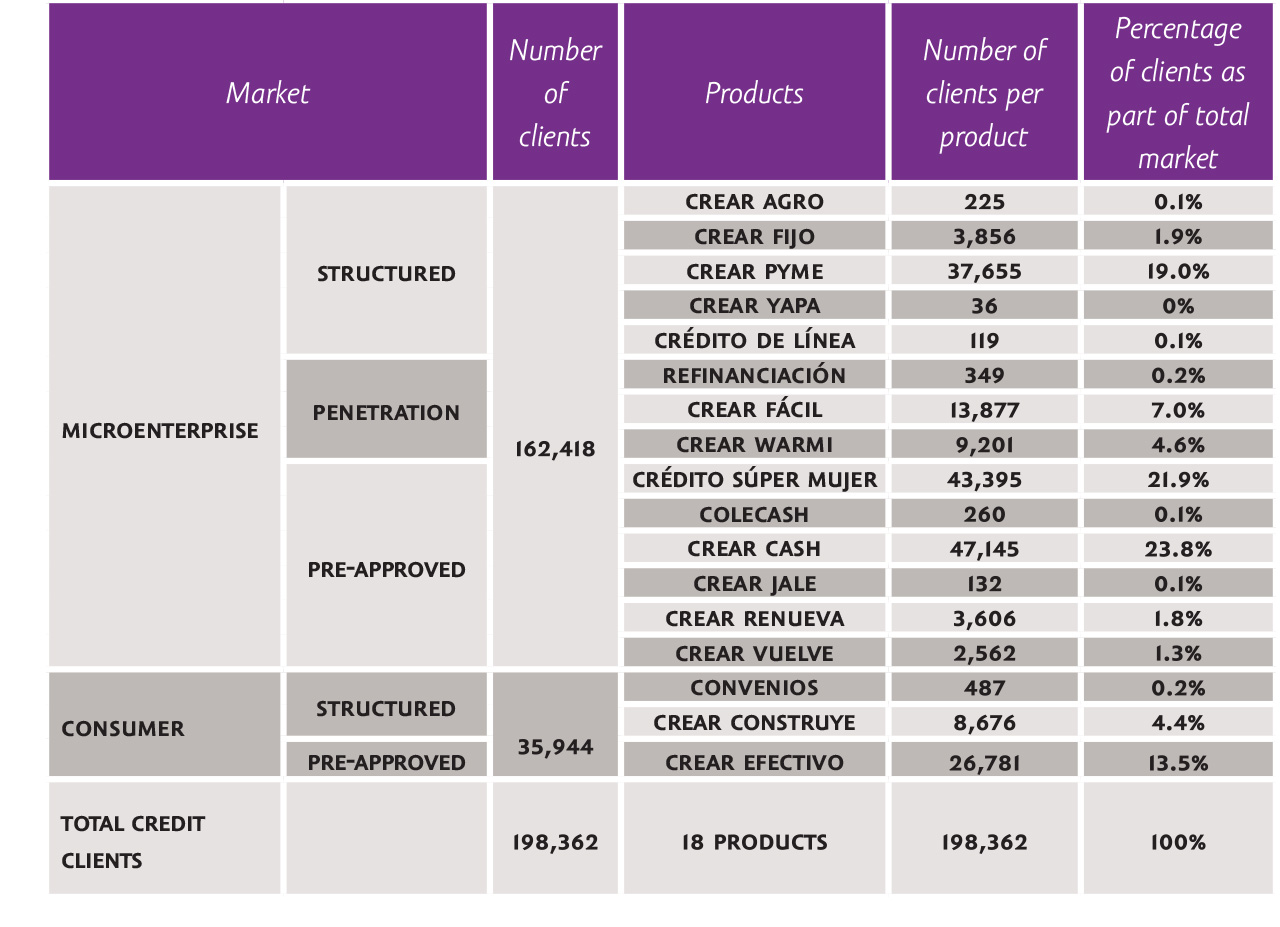

• At Compartamos Financiera the Crédito Súper Mujer demonstrated its potential, increasing from 4,946 clients in 2012 to 43,395 in 2013.

• Of total clients, 63.2% are women.

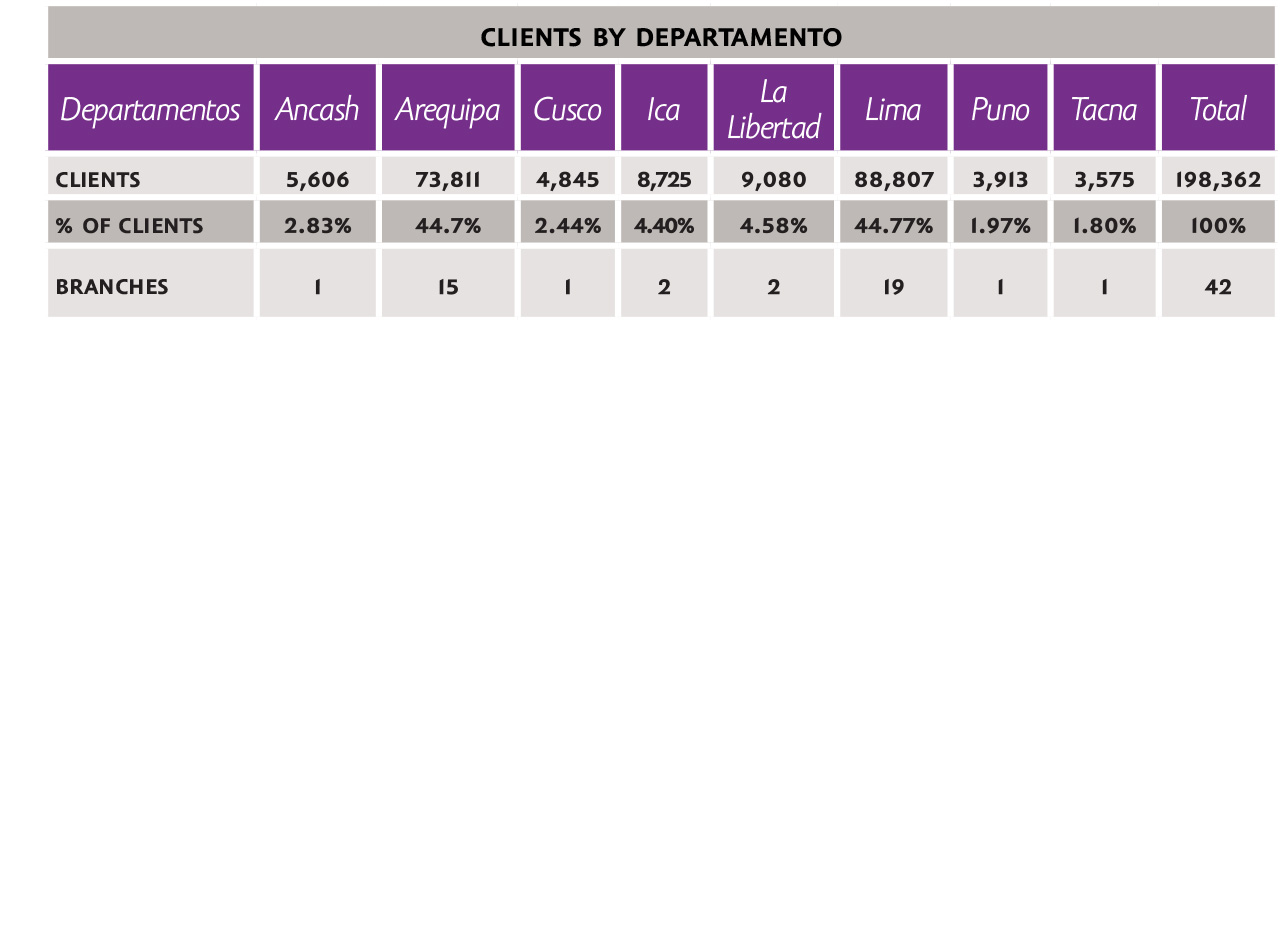

• Compartamos Financiera expanded into four new states in 2013, with Lima concentrating the greatest percentage of clients (44.7% of the total).

• The Structured Microenterprise Market accounts for 43% of Compartamos Financiera’s loan portfolio, with five different products and 41,894 clients.

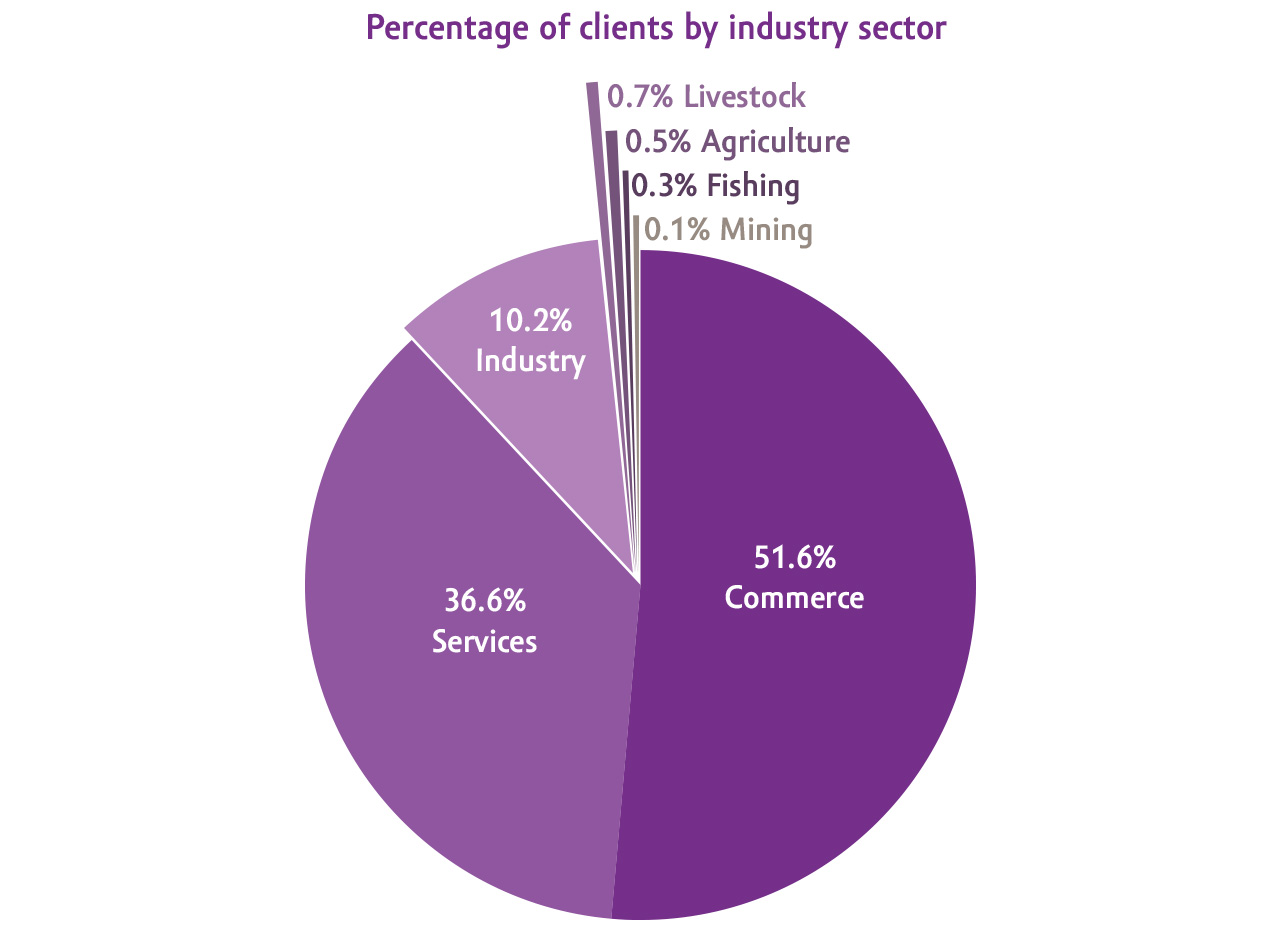

• Commerce is the activity of 51.6% of clients in Peru, followed by the service sector (36.6%).

We grow to offer opportunities for inclusion to the greatest number of people

CLIENT PROTECTION AND SERVICE

Client protection and service are a fundamental part of our offer of social value..

Protection

Our Client Protection Index, or IPAC (as it is known by its Spanish-language acronym), is an internal monitoring system that allows us to measure compliance with minimum standards and best practices in client protection. These standards have been taken from the SMART Campaign, an international initiative designed to consolidate the knowledge and experience of leading financial institutions in the microfinance sector.

We implemented IPAC in 2012 and just one year later it has become an effective tool for establishing solid and lasting relations with clients, increasing their loyalty to our brand, and helping to reduce financial risk.

Also, through our example we invite the entire microfinance sector to establish a common framework of responsible banking and so to provide protection guarantees to clients of the microfinance in the region.

In 2013, the IPAC was incorporated into the operations of Compartamos Banco through an internal monitoring system that allows us to measure and control levels of compliance with client protection standards and best practices. The IPAC itself is monitored by the 13 management departments of Compartamos Banco, by means of a Balanced Scorecard. In 2013 an Over-Indebtedness Risk Management bulletin board was created and the report on over-indebtedness in the bank’s portfolio, for the use of the Risk Committee, was consolidated.

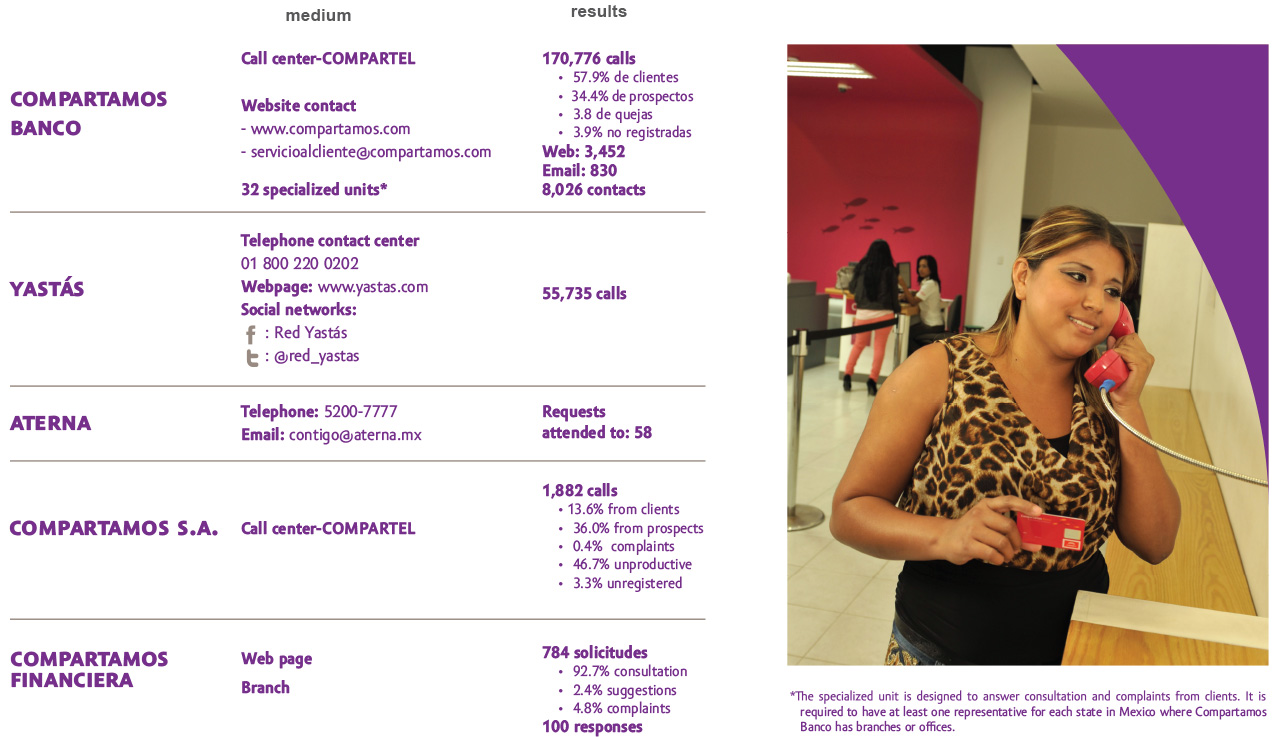

Client service

We offer our clients friendly and quality service, with open channels for complaints and suggestions to attend to all of their needs.

ACTIVITIES WITH CLIENTS

We promote training and integration activities with our clients in order to stimulate their entrepreneurial spirit, so that they can generate more economic and social value for their families, businesses, and communities.

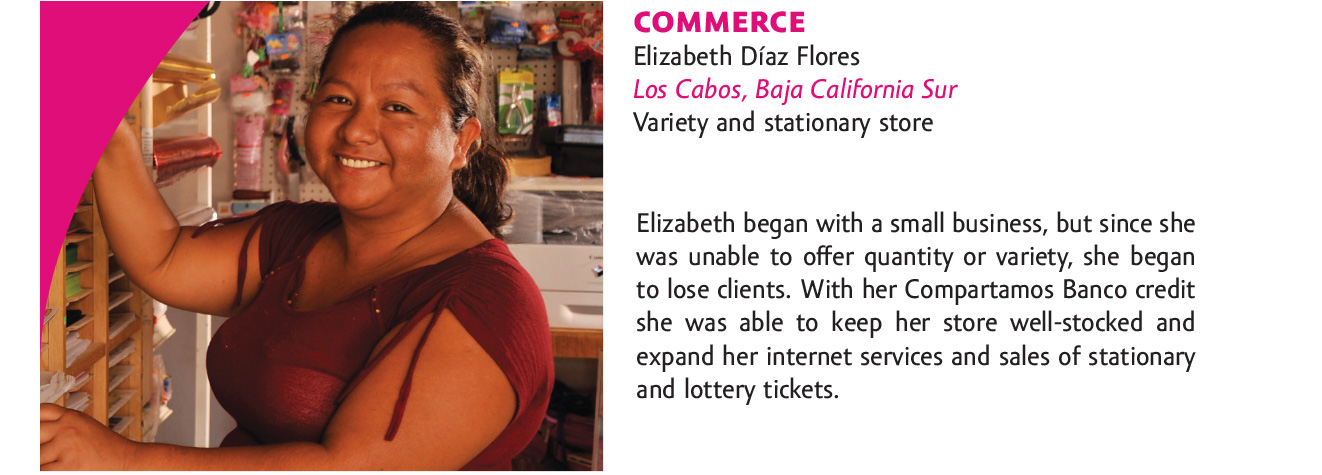

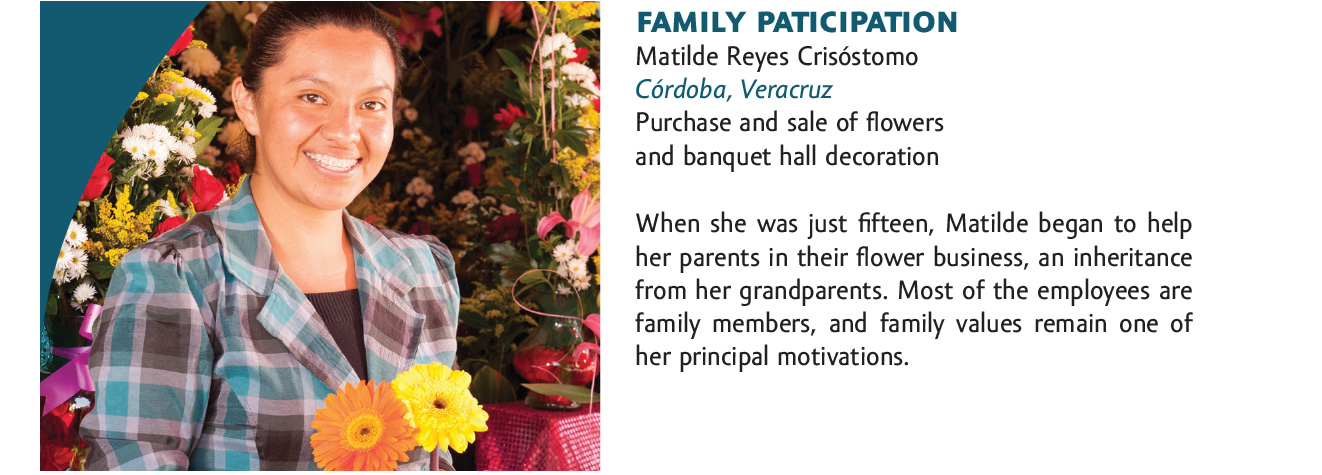

Through the Compartamos Micro-Entrepreneur Award we acknowledge the effort and dedication our clients demonstrate in offering a better future to their families, which impacts in turn the creation of opportunities for the development and wellbeing of their communities.

Among the 32 micro-entrepreneurs who received the award, five stood out for their achievements in the categories of:

• Production

• Services

• Commerce

• Family participation

• Social responsibility

Judges:

1. Angélica Fuentes

Executive President of Grupo Omnilife

2. Simón Hamparzumian,

President of Grupo Fisher’s

3. Francisco Arenas,

Professor at the IPADE

We create ties of loyalty and trust with our clients, involving them in various activities from which their other family members can also benefit.

Objective: To reward clients who share their best recipe in the most creative way: the dish that is special to the family and reflects their values, customs, and traditions. The aim is to promote family values, contribute to the positioning of the brand, and increase the loyalty of clients.

Objective: To reward clients who share their best recipe in the most creative way: the dish that is special to the family and reflects their values, customs, and traditions. The aim is to promote family values, contribute to the positioning of the brand, and increase the loyalty of clients.

Objective: To reward children who express most creatively in a drawing what they most like to share with their families, in order to foster family participation and contribute to the positioning of our brand among future generations of clients.

Objective: To reward children who express most creatively in a drawing what they most like to share with their families, in order to foster family participation and contribute to the positioning of our brand among future generations of clients.

Objective: To reward children for outstanding performance in the 2012–2013 school year. The competition promotes values such as responsibility, perseverance, and teamwork, with a view to fostering loyalty among clients through their children.

Objective: To reward children for outstanding performance in the 2012–2013 school year. The competition promotes values such as responsibility, perseverance, and teamwork, with a view to fostering loyalty among clients through their children.

OUR CAUSE

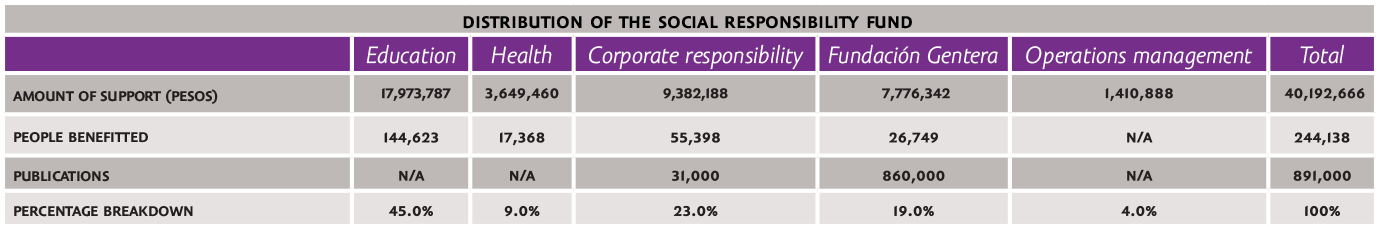

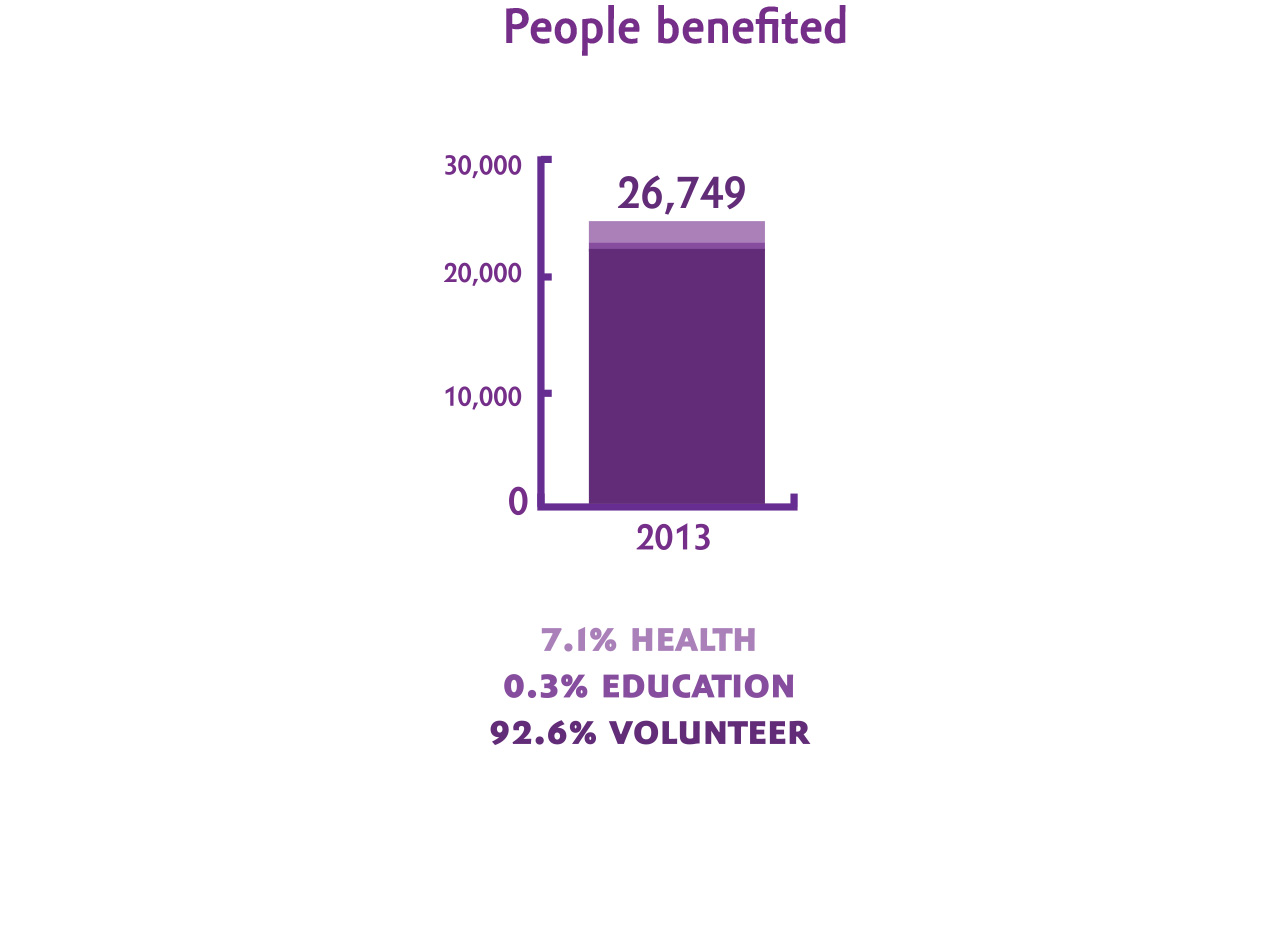

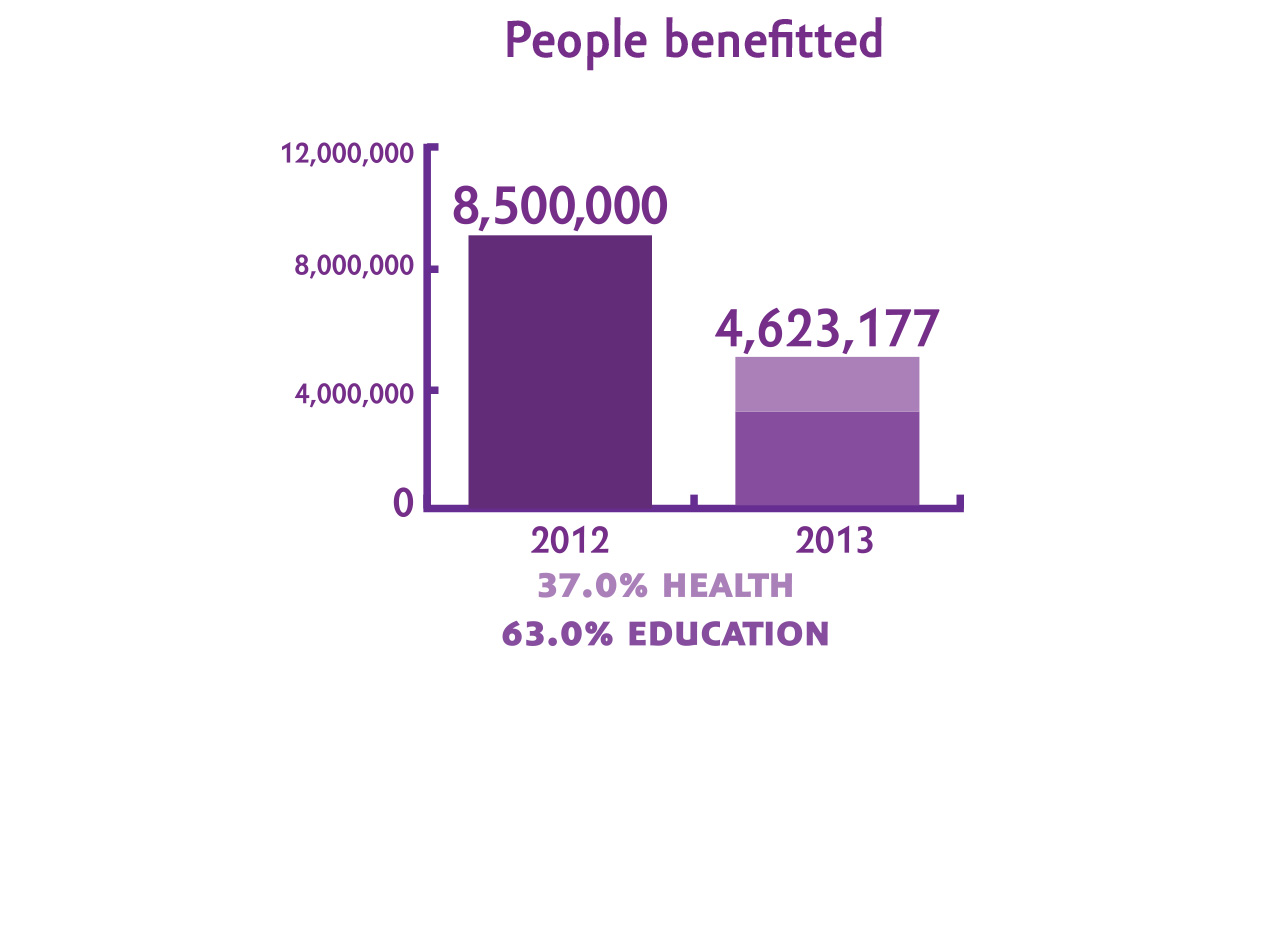

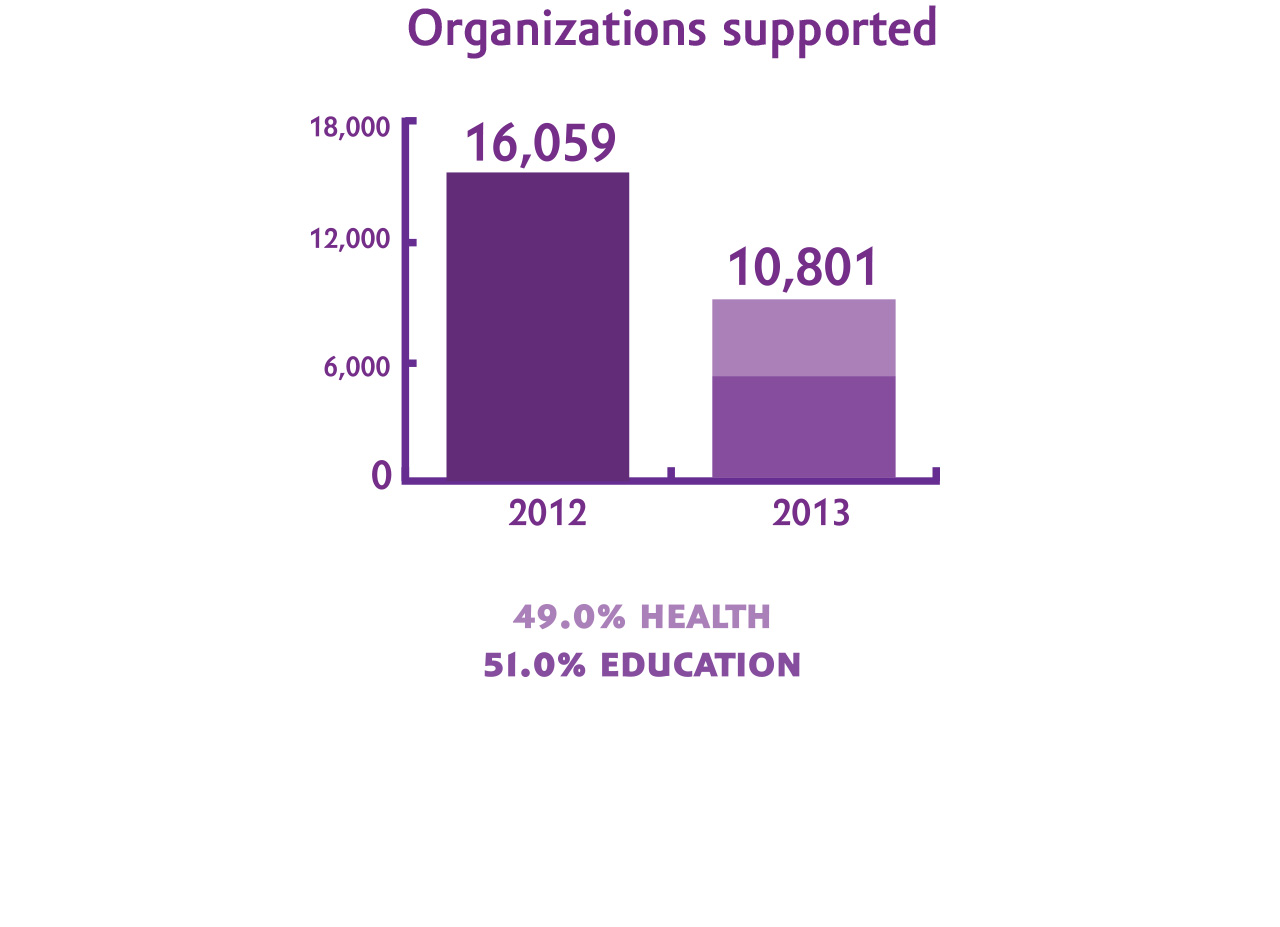

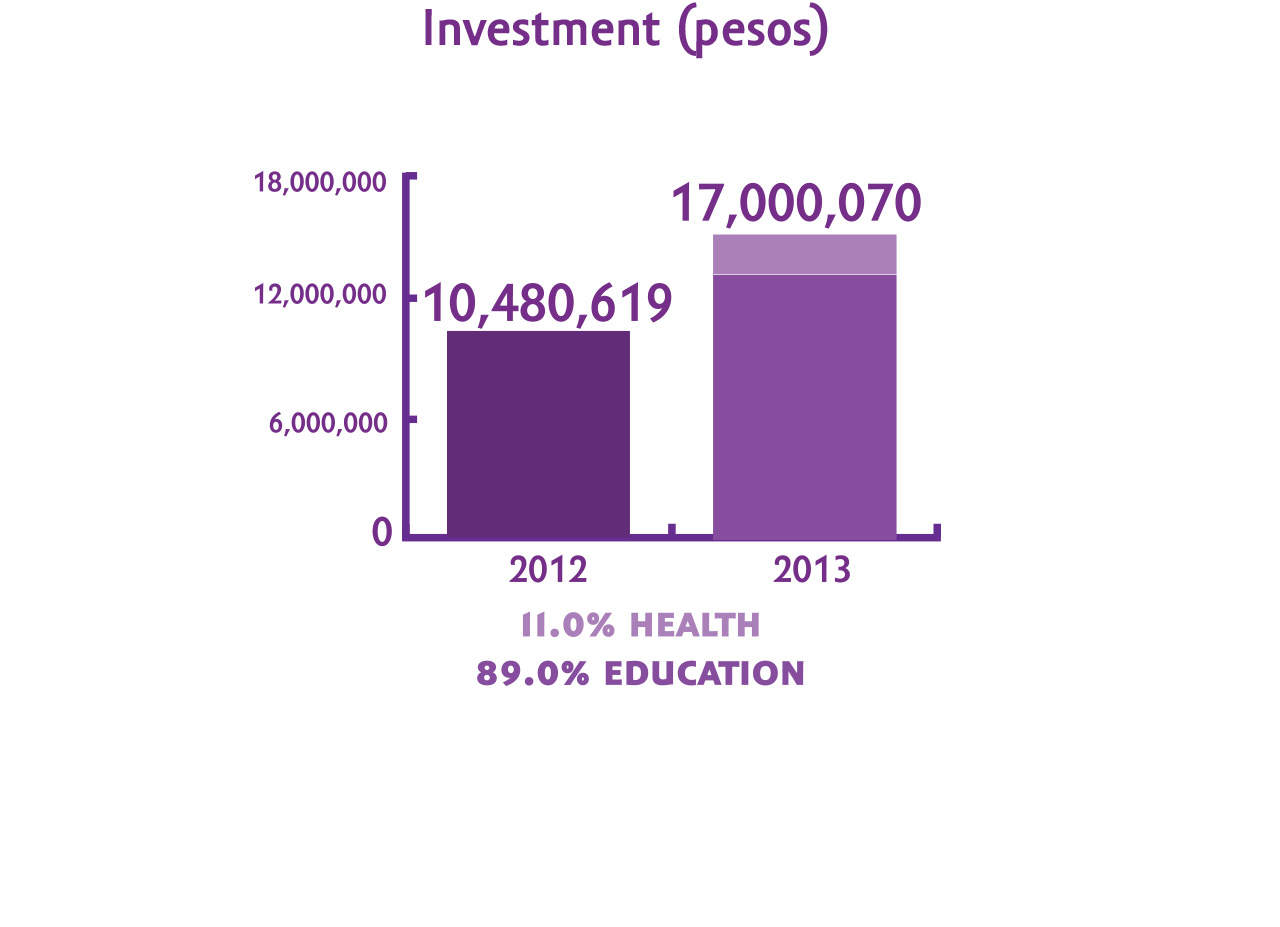

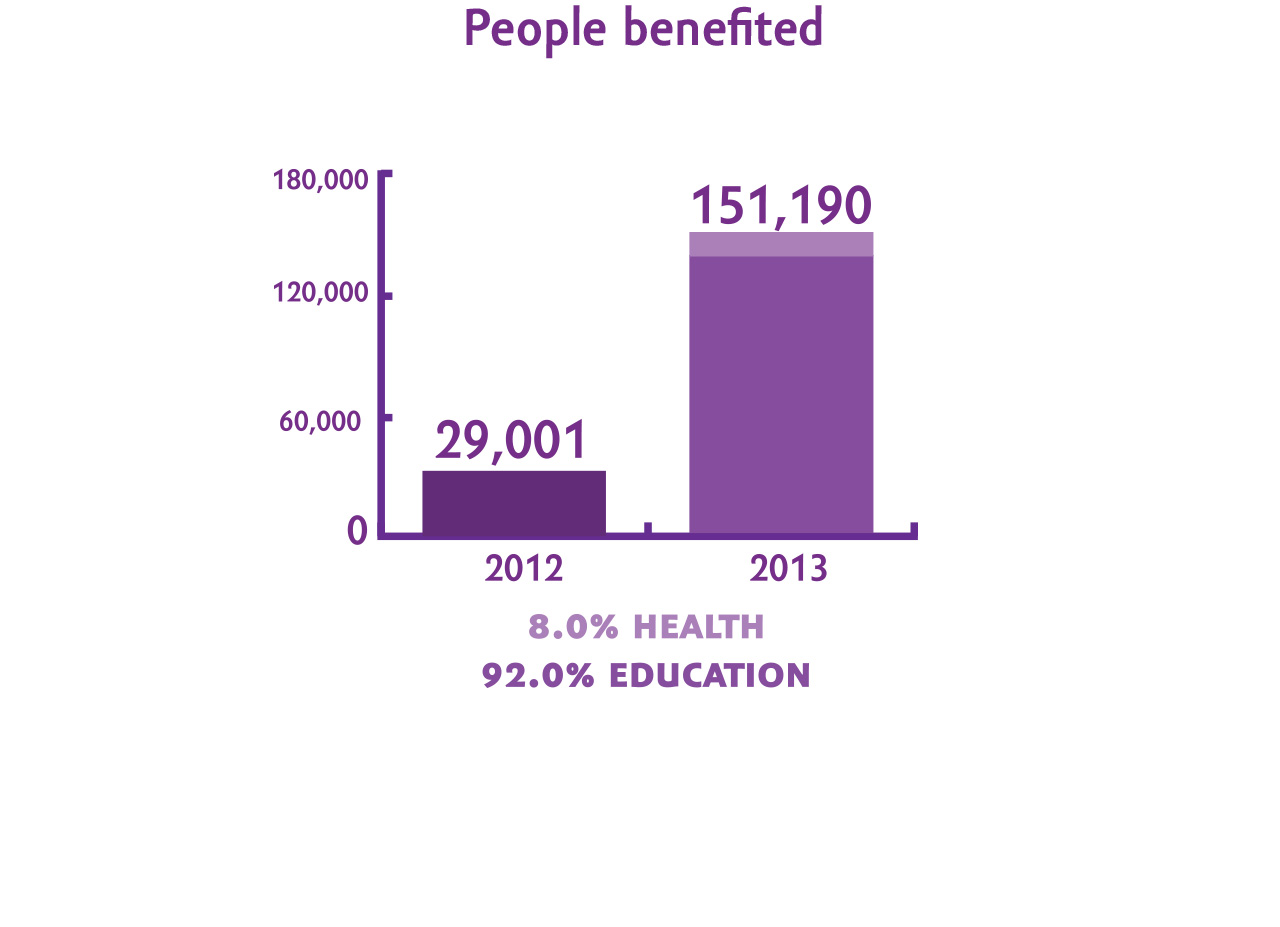

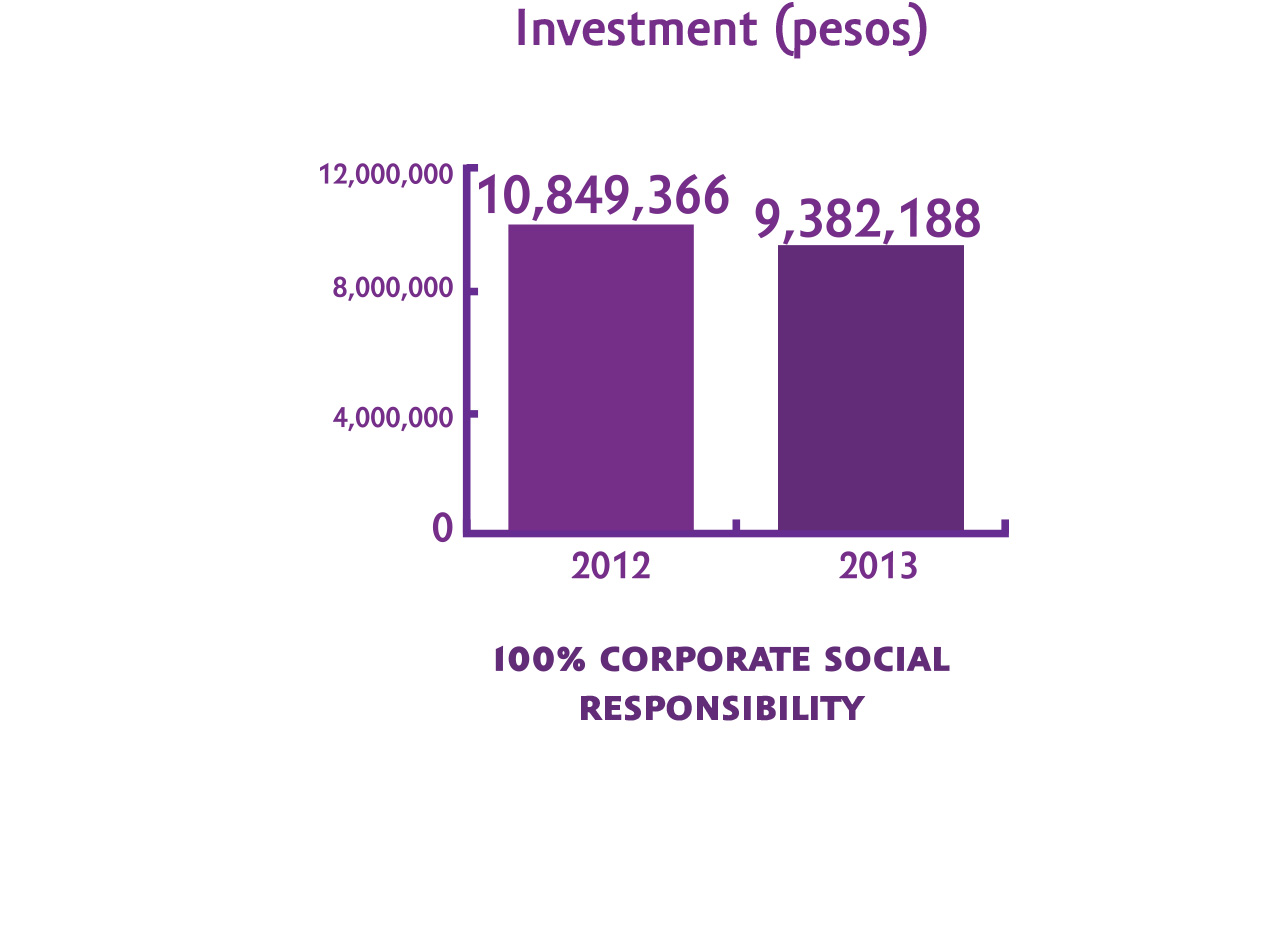

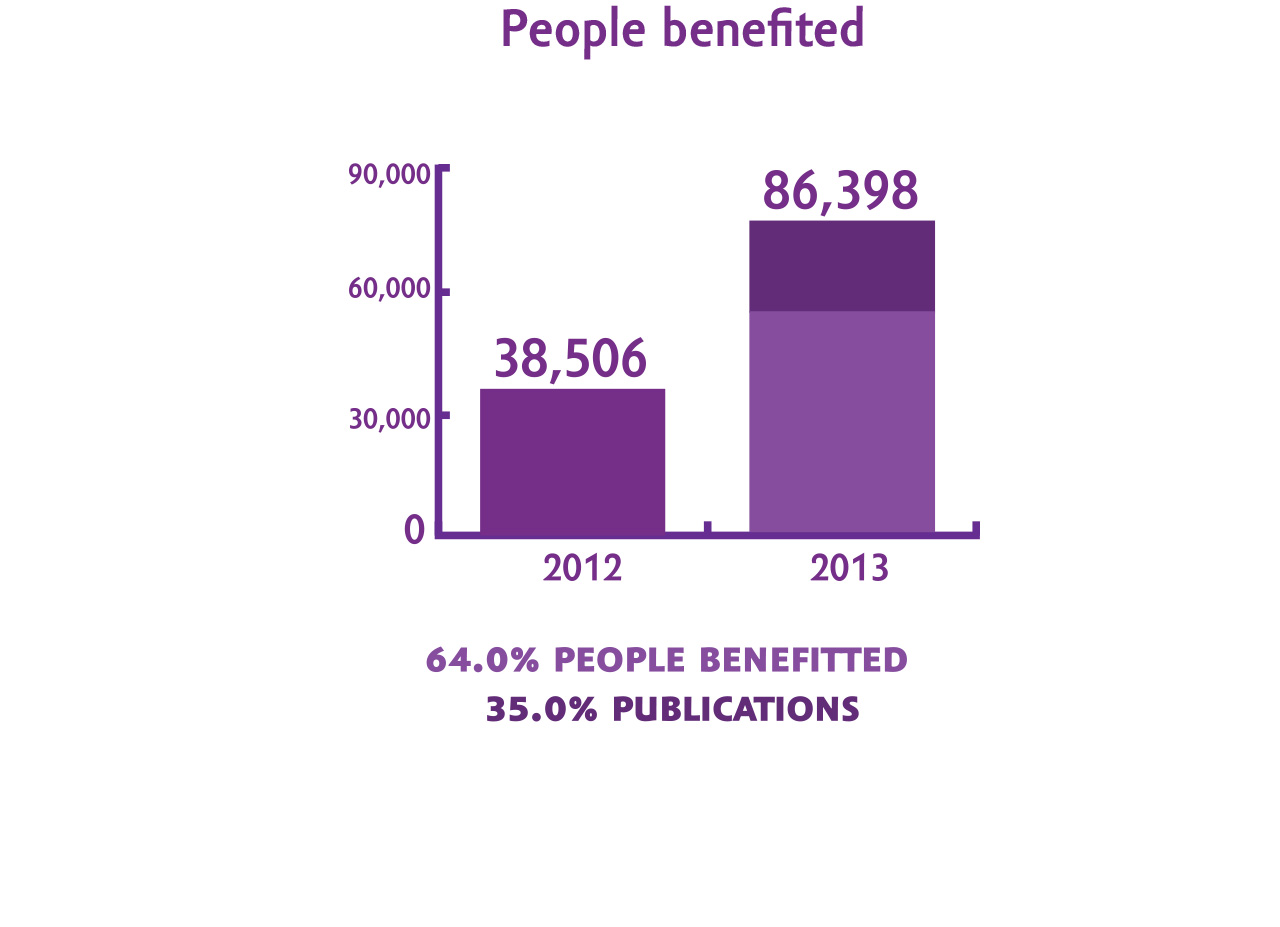

We promote the social, economic, and human development of the communities in which we work, earmarking 2% of our net annual earnings into health and education projects. We also foster a culture of volunteer work.

For four years in a row now our Social Responsibility and Sustainability Fund has empowered our efforts to support the communities where we are present, allowing them to act as agents of change and paying back a part of the benefits we receive from the communities that welcome us.

Our social responsibility actions are aligned along two axis, delimited by the Commission of Social Responsibility and Sustainability, which consists of a Strategic Commission and an Operating Commission, made up of representatives of different management areas of Gentera.

View more [+]

We are also represented by one member on the Board of Directors, who orients our social responsibility and sustainability actions. The two axes of our activities are:

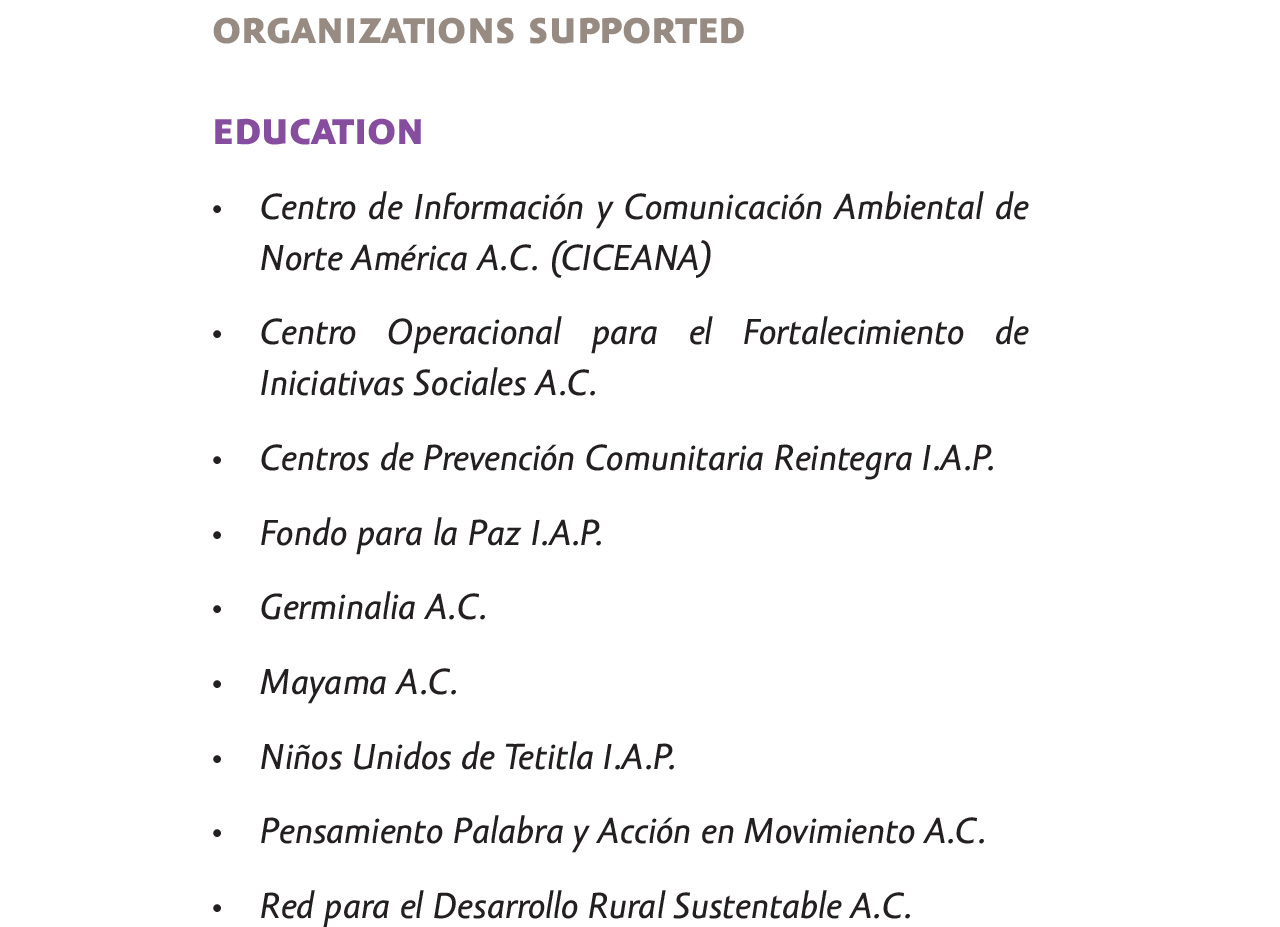

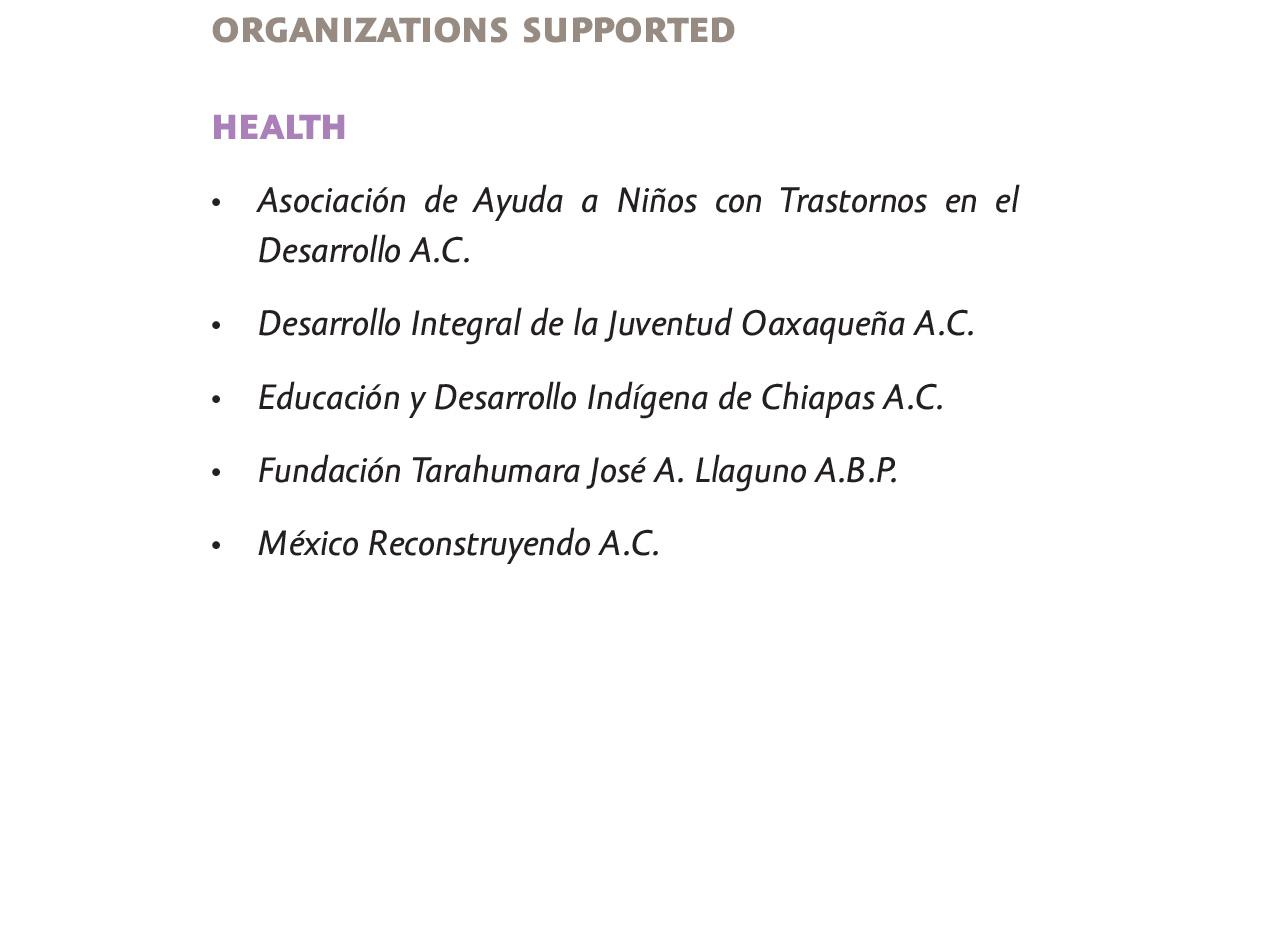

Education

• Life training: promotion of values, environmental awareness, and formal education for children, young people, and adults, including formal schooling, literacy, workplace training, and teacher training.

• Entrepreneurs: training in starting up and improving micro-businesses.

• Financial education: training in the areas of saving, budgeting, family finances, and business administration.

Health

• Diet, nutrition, obesity.

• Prevention of diabetes and high blood pressure.

• Physical exercise and healthy leisure time activities.

Close [-].

THE SOCIAL RESPONSIBILITY FUND

We have a clear purpose with each one of our social responsibility projects: to contribute to the social, economic, and human wellbeing of society. That is why we have set goals for ourselves in 2014 to continue progressing in the generation of shared value that characterizes us:

1. To center our social responsibility alliances on an single axis of action –education– and seeking to generate alliances in formal schooling, workplace training, and financial education.

2. To generate more strategic alliances to allow us to extend the benefits of the Compartamos con la Comunidad Day program and so together impact, in a single day, the greatest number of people in the communities involved.

I am very grateful to have been invited to participate in the succulent plants program. I’m very enthusiastic, because I’m someone who felt incapable of earning a daily wage. Now I feel prepared to work as part of a team. Also, they have supported us with inspirational talks. I feel better about myself and more in harmony with my family.

Margarita Lucía Cruz

San Juan Suchitepec Oaxaca. (CICEANA)

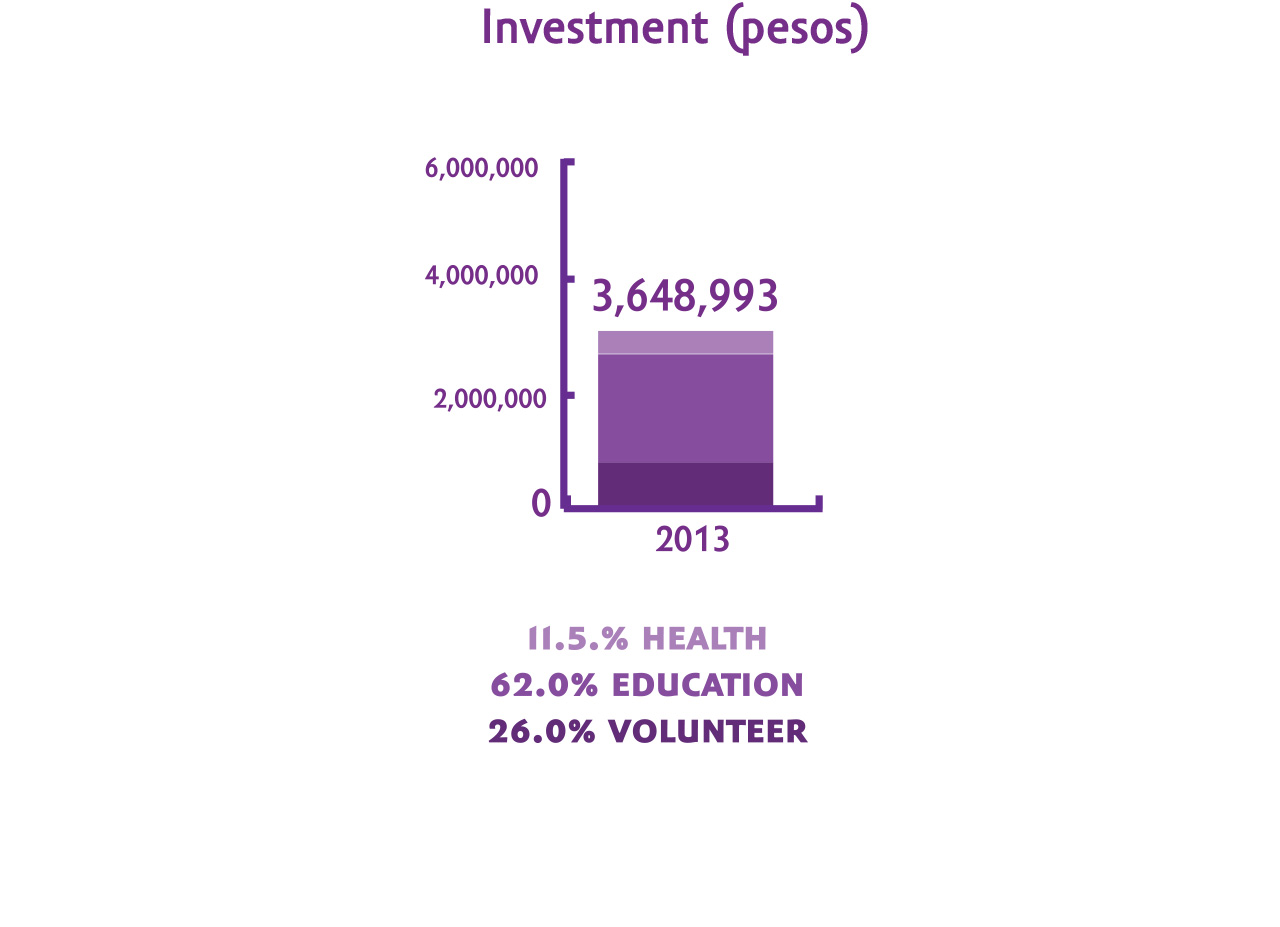

VOLUNTEER PROGRAMS

We form networks of collaboration among clients, suppliers, employees, and their family members in order to benefit the communities where we are present through volunteer work, through three initiatives:

1. Good neighbor

The aim of this program is to promote sporting activities and restore parks, sporting facilities, and schools. There are also talks held in schools and community centers, leadership workshops, and distributions of toys.

2. Ecocientízate.

The aim of this environmental awareness program is to hold cleanup days in parks, beaches, streets, and other places, as well as reforestation campaigns and talks on the importance of caring for the environment.

3. Humanízate.

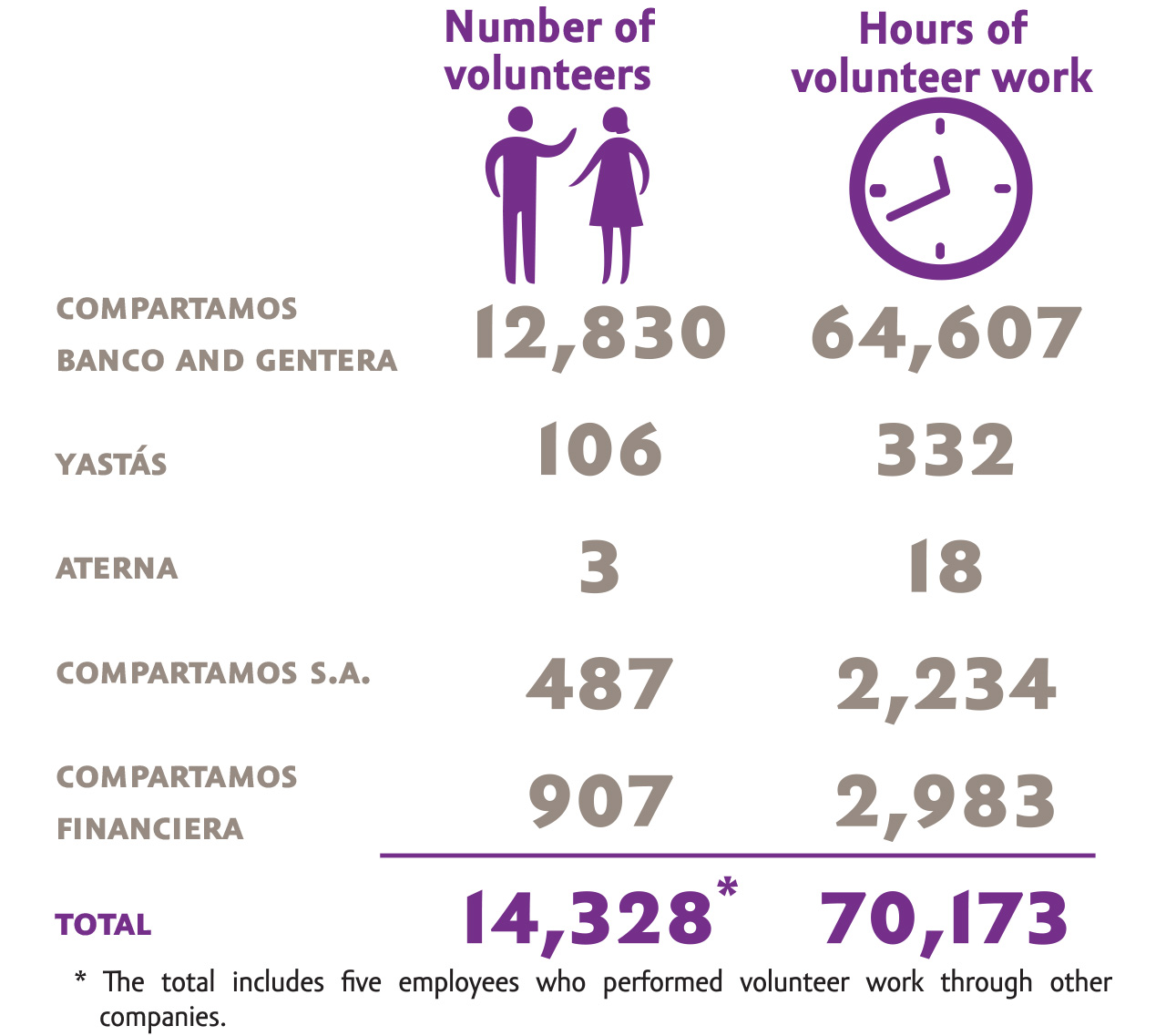

The aim of this philanthropic program is to distribute basic goods and to organize recreational events in senior citizen homes, orphanages, marginalized communities, and among people with disabilities. In 2013, the number of volunteers and the hours of volunteer work performed increased by 46.6% and 93.5%, respectively.

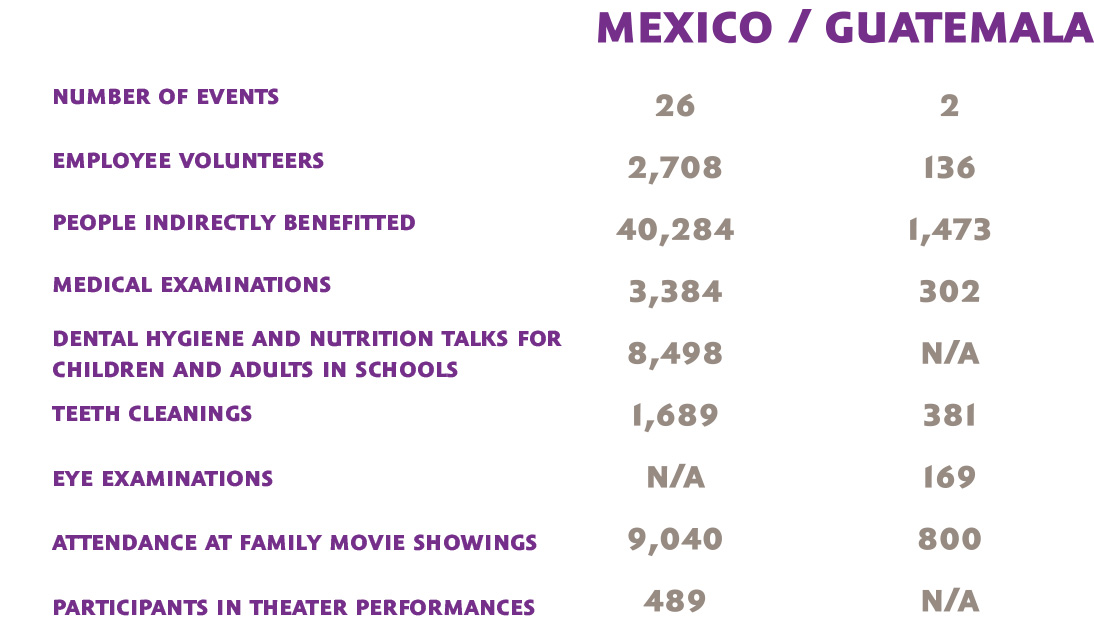

COMPARTAMOS CON LA COMUNIDAD DAY

We have not only successfully exported our business model to Guatemala, but in 2013 our social responsibility program, the Compartamos con la Comunidad Day, as well. A total of 136 employees of Compartamos S.A. participated in “Compartamos” Days in Guatemala.

In this way, we demonstrate that our Philosophy of sharing benefits with the community applies to all of the countries in which we operate.

In 2013, we established a new teeth cleaning service for children during our Compartamos con la Comunidad Days in Mexico, thanks to an alliance struck with the Fundación Alfredo Harp Helú.

OTHER SUPPORT

In response to the needs of the communities that surround us, we have developed two social support policies in Mexico.

DONATION OF FIXED ASSETS

We donate computer equipment to various organization. The equipment is in good condition but no longer serves a purpose in our offices.

Organizaciones apoyadas: Fonabec A.C., Fundación Luis María Martínez I.A.P. e .B.P., Fondo para Niños de México A.C., Asociación Mexicana para las Naciones Unidas de Jóvenes, AMNU Jóvenes A.C. y Ministerio Vive A.C., Centro de Prevención Comunitaria Reintegra A.C., A.B.P Nuestros Pequeños Hermanos A.C., Fondo para la paz A.C., Ayuda y Solidaridad con las Niñas de la Calle A.C.

CONTINGENCIAS

We give financial aid and donate supplies to employees and other people who have been victims of natural disasters. In 2013, thanks to an alliance struck with the organization Un Kilo de Ayuda, we benefitted 900 families.

Estados beneficiados: Chiapas, Chihuahua, Coahuila, Estado de México, Guerrero, Jalisco, Michoacán, Morelos, Oaxaca, Puebla, Sinaloa, Tamaulipas, Veracruz.