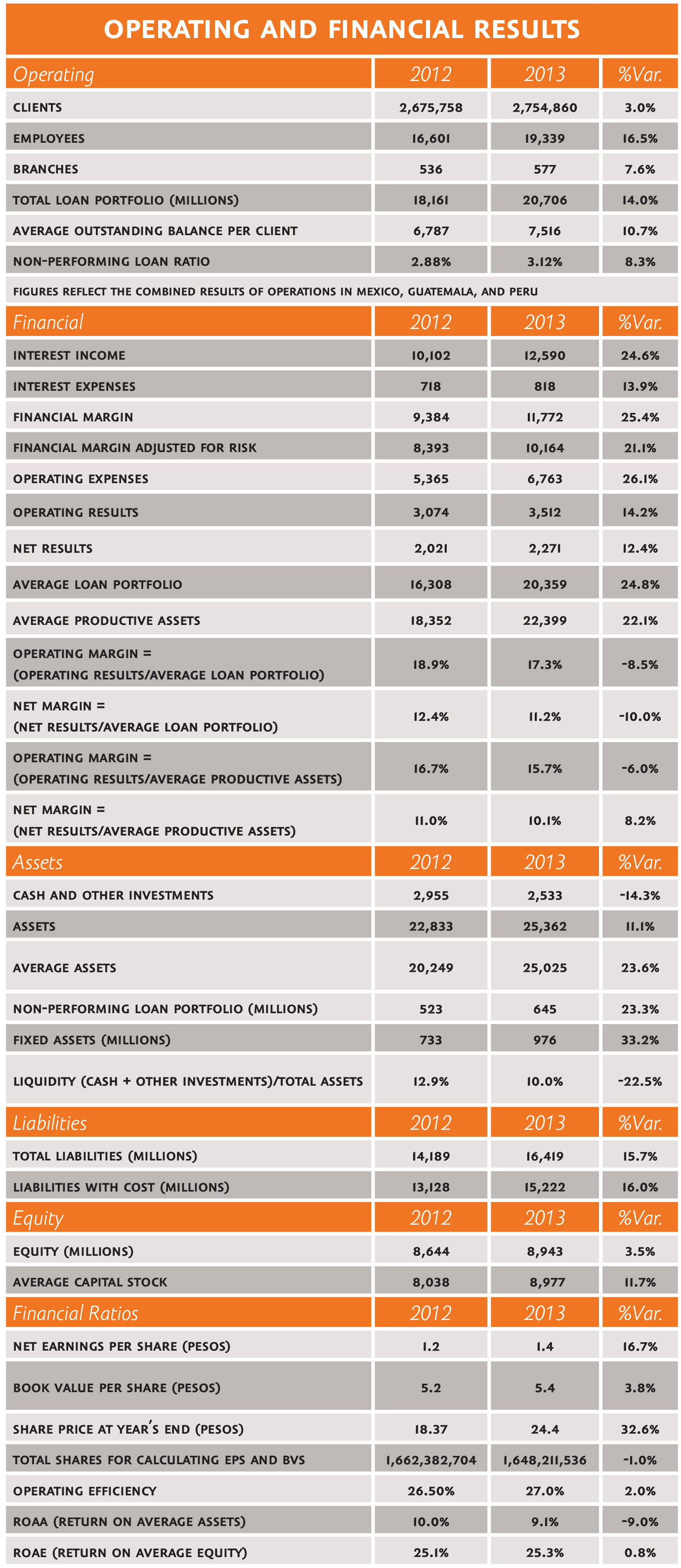

All the figures in this report are expressed in mexican pesos

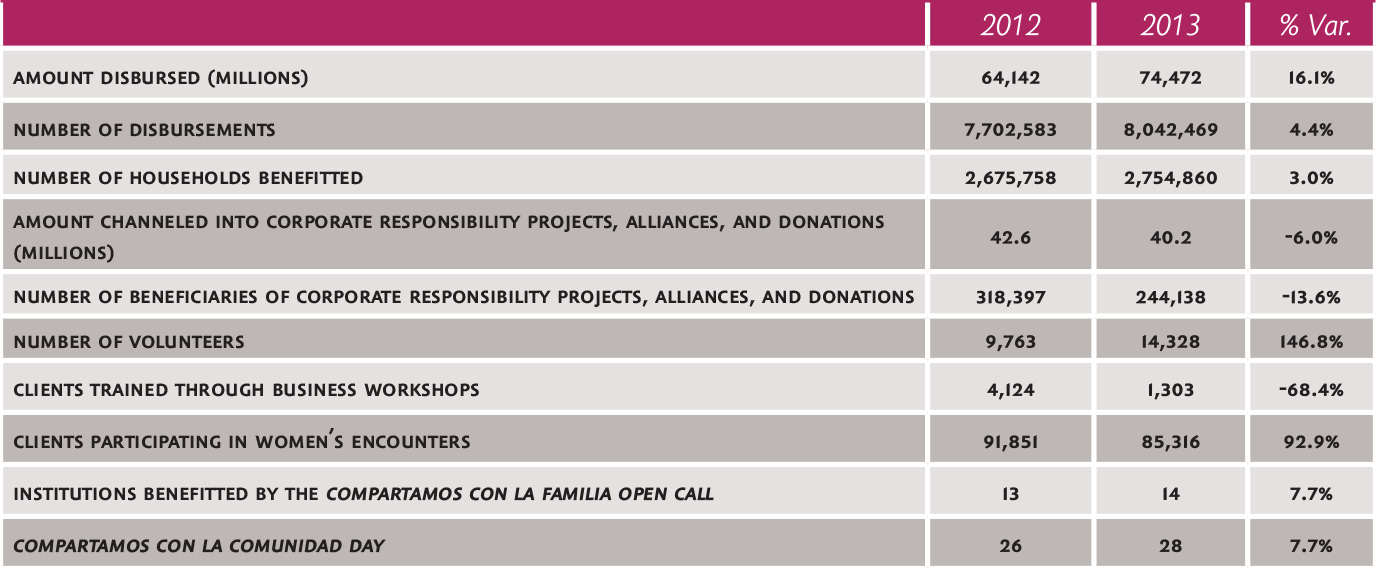

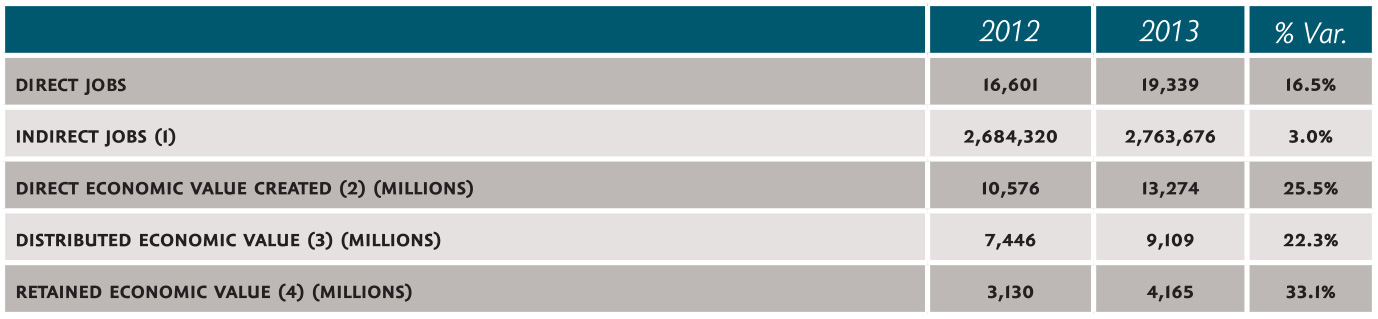

(1) Number of clients at the end of the period multiplied by 1.0032 people hired by micro-enterprises, according to the 2010 national micro-business survey conducted by the INEGI.

(2) Direct economic value created = net earnings + financial income + sales of assets + other products.

(3) Distributed economic value = cost of sales + payroll + employee benefits + training + other expenses + taxes + dividends + interest payments + community investment.

(4) Retained economic value = direct economic value created – distributed economic value.

“For Compartamos Banco, 2013 was a year of very important achievements. In recent years we have seen considerable growth in the microfinance industry and this has been reflected in an increase in the offer of credits and other products in the market.

In this context, Compartamos Banco managed in 2013 to firmly consolidate its relations with its customers. The percentage of clients retained reached a record 84.0% during the year, thanks to the convenient services we offer. Also, within a context of greater extension of credit, the quality of our loan portfolio remained within the standards we have always maintained.

At the same time, we continue progressing with the projects that will allow us to grow the bank going forward. In the month of December we began to implement Integra, our new technological platform, in its credit module. We also received authorization to handle bank transactions through the Yastás correspondent points, while the Saving project continues to progress in its technological development and operating stage.

The year 2014 promises to be one of great opportunities to keep growing and to continue building capacities for the future operations of the institution. Offering our clients outstanding service and products that answer their needs will continue to form the backbone of our actions.”

General Management of Compartamos Banco

“We wish to expand our business model and financial inclusion in the Americas by means of acquisitions, such as Compartamos Financiera in Peru, or through organic growth, as in the case of Compartamos S.A. in Guatemala.

In 2013, the loan portfolio and client base of Compartamos Financiera grew by 27.9% and 47.2%, respectively. Eight new branches were opened and the number of Crédito Súper Mujer clients reached 43,395. Compartamos S.A. strengthened its structure through the support of 173 new employees and ten new offices. Important progress was achieved in terms of financial education in Guatemala and by the consolidation of the Gentera Philosophy in both countries. In 2014 we expect to continue reinforcing these two important pillars.

Our challenge in 2014 in Peru and Guatemala is to reach more people through financial services, by continuing our financial education projects and strengthening our Philosophy. We are also looking for new opportunities to expand our operations elsewhere in the Americas.”

General Management of International Businesses

“We are an administrator of correspondents through whom payments and transactions can be made that offer both convenience and reliability to people and communities without easy access to financial services.

Our outstanding achievement in 2013 was to obtain authorization from the "Comisión Nacional Bancaria y de Valores" (National Banking and Securities Commission, or CNBV) to act as a correspondent for Compartamos Banco. In December we also received authorization to accumulate mass bank loan payment transactions, activating 600 new points for performing financial transactions through the year.

Thus, we doubled the number of our service points, allowing us to link our network to 3,171 affiliated correspondents and reaching eleven different states in Mexico, though we operate principally in Chiapas, Estado de México, Puebla, and Veracruz.

Our main goal in 2014 is to obtain more and better information about the needs of the market we serve and so to provide timely and pertinent service.”

General Management of Yastás

“In 2013 we began to internationalize our business, moving into Guatemala and Peru with basic life insurance policies for Compartamos clients in those countries. We sold a total of 11,056,537 policies and maintained 3,479,470 of them active at the end of the year.

With an average response time of less than 48 hours to accidents covered by our policies, we paid out some 96 million pesos to beneficiaries.

Our goals for 2014 are aimed at increasing the number of people covered by insurance. To this end, we will strengthen our current channels for distributing policies and develop new ones.

Through these actions, we expect to consolidate our international operations.”

General Management of Aterna

![]() Third place in the ranking of Top Companies 2013 by the magazine Expansión, a list of the places where most people wish to work for in Mexico.

Third place in the ranking of Top Companies 2013 by the magazine Expansión, a list of the places where most people wish to work for in Mexico.

![]() In 2013 we participated in the Social Progress Index.*

In 2013 we participated in the Social Progress Index.*

![]() According to the Great Place to Work Institute, we are in second place among the best companies to work for in Mexico in the category of more than 5,000 employees and among the best financial companies to work for in Mexico in the category of financial companies of more than 1,000 employees.

According to the Great Place to Work Institute, we are in second place among the best companies to work for in Mexico in the category of more than 5,000 employees and among the best financial companies to work for in Mexico in the category of financial companies of more than 1,000 employees.

![]() We received the Healthily Responsible Company distinction from the Workplace Wellness Council–Mexico.

We received the Healthily Responsible Company distinction from the Workplace Wellness Council–Mexico.

![]() We obtained the Socially Responsible Company distinction granted by the Centro Mexicano para la Filantropía (CEMEFI), as did Compartamos Banco and Yastás.

We obtained the Socially Responsible Company distinction granted by the Centro Mexicano para la Filantropía (CEMEFI), as did Compartamos Banco and Yastás.

![]() We have figured on the benchmark index (the IPC) and the Sustainable Index of the Mexican Stock Exchange for six and three years in a row, respectively.

We have figured on the benchmark index (the IPC) and the Sustainable Index of the Mexican Stock Exchange for six and three years in a row, respectively.

![]() MixMarket recognized Compartamos Banco for its transparency and social performance, granting it the Mix S.T.A.R. 2013 certification.

MixMarket recognized Compartamos Banco for its transparency and social performance, granting it the Mix S.T.A.R. 2013 certification.

![]() The industry magazine LatinFinance named Compartamos Banco the Best Microfinance Bank of 2013.

The industry magazine LatinFinance named Compartamos Banco the Best Microfinance Bank of 2013.

![]() Compartamos S.A. in Guatemala ranked fourteenth among Best Companies to Work For according to the Great Place to Work Institute.

Compartamos S.A. in Guatemala ranked fourteenth among Best Companies to Work For according to the Great Place to Work Institute.

*An initiative led by Harvard Business School professor Michael Porter whose aim is to measure the social progress of companies, social initiatives, and entrepreneurs in different countries within three main dimensions: Basic Human Needs, Foundations of Wellbeing, and Opportunity