Generation ofSocial Value

We offer inclusion opportunities to the largest number of people in the shortest time possible. Our goal is to foster development for the communities we operate in.

| Indicators | 2014 | 2015 | Variation |

|---|---|---|---|

| Disbursed amount in our financial operation (millions) | 83,204 | 96,279 | 15.7% |

| Number of disbursements | 8’321,000 | 8’750,615 | 5.2% |

| Number of clients / benefitted households | 2’874,488 | 3’207,852 | 11.6% |

Generation ofSocial Value

We offer inclusion opportunities to the largest number of people in the shortest time possible. Our goal is to foster development for the communities we operate in.

| Indicators | 2014 | 2015 | Variation |

|---|---|---|---|

| Disbursed amount in our financial operation (millions) | 83,204 | 96,279 | 15.7% |

| Number of disbursements | 8’321,000 | 8’750,615 | 5.2% |

| Number of clients / benefitted households | 2’874,488 | 3’207,852 | 11.6% |

Leaders in financial inclusion

We are a successful group which for the past 25 years has provided client-friendly financial solutions to satisfy the needs of individuals. This has favored us with sustained growth and the opportunity to generate continuous economic, social and human value for millions of people.

We celebrate our 25th

anniversary with:

- 3.2 MILLION CLIENTS

-

6 COMPANIES AND ONE

FOUNDATION - PRESENCE IN THREE COUNTRIES

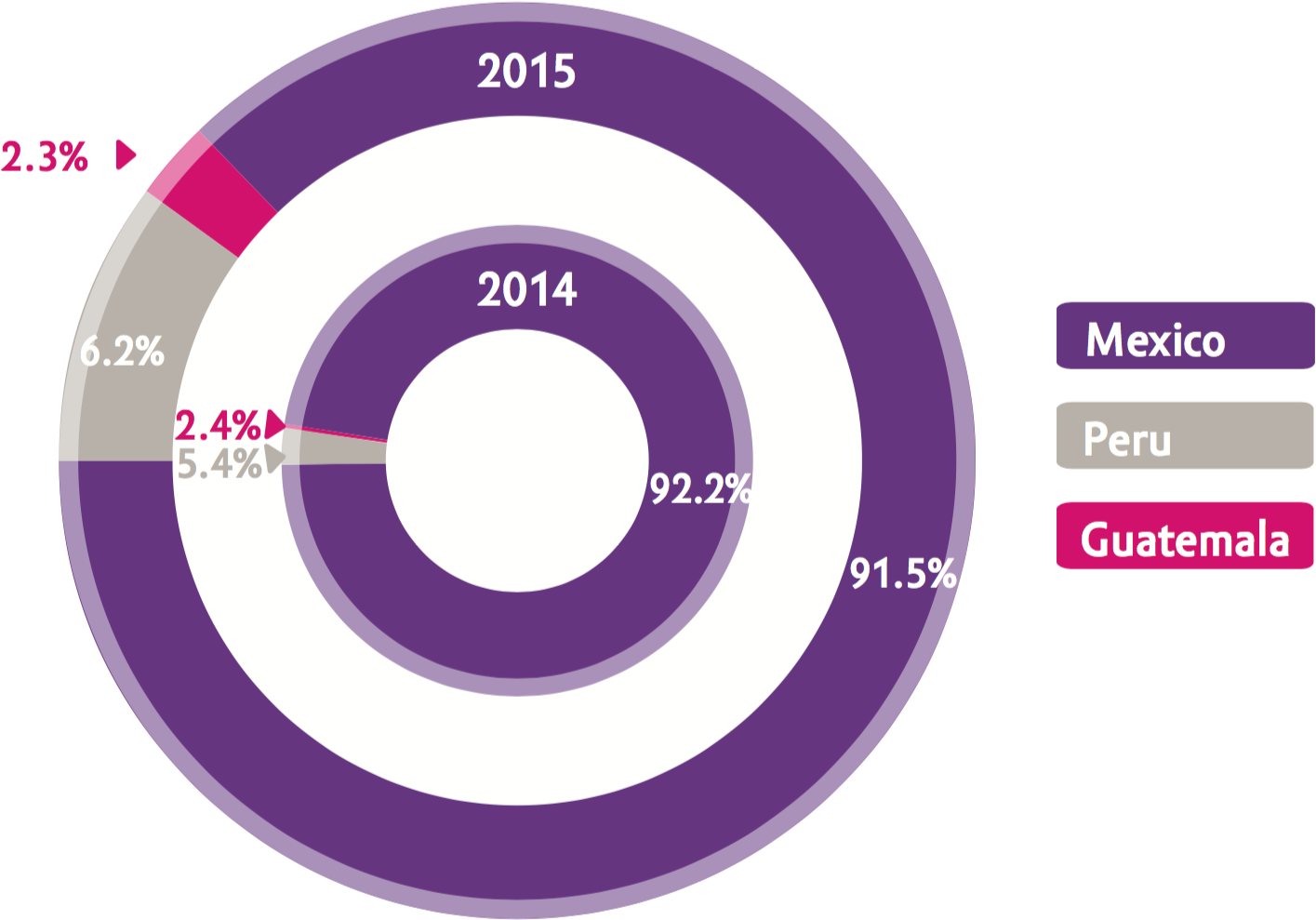

Compartamos Banco is the leader in the Mexican market with the largest portfolio and active credit clients according to the benchmark done by ProDesarrollo Finanzas y Microempresa, A.C.

www.prodesarrollo.orgCredit

Increase of

11.6% in clients

with respect to 2014,

more than 3.2 million clients

Branches*

Compartamos Banco21.1%growth

Compartamos Financiera7.1%growth

Compartamos S.A.10.7%growth

758

Branches, 19.4% increase

with respect to 2014

*Rate of growth in the number of branches with respect 2014.

| Indicators | Mexico | Peru | Guatemala | Total |

|---|---|---|---|---|

| Employees | 17,272 | 2,379 | 528 | 20,179 |

| Clients | 2’861,721 | 270,644 | 75,487 | 3’207,852 |

| % female clients | 88.2% | 77.6% | 100% | 87.6% |

| % male clients | 11.8% | 22.3% | 0% | 12.4% |

| % legal entity clients* | N/A | 0.10% | N/A | 0.10% |

| Client retention index | 84.0% | 69.1% | 71.3% | 82.4% |

| Insured clients | 2’312,419 | 270,644 | 75,487 | 2’658,550 |

| Average disbursed credit | 10,815 | 15,161 | 7,347 | 11,003 |

| Number of disbursements | 8’004,013 | 541,067 | 205,535 | 8’750,615 |

| Disbursed amount (million pesos) | 86,566 | 8,203 | 1,510 | 96,279 |

| % annual disbursement growth | 4.3% | 21.3% | 1.6% | 5.2% |

| Default rate | 2.86% | 4.18% | 2.23% | 3.09% |

| Overdue portfolio (million pesos) | 653 | 219 | 9 | 881 |

*A legal entity is an organization with rights and obligations, created by one or more physical persons in order to fulfill a social purpose with or without profit aims.

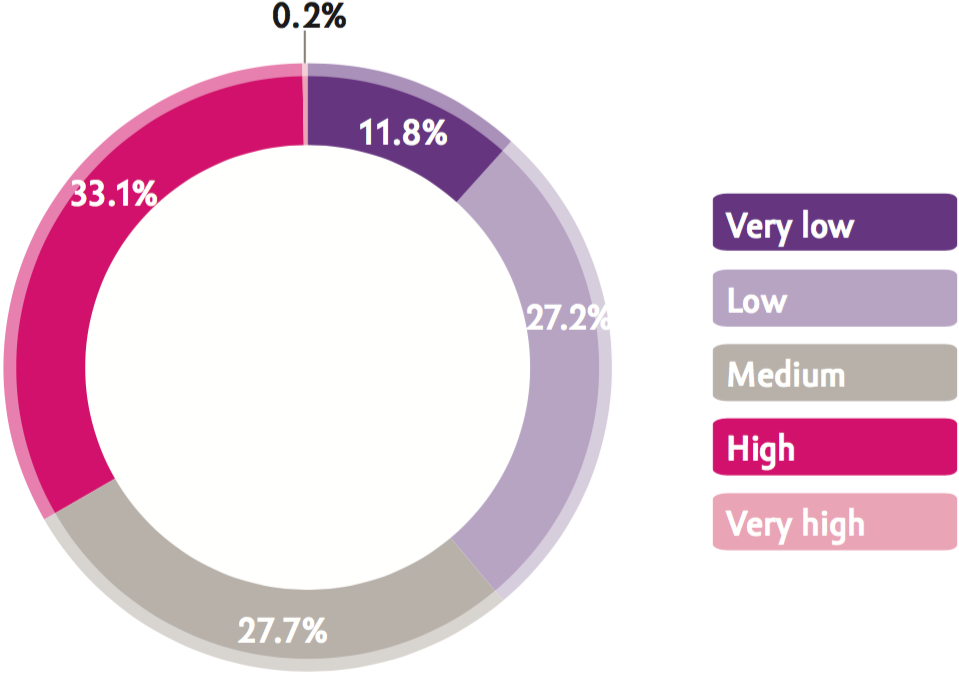

Client rate by gender

Women

Men

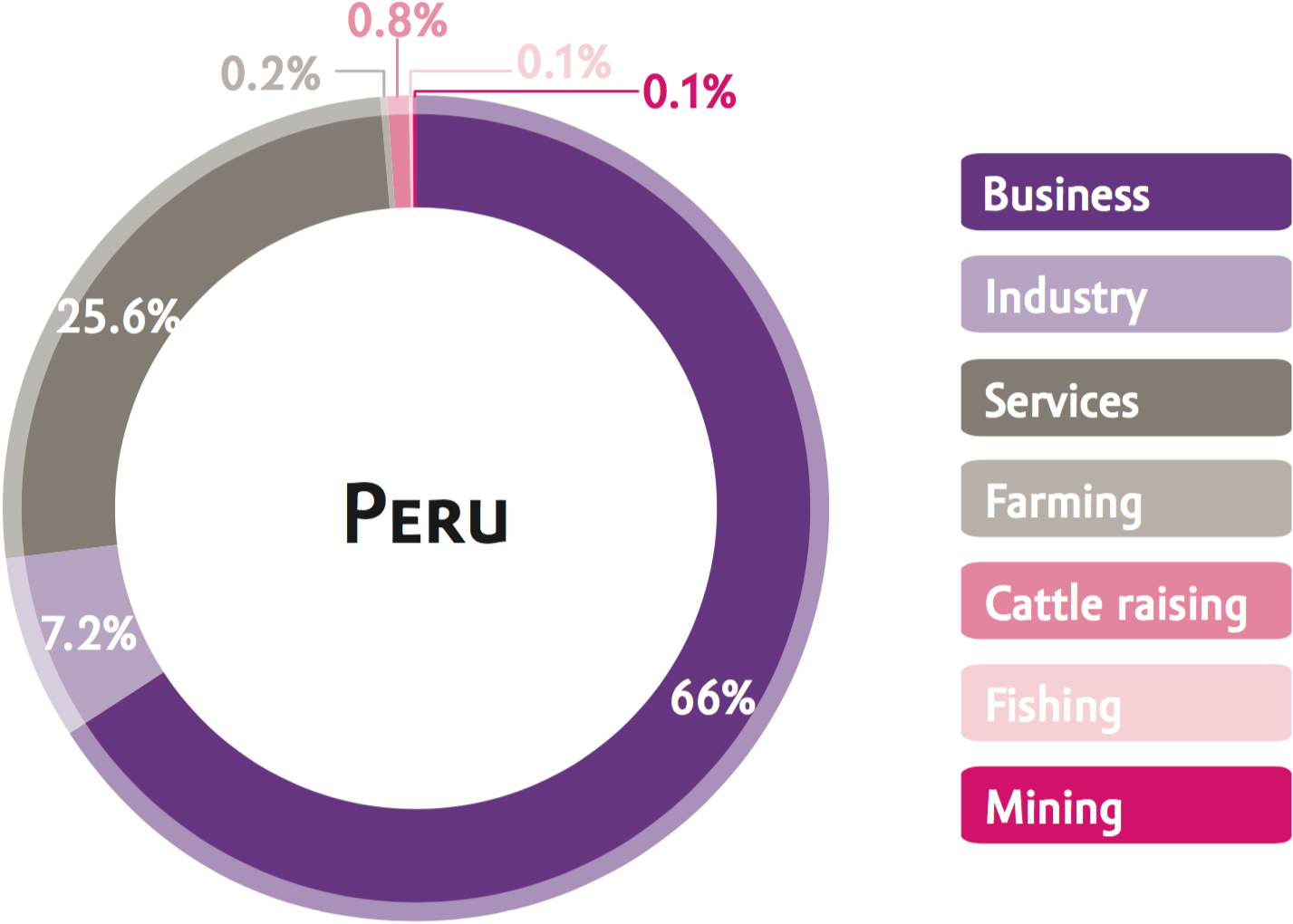

Disbursements

Disbursement Rate

million pesos disbursed, 15.7% increase with respect to 2014

More than

million insured clients, 19.3% increase with respect to 2014

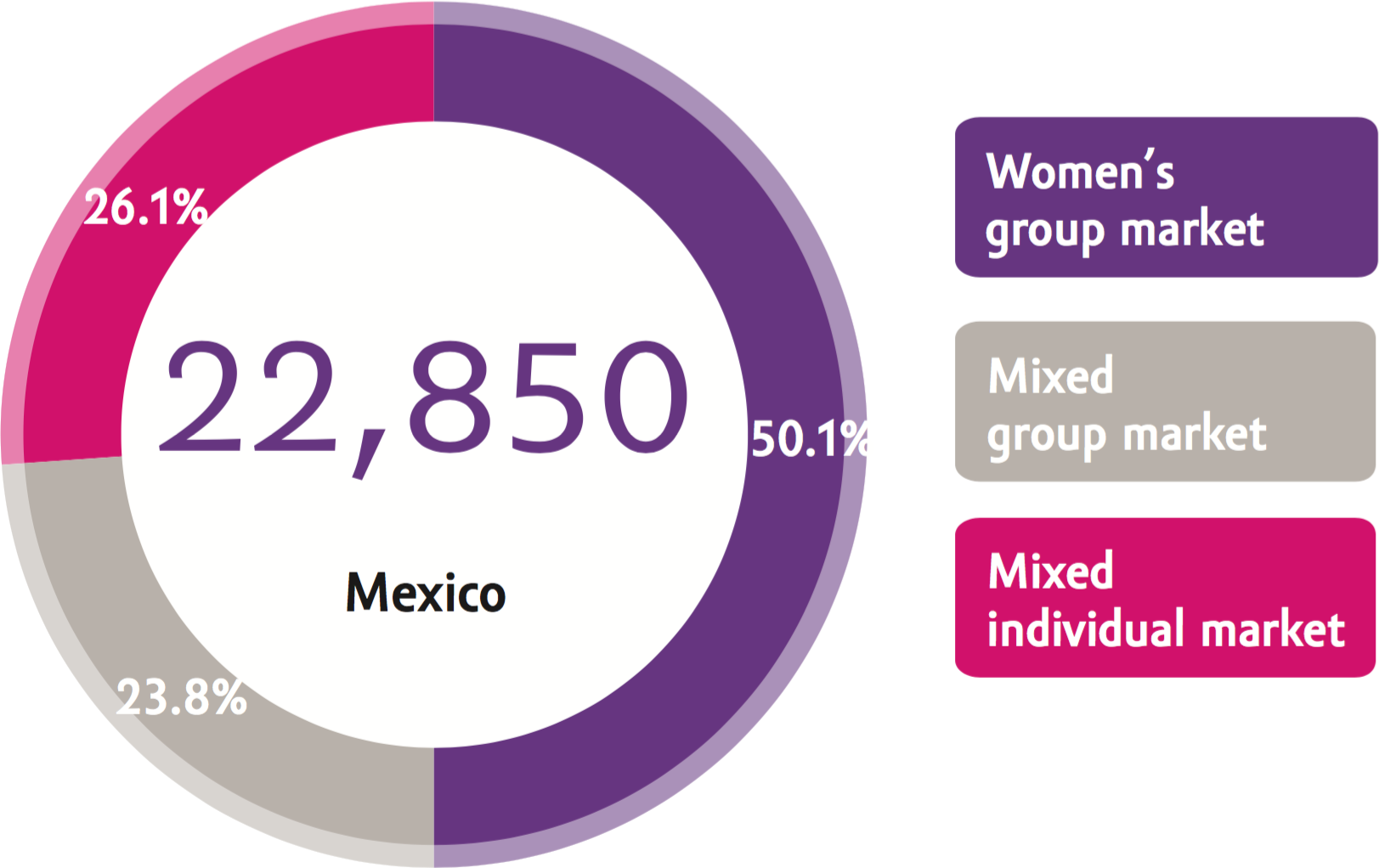

| Credit clients Mexico | |||||

|---|---|---|---|---|---|

| Market | Total clients | Products |

Clients per product |

Rate of clients with respect to served market |

Portfolio (million pesos) |

| Women’s group market | 1’788,165 | Crédito Mujer | 1’788,165 | 62.5% | 11,448 |

| Mixed group market | 915,831 | Crédito Comerciante | 915,831 | 32.0% | 5,434 |

| Mixed individual market | 157,725 | Crédito Individual | 126,765 | 4.4% | 2,334 |

| Crédito Crece y Mejora CCR* | 6,522 | 0.2% | 545 | ||

| Crédito Adicional* | 158 | 0.0% | 82 | ||

| Crédito Crece y Mejora CM* | 24,280 | 0.9% | 3,007 | ||

| 2'861,721 | 100.0% | 22,850 | |||

*Single clients.

Credit portfolio by market (million pesos)

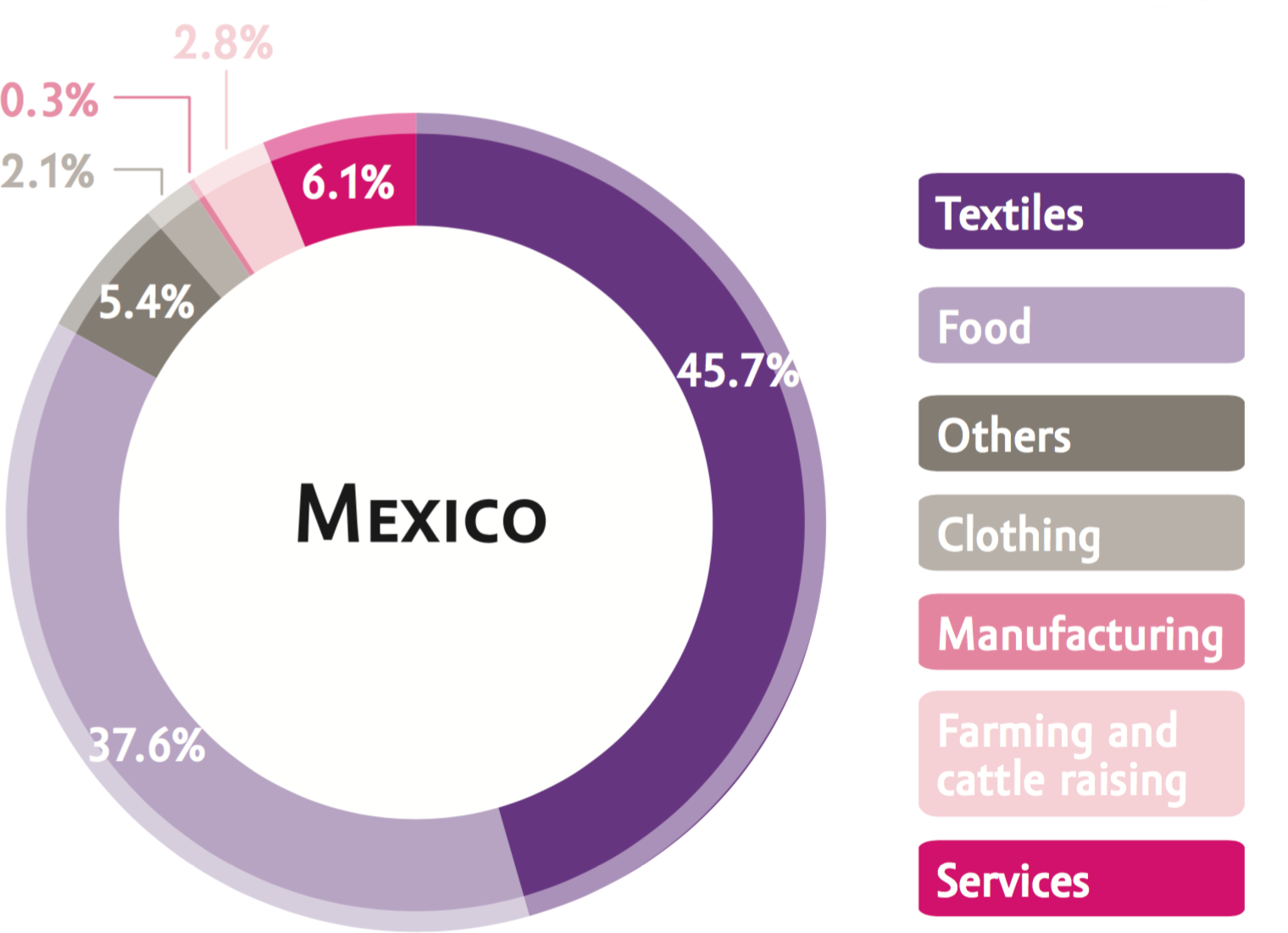

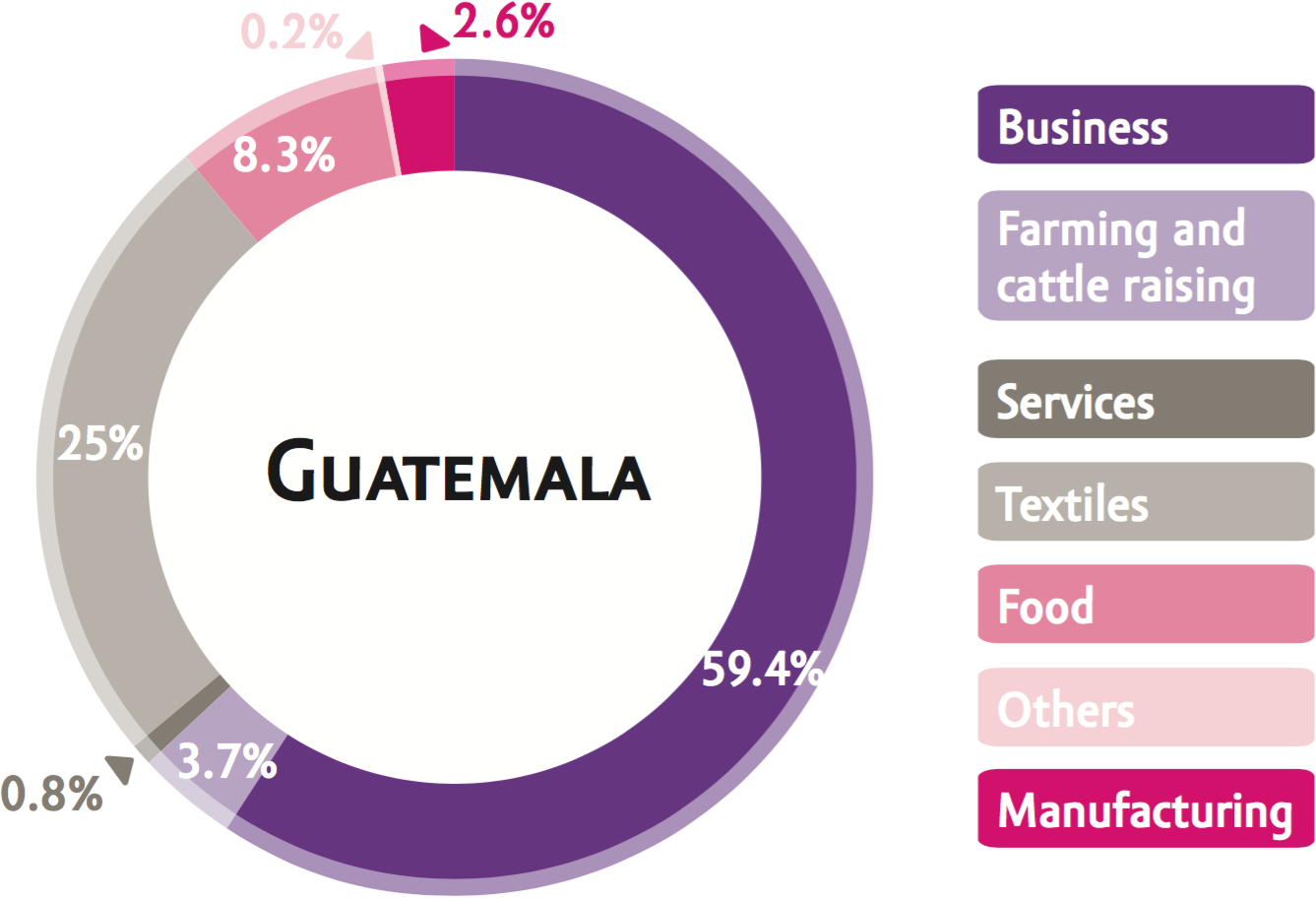

Client distribution by industrial sector

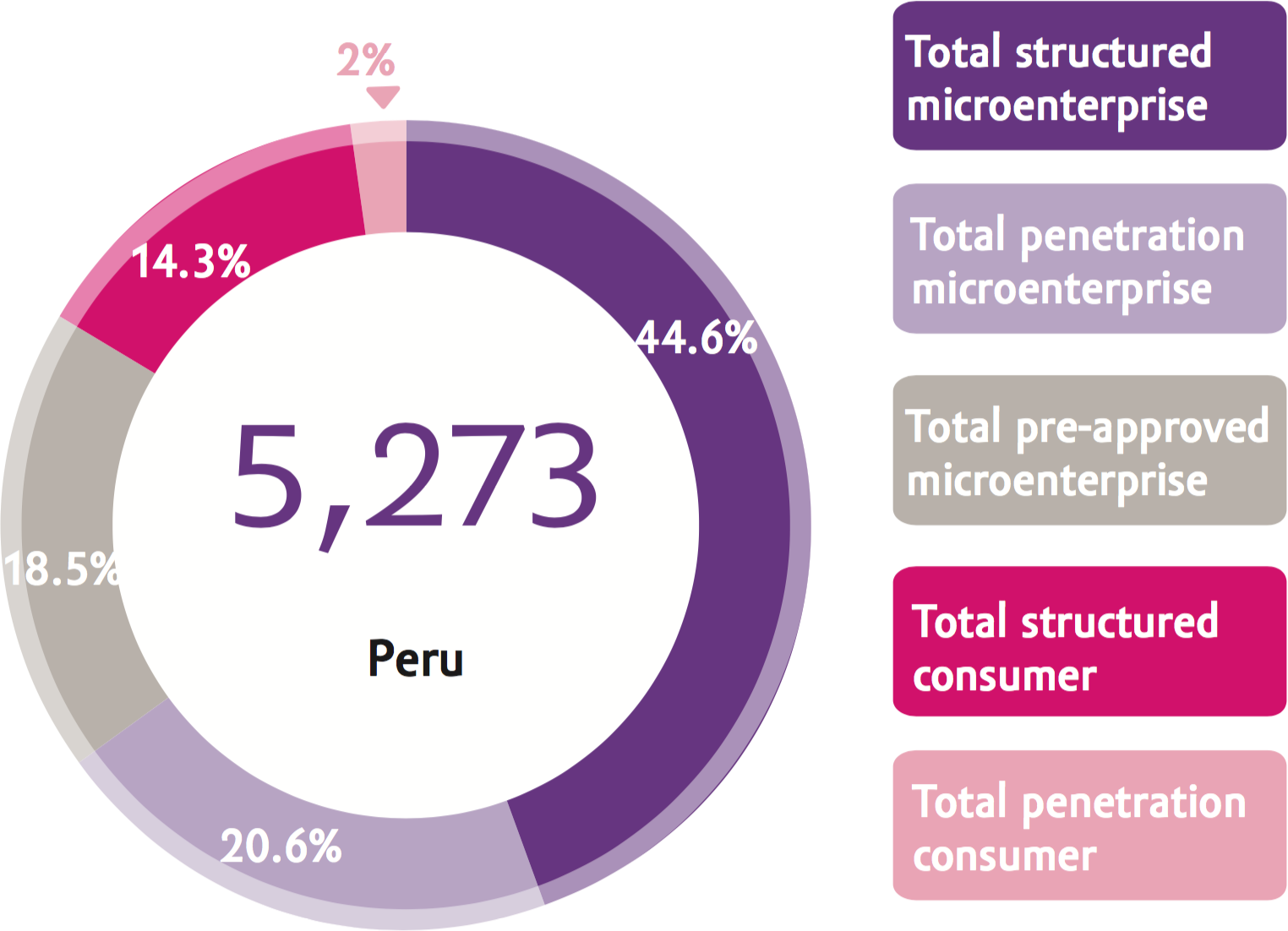

Note: Compartamos Financiera provides products for 29 mid-size businesses (0.01%); 223,468 micro-businesses (82.57%); 24,207 small businesses (8.94%); 22,939 non-revolving consumption (8.48%) and 1 mortgage credit (0.0%).

Crédito Súper Mujer

the first group credit of our operation in Peru, was massified in 2015 throughout the country

Savings

Savings accounts in Mexico

11 BANK BRANCHES AND

233,685

savings accounts, 83.3% increase

with respect to the previous year

An integral channel network was launched in 2015 through a successful pilot program in Puebla, building the first credit payment and savings transactions ecosystem that provided operations systems and processes for the Compartamos and Intermex branches, Yastás brokers and Intermex correspondents

2016 goal:

- Launch of mobile functionality for savings accounts

In 2015, Aterna reached

2 million

voluntary insurance policies

Aterna guarantees that all of its products adequately cover the needs and characteristics of the clients of every partner, allowing the protection of detected susceptibilities regarding ideal life moment, vulnerability feelings, accident impact and the strategies to confront them, as well as family, personal and material aspects.

Aterna aims its products at low-income individuals, located in marginal urban or rural areas with limited access to financial services and a low level of prevention culture.

FS7, G4-PR1Key indicators

claims

insured amount paid to

beneficiaries; 25.4% increase

with respect to 2014

Offered client coverage:

Death, cancer diagnostic, heart attack, hospitalization support, direct payment of medical accident expenses, unemployment, ATM robbery, purse or wallet robbery, assistance –medical, legal, educational, home or business–.

Sold policies

of sold insurance policies with respect to 2014

Active insurance policies

with respect to the previous year

| Indicators | 2014 | 2015 | Variation |

|---|---|---|---|

| Employees | 25 | 30 | 20.0% |

| Distribution channels | 8 | 8 | 0.0% |

| Total intermediated premiums (million pesos) | 495.2 | 625.9 | 26.4% |

2015 Achievements

Compartamos Banco

Seguro Mujer, Seguro Comerciante and Seguro Individual increased placement of their products, reaching 76% of total clients acceptance; 7,917 claims were attended for a total insured amount of 111.2 million pesos to beneficiaries, 12% of which were for diagnosed cancer.

Compartamos Financiera

Seguro Emprendedor massified the product reaching 19.56% of total client acceptance; 524 claims attended for a total insured amount of 6.9 million pesos.

Compartamos S.A.

Provided Basic Life Insurance to Crédito Mujer clients; 142 claims were attended for a total insured amount of 2.5 million pesos.

Yastás

Continued with Yastás insurance program, through which prevention products are delivered to brokers selected by seniority or performance and highest insured amounts.

Other channels

627 claims were attended and payments were made to beneficiaies for a total insured amount of 19.9 million pesos.

2016 goals:

- Implementation of a new comprehensive prevention program for clients of Compartamos Banco with Life + Health + Liability products designed for the efficient attention of their needs

- Implementation of a new technological insurance platform to allow business growth and efficiency

- Continue the learning of diverse models for open-market insurance delivery, reaching the greatest number of people in the shortest time possible

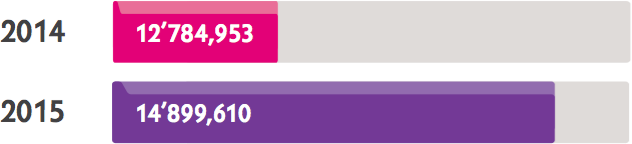

Yastás leads the innovation of convenience and last mile presence, offering financial operations and service payments in rural and suburban areas

The Yastás correspondent banking network is aimed at business owners (grocery stores, office supplies, hardware stores and drugstores) with a visionary profile who want to grow their businesses, providing them with payment of services as cell phone airtime and financial operations through Compartamos Banco.

Presence

*Note: The states with at least six financial businesses were considered.

Brokers presence in municipalities by degree of marginalization

FS14

FS14

In order to offer greater facilities and access to clients in rural areas with indigenous population, Yastás elaborated and distributed flyers in the Náhuatl and Totonacan languages with information concerning the payments that can be made through its modules.

It has 405 businesses –located mainly in the southern regions of Veracruz and Puebla– enabled to carry out savings operations. These transaction points can also take deposit operations (up to $4,000 UDIS*), accept cash withdrawals (up to $1,500 UDIS), PIN change and print balance inquiries of Mis Ahorros Compartamos accounts.

2016 goals:

- 3,000 active brokers that make financial operations

- 3 million service and remittance payment operations

- 50% of total savings operations of Compartamos Banco

- 30% of total credit operations of Compartamos Banco

Yastás is the leading credit payment channel, ranked third in credit dispersion for Compartamos Banco

13.7 MILLONES

million financial operations completed; 8% increase against 2014

The importance of Intermex lies in the innovation of capacities and the development of products to broaden the portfolio of financial solutions offered by Gentera to the bottom of the pyramid

In Mexico, cash remittances are a financial service widely used by the bottom of the pyramid. Households receiving remittances are located mainly in rural and mixed areas; 53.5% of them are located in municipalities of high and medium degree of marginalization.

G4-13In this context and in addition to an understanding of the U.S. market, in April 2015 we managed to integrate Intermex to Gentera.

The main objective of this Company is payment of family remittances in a convenient, reliable and secure way.

Remittance reception increases the probability of:

- Having a savings account between 10.2% and 11.3%

- Visiting a banking branch between 11% and 18.8%

Results obtained by Intermex in 2015 are as follows:

| Concept | 2015 |

|---|---|

| Number of remittances* | 3.95 millones |

|

Remittances paid in pesos

|

3.87 millones |

|

Remittances paid in USD

|

0.08 millones |

| Amount of remittances* | |

|

Amount paid in pesos

|

$16,194.1 millones |

|

Amount paid in USD

|

$20.8 millones |

| Number of users or clients** | 669,350 |

| Number of states in Mexico with branches | 13 |

| Total payment points in Mexico | 1,248 |

|

Compartamos Banco branches

|

60 |

|

Correspondents

|

1,188 |

| Number of U.S. agencies | 37 |

Notes:

* Accumulated figures in the period between January 1st and December 31, 2015.

** Total users cashing at least one remittance at the Intermex payment network.

Notes:

* Accumulated figures in the period between January 1st and December 31, 2015.

** Total users cashing at least one remittance at the Intermex payment network.

Intermex offers payments of national and international remittances, national and international courier and parcel service, currency exchange –operation carried out through Compartamos Banco– and cell phone airtime.

In 2015, Intermex managed to:

Enable

60 branches

to receive credit payments from Compartamos Banco clients

3.95 million

remittances sent,

equal to

16,194 million

pesos

Moreover, we started the integration of the Yastás-Intermex payment networks in order to complement services offered by commission agents. We also started the transfer of new operational capacities from Intermex to Gentera, such as the operation of bank branches and cash and currency exchange operations.

2016 goals:

- To strengthen the position of Intermex in the international remittance market, increasing its market share

- To start participation in the national remittance market

- To take financial services to those areas where banking infrastructure is limited

- Drive cross-selling of remittance payment services with clients of Compartamos Banco

- Use the capacities of Gentera to strengthen the operation and become more competitive