Sustainable growth

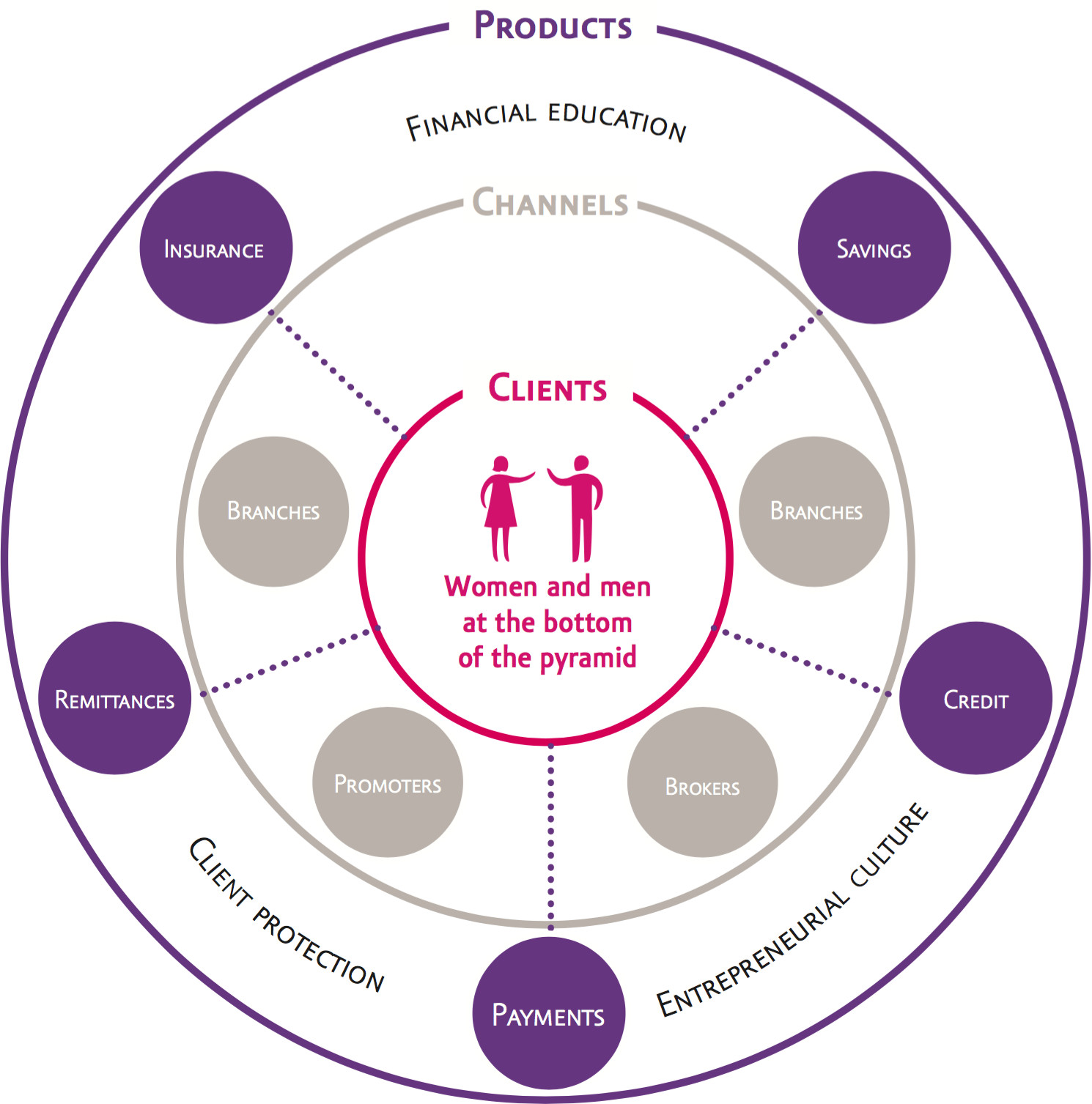

Since our clients are the reason we exist and the heart of our operation, we provide them with financial solutions for credit, savings, insurance, remittances and payment channels. In addition, we also guarantee that these products will be used for their benefit by providing financial education, focusing on client protection and promoting an entrepreneurial culture that fosters their empowerment and self-management.

Our objective is to include the largest number of people in the financial system, achieve social development and improve the quality of life of our clients

G4-PR1, FS16

In the past, financial education used to be a feature of our credit products. Today, it has also been incorporated to our savings and insurance product offer as a basic feature of their design process.

G4-DMA PRODUCT PORTFOLIO (SECTOR SPECIFIC)G4-14, G4-SO1

Financial education consists of a series of conferences, workshops and messages that are imparted to our clients, employees and community through diverse means. Our objective is to guide them through the process of making a budget and calculating its payment. In addition, we encourage savings and prevention in order to create a financial culture and promote a responsible use of financial services.

In order to bolster our financial culture, in 2015 we launched the certification “¿Dónde quedó mi dinero?”, an online course aimed at all of our employees in Mexico, Peru and Guatemala. It consists of three personal finance modules we incorporated into the set of induction courses with the purpose of providing financial education training for all of our employees.

In Mexico, our products Crédito Mujer, Crédito Comerciante and Crédito Individual integrate financial education as part of their value offer

Employees certified in financial education:

97%

in Mexico

83%

in Peru

91%

in Guatemala

To identify the benefits of our financial education, we carried out monitoring actions using different tools. One of these is a telephone survey of our clients carried out to find out level of message recall and usefulness of the information provided by our promoters. The results obtained in 2015 are the following:

Benefits of financial education

–2015 survey–

97%

of surveyed clients considered that the information provided by our sales force was clear

99%

of surveyed clients apply the information to the management of their own personal finances

89%

of the surveyed clients consider that the duration of the conferences was adequate

Note: Testimony of Crédito Mujer clients at the end of 2015.

G4-DMA AUDIT (SECTOR SPECIFIC)

Since financial education is a part of our financial services, it is subject to internal auditing. In the field, we verify that our sales force imparts this benefit to our clients.

2015 Results

Clients trained in financial education

Mexico

- 38.9% Crédito Mujer clients

- 47.0% Crédito Comerciante clients

- 50.9% Crédito Individual clients

- 5,000 brochures delivered

- 100 Training sessions (Aterna)

Peru

- 2.5% Crédito Súper Mujer clients, through 18 Encuentros Súper Mujer events

Guatemala

- 61.4% clients

Employees trained in financial educaction (Mexico)

- 9,982 Sales employees to balance financial educational contents of the three credit products of Compartamos Banco

- 200 Sales leaders at workshop on savings and retirement savings

- 4,204 Newly hired employees on methodology and personal finance

- 689 employees on formal savings themes, through the savings pilot in the Puebla region

One of our main objectives is the integration of financial education into all of our products to provide our clients with the necessary tools for the proper use of financial services and administration of their money, and to be able to reach the largest number of clients in the shortest time possible with a digital offer.

In addition to the efforts for financial inclusion of Gentera and its companies, and to the benefit of the communities we operate in, in 2015 Fundación Gentera coordinated diverse literacy and financial education programs, some of which are:

Alliance with Fundación Nemi

Presentation of the play “Compartamos Aventuras” whose objective is to contribute to reflection, constructive thinking, fostering of good habits and values, and the inculcation of savings habits in children.

83,850 BENEFITTED CHILDREN

Alliance with Ashoka

Mapping of initiatives for financial education to realize projects based on identified best practices.

Ruta Parque Financiero

Supply of tools for the elaboration of a budget based on accurate and well-informed decision-making using a model part of the financial education program.

18,009

YOUNG PARTICIPANTS BETWEEN

AGES OF 15 AND 23

Día Compartamos con la Comunidad

Test pilot for financial education-related talks in communities.

Social programs

Financial education on budgets and savings matters.

3,476 PARTICIPANTS

Over 105 thousand beneficiaries of financial education actions coordinated by fundación gentera in 2015

G4-DMA CUSTOMER HEALTH AND SAFETY

The protection of our clients and their financial health is an essential element in the generation of social, economic and human value. It is aligned with our purpose of driving an entrepreneurial vision that involves the respect for the person.

G4-DMA CUSTOMER HEALTH AND SAFETY

The protection of our clients and their financial health is an essential element in the generation of social, economic and human value. It is aligned with our purpose of driving an entrepreneurial vision that involves the respect for the person.

Gentera leads the market as an efficient institution with simple and practical processes

Gentera leads the market as an efficient institution with simple and practical processes

At Compartamos Banco, efforts are focused on the generation of innovative, simple, practical, inclusive, accessible, efficient and profitable products, that help avoid the over-indebtedness of our clients and support the upkeep of their quality of life; we manage this through the following tools:

Analysis of our

clients' needs

Identification of client segments.

Development of

product concept

Evaluation of possible impact at different levels: client acceptance, financial and profitability analysis in order to define new product features or

re-engineering to be made.

Research and

development

Based on results of market and competition studies.

This is the last phase of the design stage.

Marketing and

promotion

Once the client profile is identified, advertising strategies are developed.

In addition to this, and in order to get to know our clients and the market we served and satisfy their needs, there are specific indicators such as satisfaction surveys, brand recall and positioning, optimization of waiting and response time, and identification of moment of truth –the point of contact at which the client manifests a positive or negative perception of the products and services.

Compartamos has different programs; one of these is “Cliente único”, a program which consists in finding out client information such as history, acquired products, remittances, calls, complaints and suggestions and storing it in one single location in order to have a complete data base of clients and provide them with better service.

Considering that quality service is the essential element for guaranteeing the protection of our clients, training our promoters and sales force in the knowledge of product condition and transmission of prevention is fundamental for ensuring that our clients are well-informed and that their personal data is treated in accordance to the regulations of the Ley Federal de Protección de Datos Personales en Posesión de los Particulares1, and the principles of quality, consent, purpose, information, integrity, legality, proportionality and responsibility established in our internal processes.

Product information

G4-DMA CUSTOMER HEALTH AND SAFETY, PRODUCT AND SERVICE LABELING, COMPLIANCE, PRODUCT PORTFOLIO (SECTOR SPECIFIC)G4-PR1, G4-PR3Gentera complies with all the information that is required by the Comisión Nacional para la Protección y Defensa de los Usuarios de Servicios2 (CONDUSEF) in contracts for the provision of our services. To achieve this, we carry out reviews of legislative requirements on financial matters while we carry out an analysis of the design process of all our products based on the identification of the needs of our clients. This allows us to get on with the process of continuous improvement and product development, raise the quality of services and secure legal certainty to our clients by informing them about the benefits and obligations they acquire. These results in well-informed decision-making, and an increase in client level of satisfaction, loyalty and trust.

Compartamos leads in quality of service and currently seeks to potentiate this differentiating factor

Furthermore, through our advertising campaigns we have accurately informed about our products and services, which are in full compliance with Article 12 of the Law for Transparency and Ordainment of Financial Services and with Chapter IV of the general provisions in matters of transparency applicable to credit institutions and multiple purpose financial companies –a document issued by CONDUSEF.

In addition, we are in permanent contact with our clients and place at their disposal different user-friendly channels for clearing up doubts which we attend immediately and transparently.

Compartamos Banco is one of the leading financial institutions in Mexico in timely attention of client and user claims, according to an evaluation carried out by CONDUSEF

Confidentiality

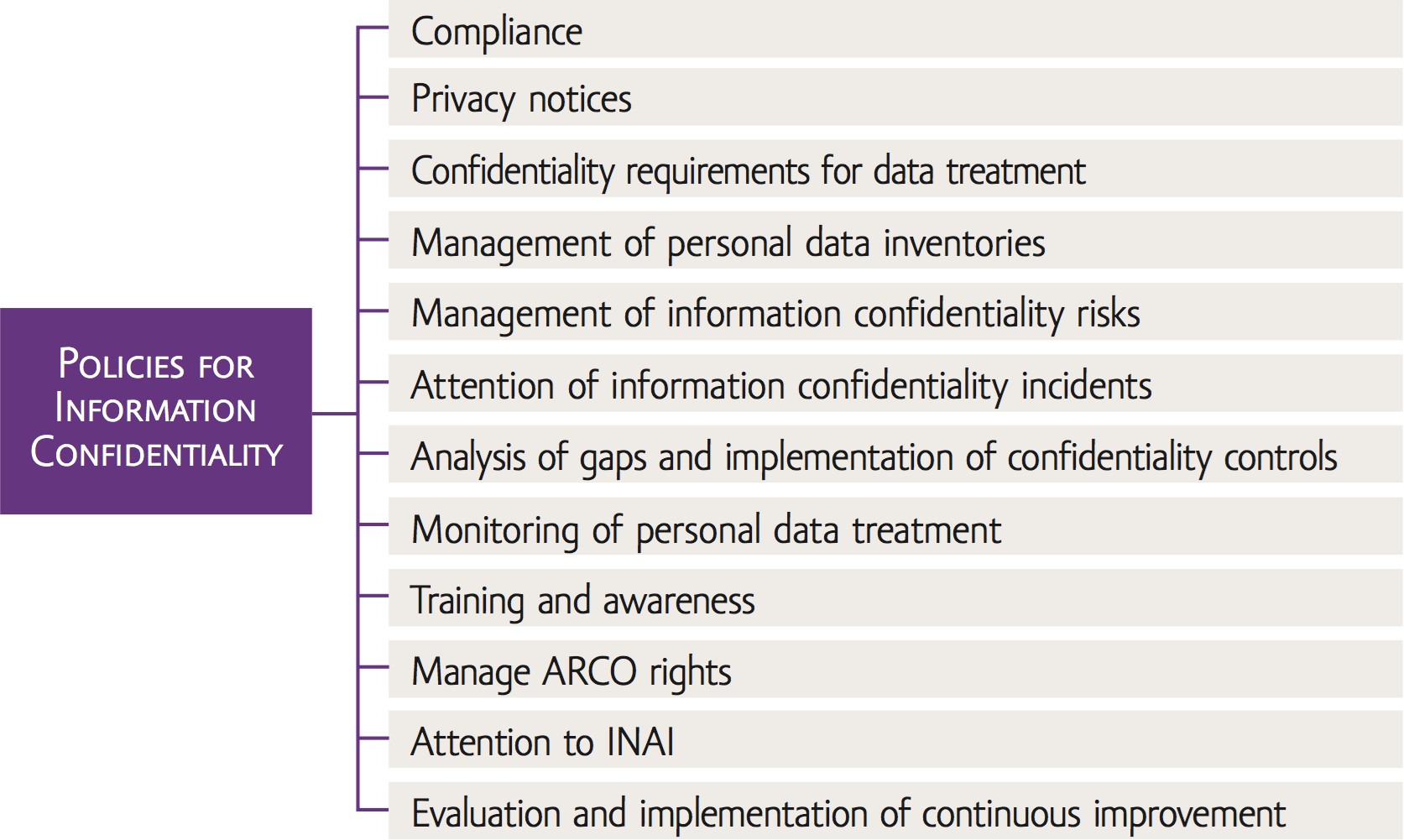

G4-DMA CUSTOMER PRIVACY, COMPLIANCERegarding confidentiality of personal data, we conduct our processes in compliance with current legislation, namely, the General Provisions Applicable to Credit Institutions as established by the Comisión Nacional Bancaria y de Valores –CNBV (in the Circular for Credit Institutions, the Law for Credit Institutions and the precepts set forth by Comisión Nacional de Seguros y Fianzas)–.

G4-DMA PRODUCT AND SERVICE LABELING (SECTOR SPECIFIC)As leaders in financial inclusion and keepers of the trust of our clients, we also have the duty of guaranteeing the confidentiality of their personal data. We secure this through our Manual of Policies for Confidentiality of Information and through the implementation of internal controls which regulate proper and legitimate handling the information and data confidentiality as a priority issue of Gentera and its companies

In accordance to our strict commitment to the protection of our clients, if it were necessary we attend ARCO (Access, Rectification, Cancellation and Opposition) rights claims in order to assure certainty in the control their personal data.

Leadership recognition

In appreciation for the loyalty and trust of our clients, in 2015, Compartamos Banco implemented different outreach programs to encourage their participation and recognize their entrepreneurship.

Emprendedores Compartamos Award

This award recognizes our best clients for their trajectory, entrepreneurial vision, dedication and effort. We reward the way in which they have used credits of Compartamos Banco and how they have contributed to the growth and consolidation of their businesses and have led them to become an example in their communities.

5,515 STORIES RECEIVED

343 PARTICIPANT OFFICES

IN 97 REGIONS

Children’s Drawing Competition

Since 2009 Compartamos Banco has organized this competition to increase loyalty of its clients through their children. It recognizes their work as parents and fosters values such as honesty, responsibility, respect and teamwork.

In 2015, the main theme was: How has Compartamos Banco supported my parents’ and family business?

75,659 DRAWINGS RECEIVED

561 PARTICIPANT OFFICES IN 105 REGIONS

Value recipies

The purpose of this program is to reward the culinary creativity of the clients of Compartamos Banco and loyalty to their traditions; the program also recognizes family values and unity.

This year, clients entered a recipe for a dessert which contended for originality. Contestants were also required to explain the significance of the recipe for their family.

1Federal Law for the Protection of Personal Data of Individuals

2National Commission for the Protection of Users of Financial Services

118,915 RECIPES RECEIVED

541 PARTICIPANT OFFICES

IN 103 REGIONS