True to our beliefs

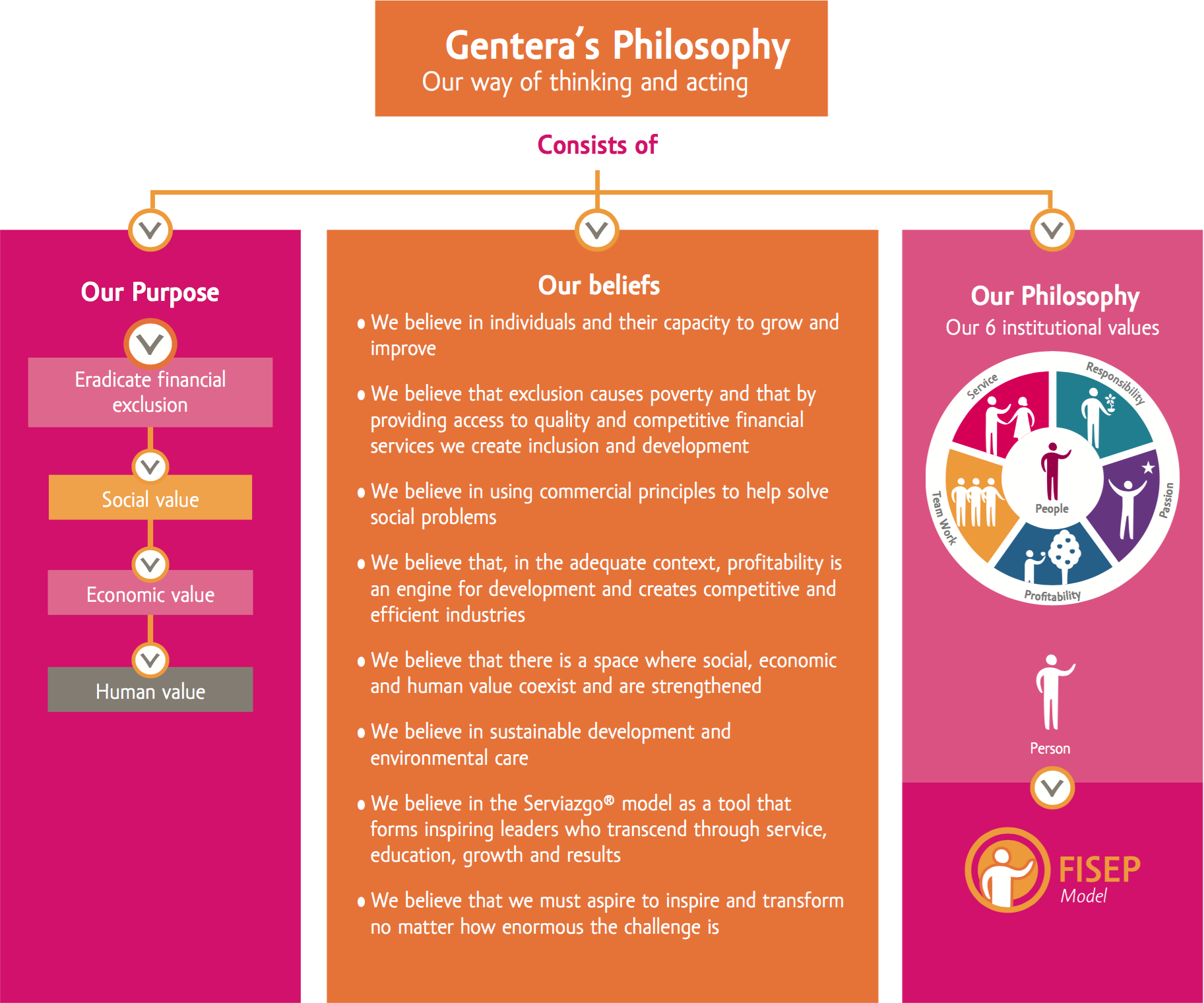

Throughout our 25 years of history, we have continued to be true to our original values and principles. We have been led by our Philosophy, a way of life that guides everything we do, and recognizes every person as unique, respecting his dignity, rights and obligations.

Our Philosophy is our differentiator;it is our way of thinking

and acting

G4-56, G4-57, G4-58, G4-SO4

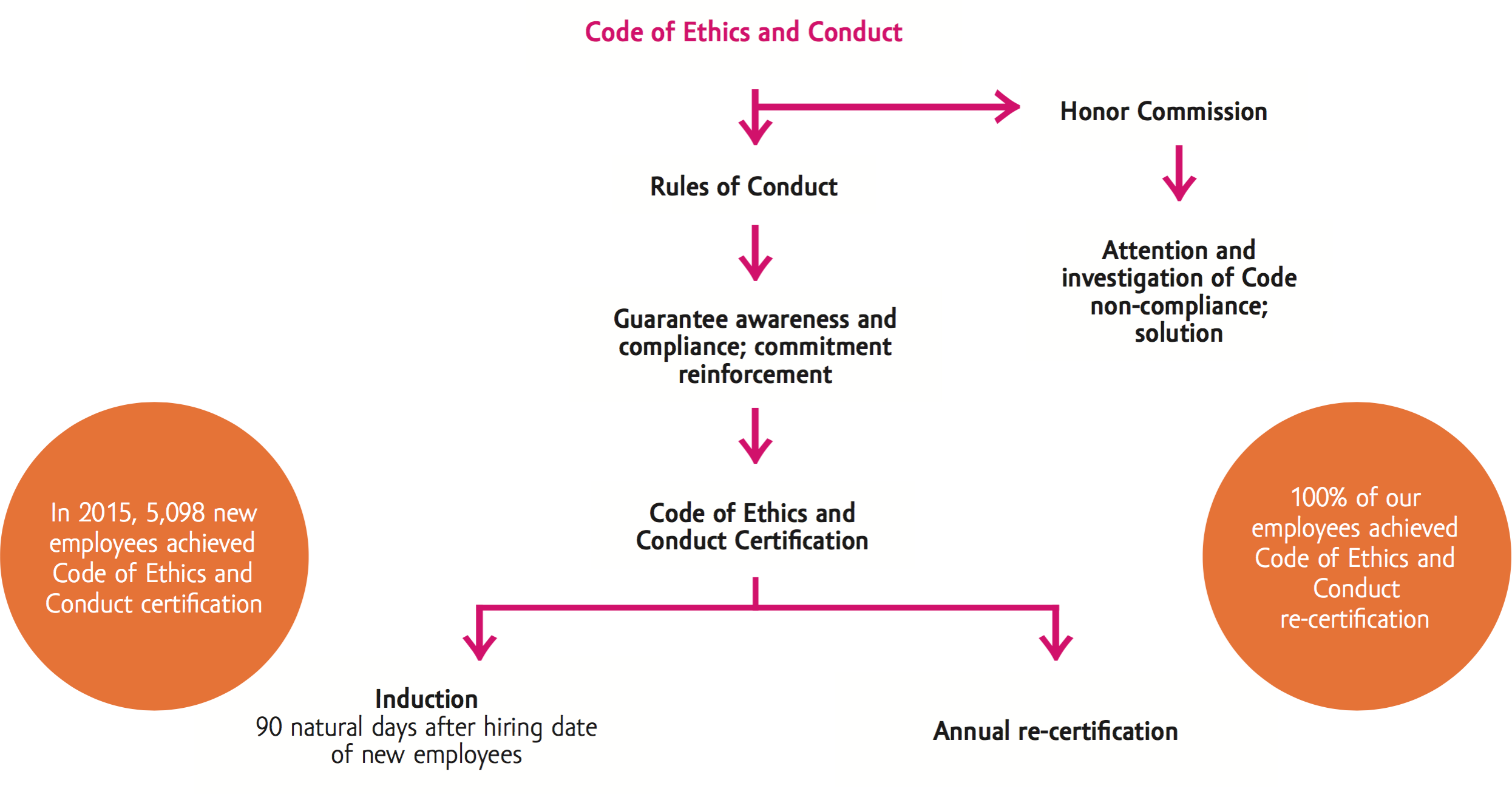

It is the instrument that communicates our Philosophy guiding our actions and daily work. It is the means through which we share our essence with all our stakeholders. It applies to our employees, consultants and commissioners, as well as to our clients and suppliers.

We convey ethical behavior through rules of conduct and behavior that foster healthy relations and protect the interests of our internal and external stakeholders giving us a high degree of credibility. The rules of conduct address themes such as interest conflict, handling of information, privileged information, corruption, harassment and work environment, among others.

In addition, every year we carry out our Philosophy survey in order to measure how our values are experienced in daily work.

In 2015, we conducted

15,300 surveys,

between our employees, getting an annual global satisfaction result of 88% of them experiencing our Philosophy

To protect our Philosophy and maintain our values, we have established in all our companies, a confidential means for denouncing non-compliances of the Code of Ethics and Conduct; these are attended by our Honor Commission.

For more information about our Code of Ethics and Conduct and the means of denunciation, visit our website

The main work we carry out to identify and mitigate risks regarding regulatory compliance throughout Gentera and its companies, is to provide suitable legal counseling and ensuring correct and timely compliance with the requirements of the authorities. This is duly established in our institutional procedures. The bodies that regulate the operations of our Group in the three countries where we operate in are the following:

| Mexico | Peru | Guatemala |

|---|---|---|

|

|

|

|

|

|

|

|

|

|

||

|

||

|

||

|

Because Gentera and its companies have a robust process to guarantee compliance with the legal provisions issued by the above institutions, we avoid any economic impact to the group or to its reputation, managing to achieve a good standing before regulators like CNBV and CONDUSEF.

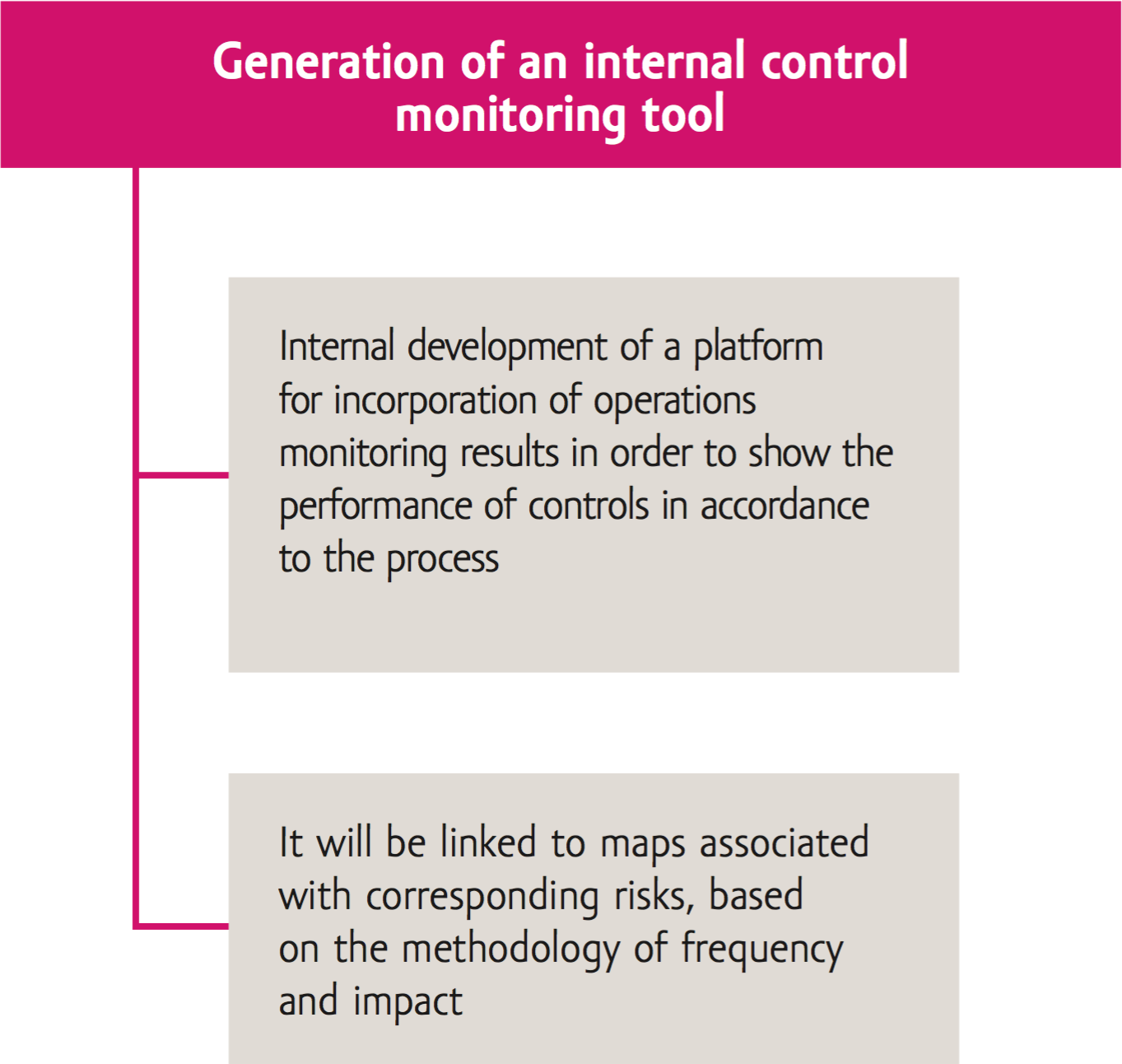

Compartamos Banco fosters an organizational culture of self-control in which the role played by each one of its employees in following up and applying the control instruments is essential and inspires the trust of our clients. This is mainly due to the fact that all institutional operations are standardized and comply with current regulations.

In 2015, the CNBV recognized Compartamos Banco as a financial institution with a robust internal control system, constituted by policies and procedures that guarantee the ethical conduct of its employees

| Internal Control Procedure | ||

|---|---|---|

| Input | Process | Deliverables |

|

|

|

With this process we streamline our operations, obtain reliable and opportune financial information, comply with applicable current laws and regulations, and safeguard the resources of our institution. To achieve these objectives and consolidate our processes, we have established a priority goal:

To secure our operations are aligned with applicable regulations and our mission, we have an audit process by which we verify –conforming to activities, frequency, and scope described in the Annual Internal Audit Plan– that through standard and efficient application of the policies and procedures of our internal control, proper risk management is carried out and identification of improvement opportunities is achieved in order to renew or business model.

Moreover, in accordance to the International Standards for the Professional Practice of Internal Audit (issued by the Institute of Internal Auditors –1210.A2–, our auditors have sufficient knowledge to evaluate the risk of fraud and the manner in which it is managed by the organization, so we have established a Fraud Follow Up, which follows up on this type of incidents.

Regarding public policy, our group actively participates in sector chambers, networks and organisms in order to position our activities, inform about the way in which we manage economic, social and human value, and to share good practices with the financial sector.

Being an election year, 2015 posed several challenges due to new themes arising in the political agenda, which limited our interaction with legislative bodies and required constant monitoring of circumstances in order to identify matters that would restrict our business model and to avoid reputation risks related to the control of financial services.

2015 was a year

of consolidation of

activities related to

financial reform passed

by the Mexican congress

in 2014, creating

opportunities for

the further aspirations

of the Group

The process of managing and decreasing risks in free competition and public policy is based on close monitoring of compliance with the requirements of the authorities and adequate communication of the resulting impacts, achieving the improvement in the opinion of the Group among the stakeholders, positioning in sector chambers, and profitability of the business.

This management mode turns out to be a successful entrepreneurial project in terms of transparency and ethics due to permanent follow-up by the public in the media, biennial opinion studies and the achievement of plans and strategies defined by the External Relations and Social Responsibility Committee in order to follow up on the established objectives and goals.

2016 GOALS

- Maintaining the grade in opinion studies

- Continuity of specialized attention of every audience

The associations in which we actively participated as a Group are:

| Mexico | Peru |

|---|---|

|

|

On the other hand, we are currently evaluating associations in Guatemala in order to determine which of them we will associate with in 2016.

Compartamos Banco is part of the Asociación de Bancos de México (ABM), and, in accordance with its established policies, it participates with voting rights in some of its committees which address specific themes related to sustainability, social responsibility and financial education.